We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Trend Riding Strategy - The Path to Profitable Forex Trading

Picture this: While most traders frantically jump between strategies, chasing the next "secret formula," a select group of professionals quietly extracts consistent profits from the markets year after year.

Their edge? Not some complex algorithm or insider knowledge, but rather a profound understanding of market rhythm and the discipline to align with it rather than fight against it.

This elite approach is known as trend riding, arguably the most powerful yet misunderstood strategy in trading. While deceptively simple in concept, its successful execution separates the amateur from the professional, the consistent winner from the perpetual struggler.

In an age of algorithmic high-frequency trading and artificial intelligence, it might seem counter-intuitive that something as fundamental as trend riding remains relevant.

Yet the historical record is clear, from the legendary turtle traders who generated millions from trend following to modern hedge funds that deploy sophisticated versions of these same principles, the ability to identify and ride trends continues to be the backbone of sustainable trading success.

Understanding Trend Trading: Core Principles

Trend trading differs fundamentally from other approaches like range trading or counter-trend strategies. While some traders attempt to predict market tops and bottoms (a notoriously difficult task), trend traders accept that they'll never catch the exact beginning or end of moves.

Instead, they focus on capturing the "meat of the move", the substantial middle portion of trends where the highest probability profits exist.

Key Principles of Successful Trend Trading

- Trend Identification: Using technical analysis to determine the current market direction across relevant time frames.

- Trade with the Trend: Entering positions only in the direction of the established trend to maximize the probability of success.

- Momentum Confirmation: Ensuring the trend has sufficient strength before committing capital.

- Strategic Position Entry: Finding optimal entry points that offer favorable risk-reward ratios.

- Trailing Risk Management: Protecting capital while allowing profits to run as the trend develops.

The legendary turtle trading experiment of the 1980s demonstrated that ordinary people could generate substantial profits simply by following trend-based trading rules. This experiment proved that with proper training and discipline, trend following strategies could produce remarkable results across various market conditions.

