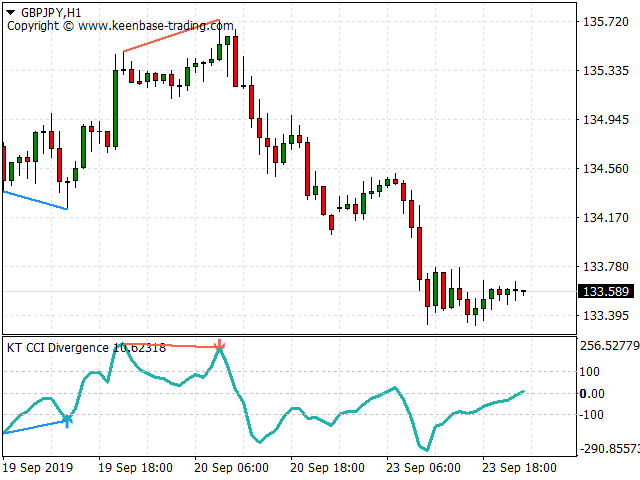

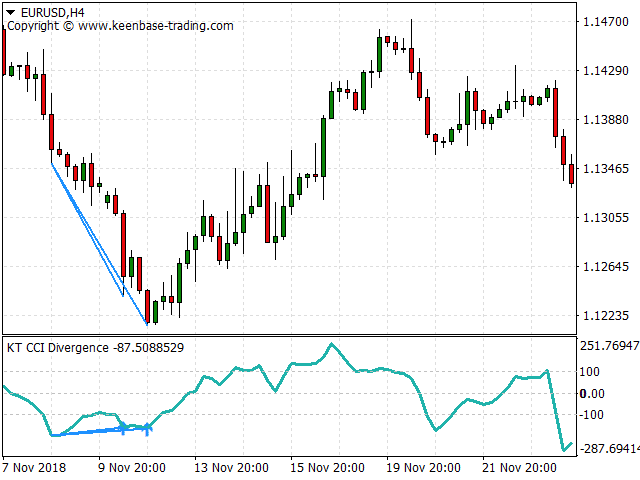

We also have regular divergence and hidden divergence. The former is the most common type in trend reversals, while the latter occurs in trend continuations.

Regardless, a divergence signal on a price chart is an important occurrence observed by many traders.

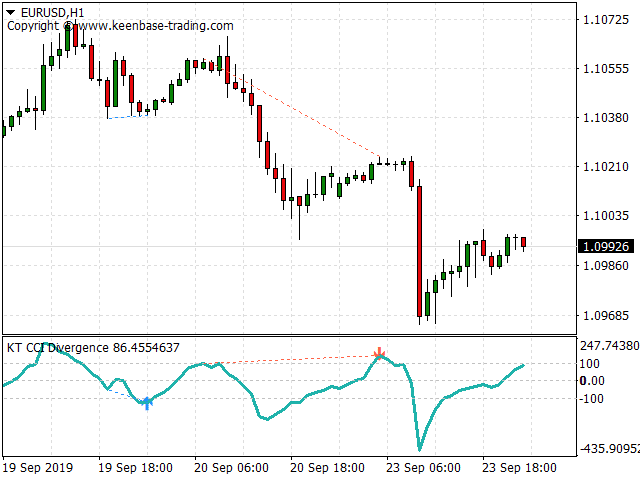

Divergence is one of the vital signals depicting the market's upcoming price reversal. However, manually spotting the divergence between price and CCI can be a hectic and ambiguous task.

We created this indicator to show the regular and hidden divergence between the price and CCI oscillator.

Key Features

- Automatically marks symmetrical divergence between price and CCI as dotted lines; most standard indicators do not do this!

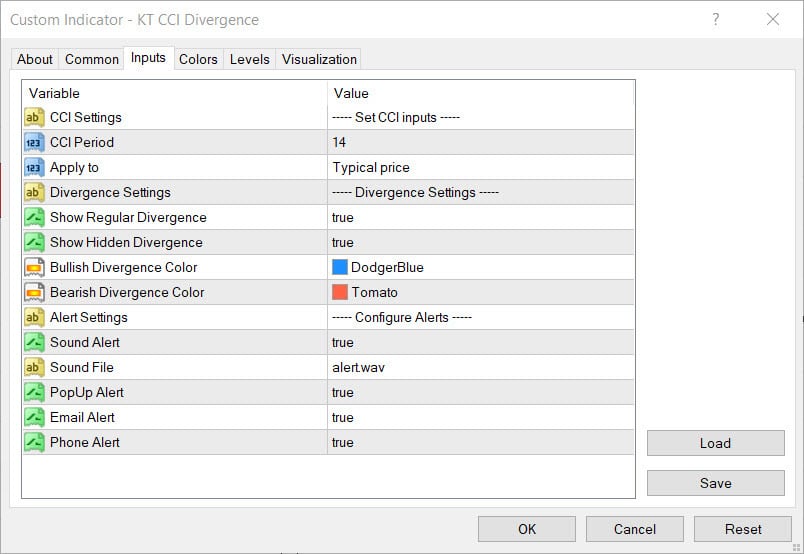

- It comes with all MetaTrader alerts (which you can adjust).

- It has customizable input, color, levels, and visualization settings.

- Simple to use for all trading strategies.

- Works on any symbol and time frame on MT4/MT5.

- Marks regular and hidden divergences between the price and CCI oscillator.

- Unsymmetrical divergences are discarded for better accuracy and lesser clutter.

- Support trading strategies for trend reversal and trend continuation.

- Fully compatible for embedding in Expert Advisors.

- It can be used for entries as well as for exits.

- The stop loss can be placed at a higher or lower divergence anchor point.

- Good to use with the default settings.

Inputs Parameters

Key Uses for Market Open Traders

When a market opens (for instance, on a currency pair), traders can look for divergences between price and CCI. This information can offer clues on fresh reversals or trend continuations that often emerge during open sessions.

Key Uses for Post News Traders

After a news event, traders look for exit signals. When you’re in a profitable position, the indicator can offer triggers in this regard. So, bearish divergences appearing in a buy order may indicate a suitable time for exiting a news move; the opposite is true for bullish divergences.

Key Uses for General Pattern Traders

Most patterns generally suggest either a reversal or trend continuation. The indicator is a popular tool to detect divergence reversals and can be used as a final confirmation factor for a continuation entry.

Combine the CCI Divergence Indicator MT5 with Other Indicators

You can combine it with other indicators to add confluence. You may also easily integrate it with expert advisors (EAs) on MT4 or MT5. We also have a CCI Divergence EA at Keenbase to trade divergences automatically!

Summary

This unique indicator makes spotting divergences much more effortless than manually. Try it out on a demo trading account to integrate it into your strategies!

Limitations

Using the CCI divergence as a standalone entry signal can be risky. Every divergence can't be interpreted as a strong reversal signal. Try to combine it with price action and trend direction to avoid false signals.