KT Trend Trading Suite: Your Complete Trend Riding Solution

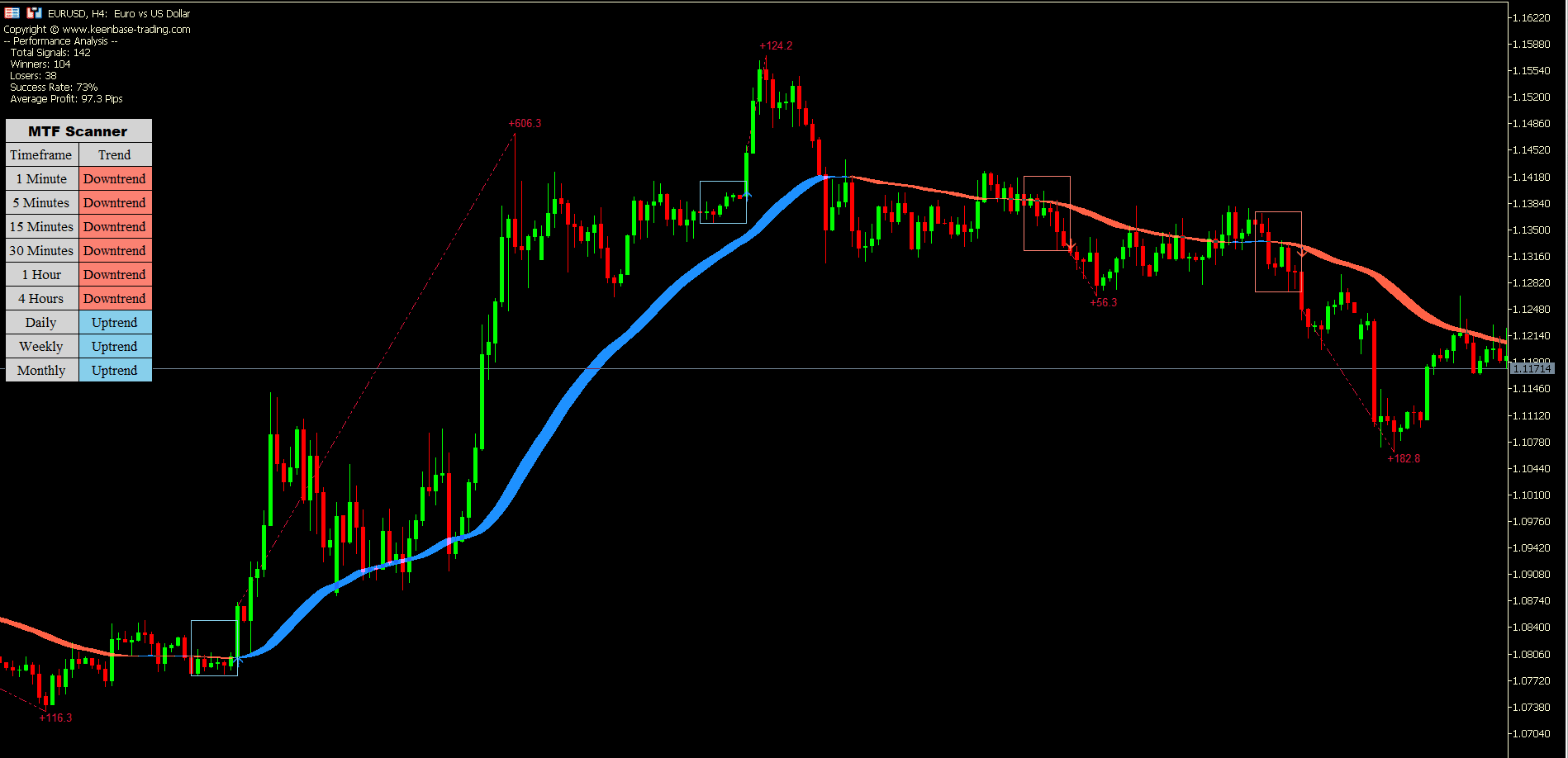

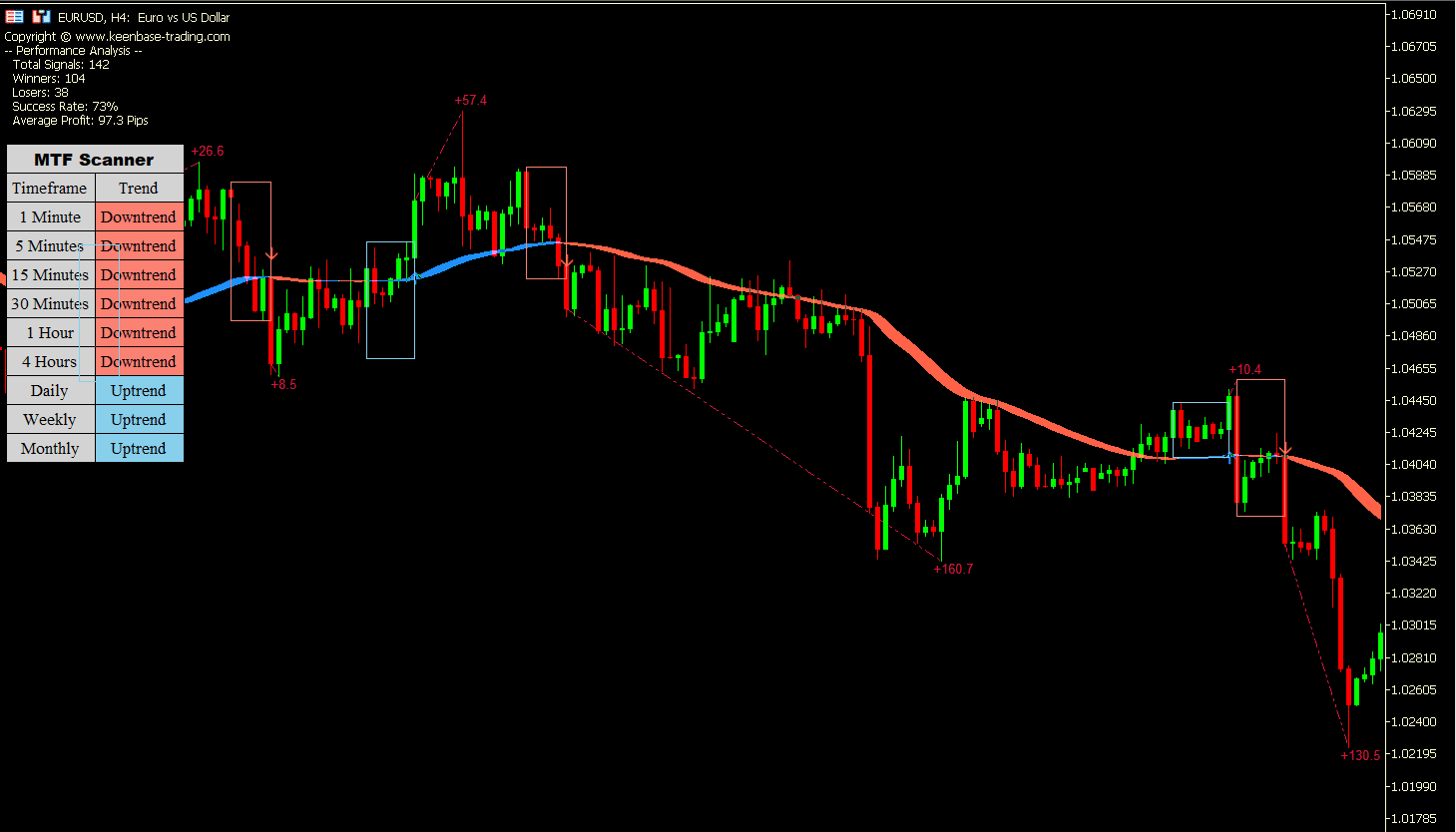

While understanding trend trading principles is essential, implementing them effectively requires powerful analytical tools. The KT Trend Trading Suite from Keenbase Trading is a comprehensive indicator designed specifically to identify and capitalize on market trends across multiple time frames.

Key Features of the KT Trend Trading Suite

The KT Trend Trading Suite combines several advanced technical analysis components to provide a complete trend trading solution:

- Unified Market Dynamics Analysis: The indicator combines several market dynamics into a single equation to provide a clear depiction of the market trend, eliminating confusion and contradictory signals.

- Precise Entry Signals: Draws rectangular boxes with entry signals that mark optimal entry points based on local maxima and minima, removing guesswork from your trading decisions.

- Performance Analysis: The indicator measures the accuracy of its signals and provides performance metrics, allowing you to objectively evaluate its effectiveness in your trading environment.

- Multi-Timeframe Dashboard: Includes an integrated dashboard that scans all available timeframes and displays the established trend direction in each, helping you align your trades with the dominant trend across multiple timeframes.

- Superior Trend Signals: Compared to traditional approaches like Ichimoku system, the KT Trend Trading Suite provides more accurate trend following signals with less complexity and noise.

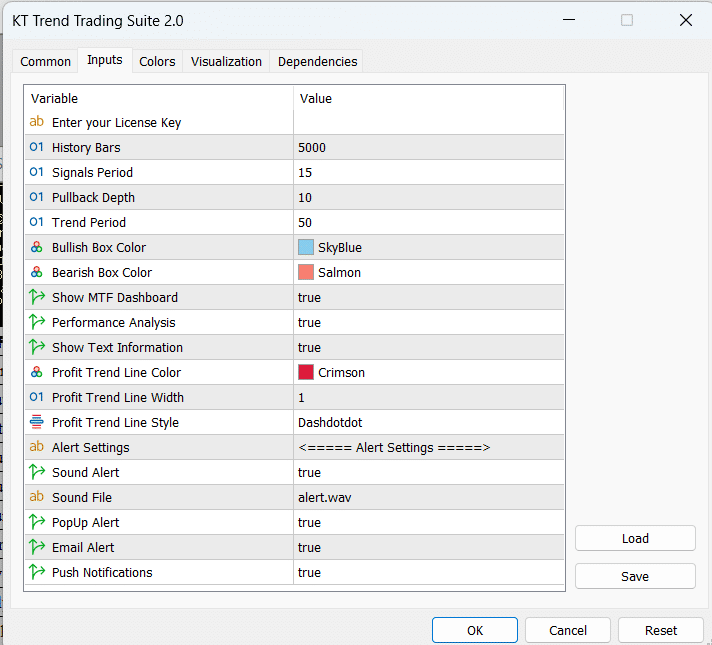

Customizable Settings for Your Trading Style

The KT Trend Trading Suite can be tailored to your specific trading preferences through several key parameters:

- History Bars: Define the number of historical bars to include for signals generated in the past.

- Signals Period: Adjust the magnitude of entry signals to match your trading style.

- Pullback Depth: Fine-tune the depth of pullbacks that typically occur before trend continuation moves.

- Trend Period: Customize the value used to identify the main trend direction.

This flexibility ensures the indicator works optimally across different markets and timeframes, whether you're trading Forex, stocks, or commodities.

Enhanced Trading Performance with Complementary Tools

For maximum effectiveness, the KT Trend Trading Suite works exceptionally well when combined with:

- Volume analysis to confirm trend strength and predict potential reversals.

- KT Auto Trend Lines to visualize support and resistance levels.

- Higher High Lower Low Indicator to confirm trend structure.

This integrated approach ensures you have all the necessary tools to make informed trading decisions at every stage of trend development.

Risk Management: The Foundation of Trend Trading Success

Before discussing technical indicators and entry strategies, we must emphasize that proper risk and equity management forms the bedrock of all successful trend trading systems. Without effective risk controls, even the most sophisticated trend identification techniques will eventually lead to account-destroying losses.

Essential Risk Management Techniques

- Position Sizing: Never risk more than 1-2% of your trading capital on any single trade, regardless of how confident you feel about the setup.

- Stop-Loss Placement: Always define your maximum acceptable loss before entering a trade, typically placing stops below significant support in uptrend or above resistance in downtrends.

- Risk-Reward Ratio: Only take trades that offer a minimum potential reward of 2-3 times your initial risk to ensure profitable results over time.

- Correlation Management: Be aware of correlations between positions to avoid overexposure to similar market risks.

- Equity Protection: Monitor overall account exposure and implement defensive measures during periods of adverse price movements.

Technical Analysis: The Trend Trader's Toolkit

Technical analysis provides the essential tools for identifying trends, confirming momentum, and determining optimal entry and exit points. While some traders become overwhelmed by the vast array of indicators available, successful trend traders typically focus on a select few that provide complementary insights.

Moving Averages: The Foundation of Trend Identification

Moving averages smooth price data to reveal the underlying trend direction while filtering out short-term noise. They create a visual representation of the prevailing trend that helps traders make objective decisions about market direction.

When a shorter-term moving average crosses above a longer-term moving average, it can signal an emerging uptrend (and vice versa for downtrends). This simple yet powerful approach forms the basis of many successful trend trading strategies.

Chart Patterns: Visual Confirmation of Trend Continuation

While moving averages help identify the trend direction, chart patterns provide visual confirmation of trend continuation or potential reversals. Recognizing these patterns early helps trend traders position themselves advantageously before major price movements occur.

Momentum Indicators: Measuring Trend Strength

Momentum indicators help assess the strength of existing trends and provide early warning of potential weakening or reversals. The most valuable momentum tools include:

Relative Strength Index (RSI)

The Relative Strength Index measures the speed and magnitude of price movements on a scale from 0 to 100. In strong uptrends, RSI typically remains above 40, while powerful downtrends keep RSI below 60. Trend traders watch for divergences between price and RSI that may signal trend exhaustion.

Moving Average Convergence Divergence (MACD)

The MACD combines moving averages to create a powerful momentum oscillator that helps confirm trend direction and strength. By monitoring MACD line crosses, histogram changes, and divergences between price and MACD, traders can build a comprehensive picture of market conditions.

Market Conditions: Adapting to Different Trading Environments

Not all market conditions are equally favorable for trend trading. Successful practitioners adapt their approach based on the prevailing market environment:

Trending Markets: Optimal Conditions

Strongly trending markets provide the ideal environment for trend trading strategies. During these periods, traders can take more aggressive positions, use pullbacks to moving averages as entry opportunities, and trail stops more closely to maximize profit capture.

Range-Bound Markets: Patience Required

During consolidation phases, trend traders should exercise caution by reducing position sizes, waiting for clear breakouts from established ranges, and being alert for false breakouts that can trap inexperienced traders.

Achieving Consistent Results with the Trend Riding Strategy

The trend riding strategy represents one of the most reliable paths to trading success when implemented with discipline and proper risk management. By focusing on identifying established trends, confirming momentum, and strategically entering positions with favorable risk-reward profiles, traders can achieve the consistency that eludes most market participants.

The KT Trend Trading Suite brings this powerful approach within reach of all traders, regardless of experience level or time constraints. By providing clear, objective trend signals and precise entry points, it helps you overcome the challenges of trend identification and trade timing that plague many traders.

Whether you're a novice seeking a proven trading methodology or an experienced trader looking to improve consistency and reduce subjectivity, it can transform your trend trading results and put you on the path to long-term profitability.

Ready to elevate your trading with the power of professional-grade trend analysis? Explore the KT Trend Trading Suite today and discover how this comprehensive indicator can help you identify and capture the most profitable trend moves across multiple markets.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: