We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Mastering Advanced Ichimoku Trading Strategies: Enhance Your Market Edge

Elevate your skillset with advanced ichimoku trading strategies designed for precision and versatility. This article provides a clear pathway for experienced traders to harness complex Ichimoku techniques, tuned explicitly for strategic entry and exit timing in diverse markets.

Gain a distinct trading advantage by mastering these sophisticated strategies, tailored for real-world application without excessive complexity.

The Ichimoku Kinko Hyo is a Japanese charting method used to assess different market situations. The history of Ichimoku cloud indicator dates back to 1930, when it was first published by a Japanese reporter, Goichi Hosoda.

Ichimoku charting stands out as a highly regarded and comprehensive approach for technical analysis.

Before we can dive into learning about some advanced Ichimoku trading strategies and Ichimoku training, we first understand the Ichimoku indicator briefly.

- Ichimoku - Glance or One Look

- Kinko – Equilibrium

- Hyo – Chart

The indicator's name can be translated as 'one look equilibrium chart.' The Ichimoku cloud trading means traders can identify the market trend with just one look.

- Bullish Trend: If Senkou Span A is above Senkou Span B.

- Bearish Trend: If Senkou Span A is below Senkou Span B.

By incorporating more data points, the Ichimoku Indicator offers a holistic perspective of dynamic support and resistance levels, trend strength, and potential entry and exit points.

Traders and analysts often utilize this powerful tool to make informed decisions and confidently navigate the financial markets.

Key Takeaways

- The Ichimoku Kinko Hyo is a versatile trading system developed by Goichi Hosoda that offers a holistic view of the market, including trends, momentum, support, and resistance levels, by integrating five critical components known as the Tenkan-Sen, Kijun-Sen, Senkou Span A, Senkou Span B, and Chikou Span.

- Effective use of Ichimoku involves implementing strategic entry and exit strategies based on cloud signals and color, the cloud's thickness, and the Chikou Span's positioning, combined with risk management practices, to enhance profitability and reduce market exposure.

- Continuous learning and adaptation are essential for mastering the Ichimoku system, with advanced Ichimoku trading education focusing on customization of indicator settings, effective backtesting for strategy confidence, and ongoing practice across different market conditions and asset classes.

Components of Ichimoku Kinko Hyo

It is consists of five main components:

- Tenkan Sen (Red line)

- Kijun Sen (Blue line/Base line)

- Chikou (Green line)

- Senkou Span A

- Senkou Span B

The Tenkan Sen line (also known as conversion line) is the midpoint of the last nine-day high & low. Likewise, the 'Kijun Sen' line is the midpoint of the previous 26 days' high and low.

Senkou Span A (also known as leading span A) is the midpoint between the Tenkan Sen and the Kijun Sen lines. Senkou Span B (also known as leading span B) is the 52-day high and low midpoint. Both these lines act as the upper and lower limit of the cloud.

'Chikou Span' represents the current value of the asset.

The most straightforward way of using this indicator is to generate substantial trading opportunities. Also, remember that these strategies work in all types of markets and time-frame.

Ichimoku is a reliable indicator that can be used standalone to generate trading signals. However, we can also combine it with other reliable indicators to improve the signals' accuracy.

Unlocking the Secrets of Ichimoku Kinko Hyo

Translated as “one look equilibrium chart,” the Ichimoku Kinko Hyo is renowned for offering a quick, comprehensive snapshot of the market’s status. Conceived by Goichi Hosoda in the 1930s, this approach leverages multiple indicators on one graph.

It seamlessly combines information about support and resistance levels, trend direction, and momentum within a single visual representation.

To harness the effectiveness of the Ichimoku strategy requires understanding its fundamental elements—the five main components that comprise what is known as the Ichimoku Cloud. Mastery of these elements lays the groundwork for proficient use of this technique.

One must familiarize themselves with these core principles and learn how to decode complex signals from diverse time frames and financial instruments using advanced applications based on this method.

The Five Pillars of Ichimoku

Resembling a structural masterpiece, the Ichimoku system stands upon five essential elements:

- Tenkan-Sen

- Kijun-Sen

- Senkou Span A

- Senkou Span B

- Chikou Span

Much like gears within a well-oiled mechanism, these components each fulfill a crucial function to ensure the effective operation of the Ichimoku system.

For example, the formation of “the cloud” is attributed to Senkou Span A and B. This feature graphically represents areas that may become key for future support or resistance levels.

Interpreting the Clouds: Signals and Meanings

The Ichimoku Cloud is a forecasting tool for traders, much like how weather patterns help meteorologists make predictions. The Ichimoku Cloud Indicator is integral to this process, allowing traders to use the Ichimoku Cloud Strategy to foresee movements in the market.

Skilled Ichimoku Cloud Trading strategy practitioners can leverage these projections to take calculated trading actions. For example, whether the price is above or below the cloud gives insight into collective market sentiment—above indicates bullish tendencies, while beneath signals bearish inclinations.

Key features of the cloud on a chart include:

- Its color signifies prevailing market moods: green points towards bullish trends, and red hints at bearish ones.

- Shifts in hue may be harbingers of an imminent trend change.

- The density of the cloud reflects both volatility and robustness. Greater thickness indicates more substantial support or resistance levels.

When there’s an intersection within Senkou Span A over Senkou Span B, resulting in a twist inside the cloud itself, it often heralds shifting trends that alert traders about potential alterations in the market trajectory ahead.

Advanced Forex Trading - Ichimoku Trading Strategy Explained

This post will cover some practical Forex Ichimoku trading system that both novice and experienced traders can use.

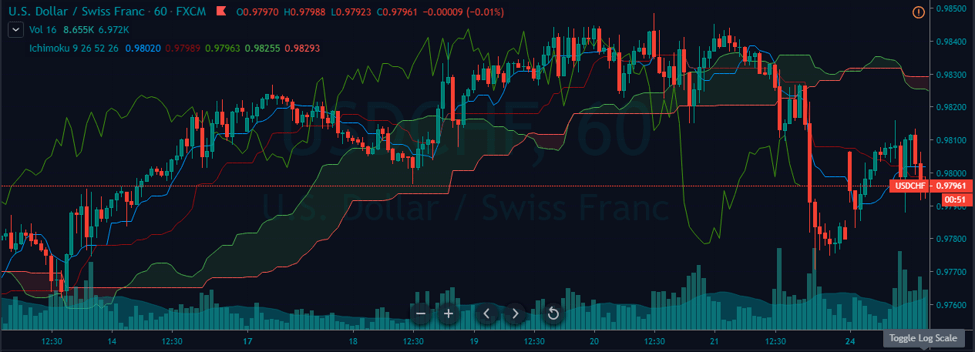

Strategy One: Day Trading with Ichimoku Cloud Strategy

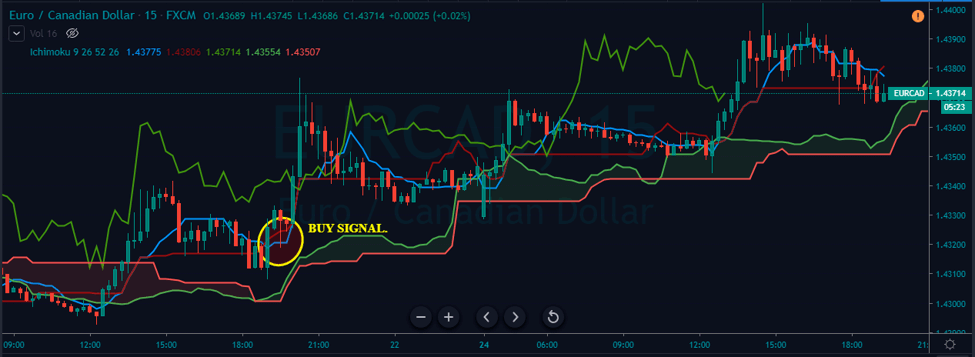

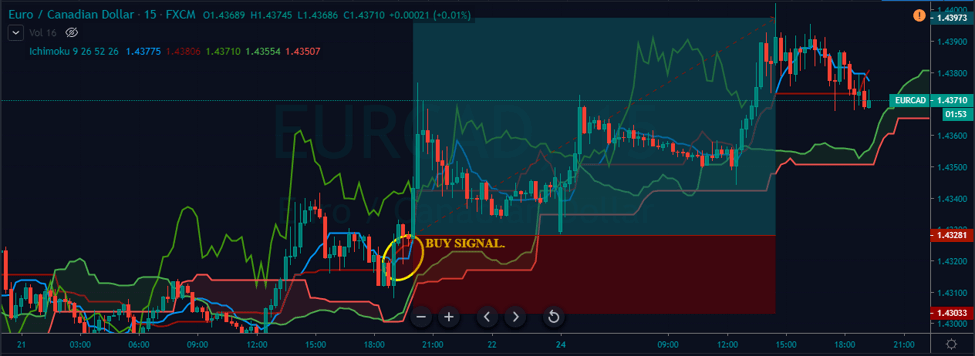

Ichimoku works well in a trending market over the ranging market. For example, in the below chart, the EUR/CAD Forex is in an uptrend.

This Ichimoku cloud trading strategy is simple; we must look for the cloud to go below the price action. At the same time, if the Tenkan Sen Line crosses the Kijun Sen Line, it indicates a 'buy' signal.

The Ichimoku cloud is under the price, indicating an uptrend. Also, in the yellow circle, the Tenkan line cross above the Kijun line.

- Entry: Aggressive traders can enter the trade right after the crossover but If you are a conservative trader, make sure to enter after a bullish candle.

- Stop-Loss: The stop-loss is placed just below the cloud because the Ichimoku cloud acts as a dynamic support/resistance level.

- Take-Profit: The take-profit must be placed according to the price momentum. In this case, the take-profit was placed at a resistance level on a higher's time-frame.

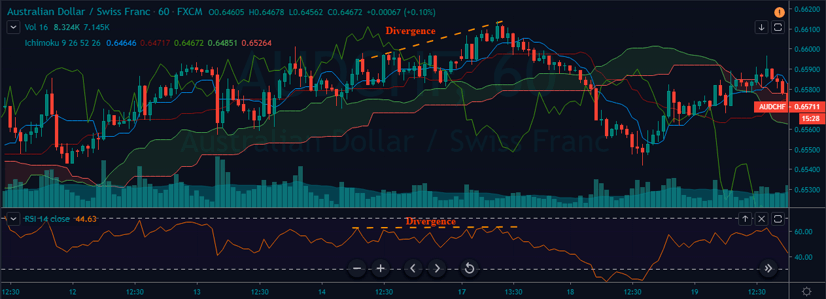

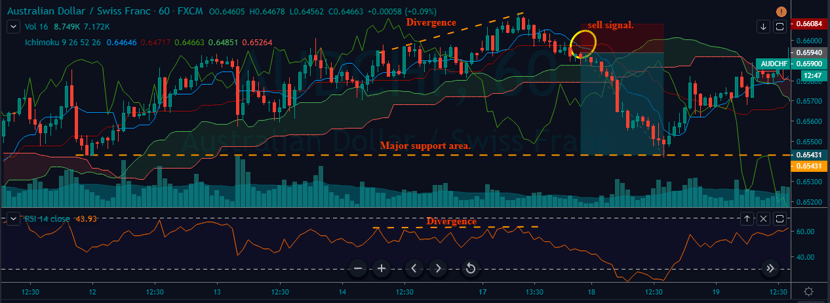

Strategy Two: Ichimoku Cloud + RSI Divergence

We have paired the Ichimoku cloud with the RSI indicator to take full advantage of the market's underlying trend. This strategy will help us in identifying potential market reversals.

The primary step is identifying the market divergence using the RSI Divergence indicator. Divergence is a phenomenon where the price moves in one direction, but the oscillator goes in another.

As you can see below, the price action prints a divergence in the AUD/CHF Forex pair.

Example of a Sell Signal

- Entry: In the below chart, the yellow circle is where the Tenkan Sen Line crosses the Kijun Sen Line, where we have entered the market.

- Stop-Loss: The stop-loss is placed at the last swing high.

- Take-Profit: The take-profit is placed at a significant support level in a higher's time-frame.

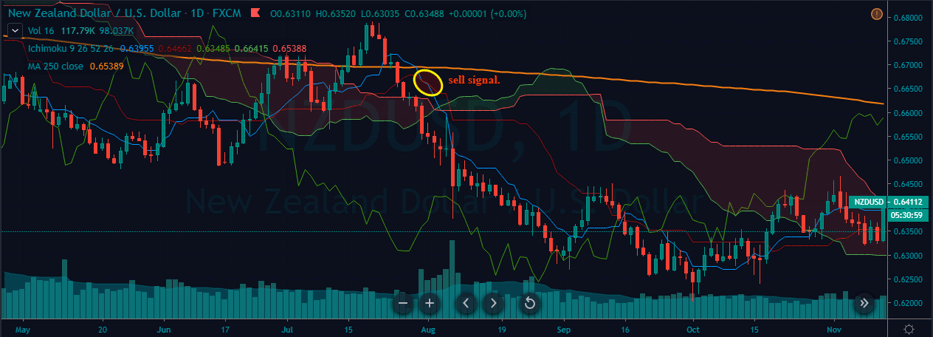

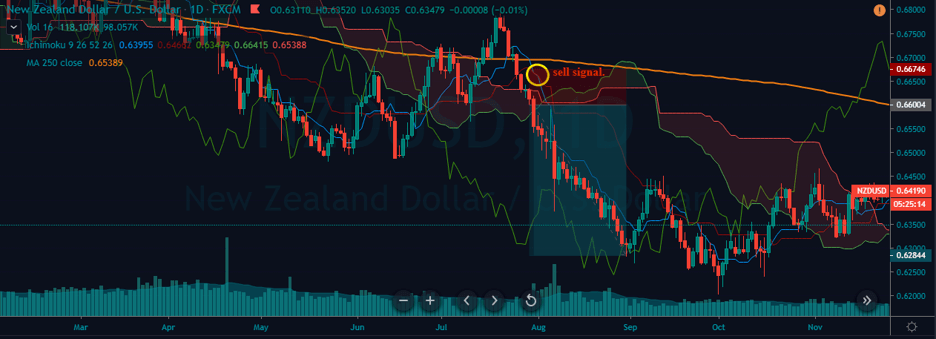

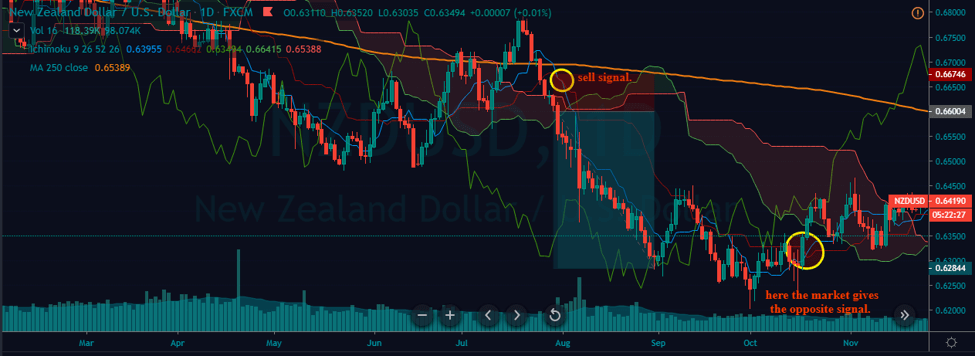

Strategy Three: Ichimoku Cloud + Moving Average

This strategy is specially designed for long-term traders. Here, we are using 250-period Moving Average to trade the market cycles.

The trend is down if the moving average line is above the price action. Likewise, if the moving average line is below the price action, the market is in an uptrend.

Check the position of the moving average line on the price chart. If the line is below the price action, wait for the Tenkan Sen Line to cross the Kijun Sen Line below the price action to go long on any given security.

Conversely, if the moving average line is above the price action, wait for the Tenkan Sen Line to cut the Kijun Sen Line above the price action to go short.

Below is a Daily chart of the NZD/USD market in which we have identified a potential 'sell' trade.

When the moving average line goes below the closing price, it indicates preparing for sell entry. Within a few days, the Tenkan Sen Line cuts the Kijun Sen Line in the encircled region, confirming a 'sell' trade in this Forex pair.

- Entry: We can enter right after the crossover of the line on the Ichimoku indicator. Conservative traders can wait for a couple of bearish candles and then go short.

- Stop-Loss: For this trade, the stop-loss is placed just above the entry price because the higher timeframes tend to spike significantly less. If you are not comfortable with a stop-loss that tight, you can set it according to your trading style.

- Take-Profit: As we can see in the below chart, markets started to lose momentum at the beginning of September. Overall it was a 300 pip trade, and we closed the whole position at the encircled area, as the indicator obtained an opposite signal.

Advanced Ichimoku Trading Strategies PDF

You can easily convert this article into a PDF here. You can print out the pdf or save it as an ebook. It'll be equivalent to going through an advanced Ichimoku course.

Advanced Techniques: Time Frames and Asset Classes

The Ichimoku system is much more than a simple strategy. It’s an adaptable instrument that demonstrates its utility over different time frames and types of investments.

It caters to the day trader, who must make rapid choices while closely monitoring real-time charts, and the long-term investor, who evaluates broader trends on weekly charts.

This allows traders to shift perspectives between varying time frames for a holistic understanding of prevailing market attitudes and thus bolster their trading decisions.

The Ichimoku framework extends its applicability past forex transactions and shows comparable efficiency in arenas such as stock exchange markets, commodities, and digital currency trades.

For example, commodity dealers can leverage the Ichimoku method for gauging momentum within markets susceptible to trends.

Regardless of which financial sphere or class one specializes in, utilizing sophisticated techniques inherent in the Ichimoku system affords traders an advantageous position when navigating their trade activities.

Enhancing Profitability with Ichimoku: Entry and Exit Strategies

Effective risk management and maximizing every trade’s potential are central to profitability in forex trading, not just accumulating winning trades.

This is especially relevant when employing the Ichimoku system, where disciplined use of its strategies can lead to noteworthy outcomes – for instance, an account achieving a 56% increase demonstrates the powerful impact of this approach.

Adopting an Ichimoku trading strategy enables traders to achieve multiple advantages such as:

- Minimize time subject to market risks.

- Prevent significant declines that often accompany buy-and-hold methods.

- Amplify profits through strategic trade entries and exits.

- Employ confluence for enhanced entry tactics, boosting performance.

- Tailor exit points based on risk management coupled with prospective rewards.

Incorporating these sophisticated money-trading methodologies into your repertoire—including proven profitable trading strategies—can enhance your capabilities within the financial markets specific to advanced Forex trading.

Strategic Entries: The Power of Confluence

Effective entry strategies are crucial to successful trading. Utilizing the Ichimoku system’s indicators with additional technical instruments can elevate the likelihood of successful trades.

For example, this strategy improves entry success rates when the Conversion Line crosses above the Base Line following a price breakout beyond the cloud.

There is room for refinement. When traders integrate fractals and use Fibonacci retracement levels with elements of the Ichimoku system, such as the cloud, they can hone their entry points more precisely. This method assists in identifying potential reversal areas, enabling market entry at optimal moments.

Setting Your Exits: Risk Management and Reward Potential

An effective exit strategy, such as finding the right entry points, is vital for trading success. It’s wise to position protective stop losses beneath the breakout candlestick to mitigate potential substantial losses.

Alternatively, placing these stop losses at a swing high or low can offer a more nuanced approach to risk management than relying solely on a fixed baseline.

Incorporating elements of the Ichimoku Cloud into your strategy, such as employing its Senkou Span to serve dynamic support and resistance functions, can guide you in establishing well-informed trade exit points.

Traders are advised to close positions once they hit their pre-set risk-to-reward target ratio. For instance, exiting at 1:2 helps lock in gains while controlling possible downturns.

This technique proved advantageous during a USD/JPY transaction that garnered approximately 500 pips while maintaining a steady 2:1 risk/reward threshold.

Ichimoku and Price Action: A Symbiotic Relationship

When used together, the Ichimoku system and price action create a mutually beneficial relationship that strengthens each other’s ability to perform. This robust duo aids in clearly discerning main trends as well as crucial support and resistance thresholds while potentially signaling shifts in market direction.

Integrating Ichimoku indicators with additional technical and fundamental scrutiny methods can pinpoint trades with higher odds for success, thereby enhancing the quality of trading decisions.

We will delve into how one can determine the vigor of prevailing trends and spot potential reversals using price action cues and the Ichimoku framework throughout this segment. We’ll examine strategies for proficiently executing trades based on breakouts or rebounds within the context provided by these tools.

Identifying Trend Strength and Reversals

In a trading strategy, gauging trends' vigor and the likelihood of directional changes is essential. Leveraging price action with the Ichimoku system offers a sturdy method for achieving this objective. The Ichimoku Cloud suggests a robust bullish tendency when Senkou Span A resides above Senkou Span B.

Conversely, signals pointing to an imminent trend shift include:

- An alteration in hue within the cloud due to a crossover between Senkou Spans.

- When Chikou Span rises past price levels, indicating ascending momentum.

- And when Chikou Span descends beneath prices, signaling an evolving bearish trend.

These markers are instrumental for traders seeking verification of how trends are headed.

Engaging scrutiny as to how prices interact with Tenkan-Sen can reveal crucial signs. Where ‘bounces’ from this line may signal sustained movements or flag potential reversal zones.

Trading Breakouts and Bounces

Combined with price action patterns, the Ichimoku system facilitates a structured approach to engaging with breakouts and bounces—key trading opportunities. A bullish indication is given when prices ascend above the Ichimoku Cloud, potentially pointing towards a breakout.

An entry signal for buying is triggered if the market ends higher than the upper boundary of the cloud. Conversely, closing under its lower border suggests selling.

Within this framework, dynamic support or resistance levels can be found using Kijun-Sen or Tenkan-Sen lines during trading bounces, which may offer profitable points for entering trades.

The position of the Chikou Span with the current price movement plays a vital role in confirming both momentum and sustainability, whether it’s related to breakouts or retracements.

With these methods, traders looking at breakouts might find value by spotting inside bars that form within the boundaries of the Ichimoku Cloud and considering engulfing candle formations for more robust validation before making trade decisions.

Fine-Tuning Your Ichimoku Strategy: Optimization Tips

Each trader’s approach is distinct, and their trading strategy should reflect that individuality. The Ichimoku system offers the adaptability necessary for traders to customize it according to their unique trading style and the objectives they wish to achieve.

Success with the Ichimoku strategy significantly depends on effective risk management, adherence to discipline, and compliance with established rules for trading. Understanding the nuances of Ichimoku trading can greatly assist traders in refining their strategies.

In this portion of our discussion, we will explore how you can tailor your settings for the Ichimoku indicator and why backtesting is a critical step towards building confidence in your personalized method of Ichimoku trading.

Personalizing Indicator Settings

The Ichimoku system offers a flexible approach to trading, with adjustable settings that can be tailored to suit your unique trading preferences and goals. Traders focusing on short-term movements, such as scalpers and day traders, modify the Ichimoku parameters for intraday timeframes.

This customization facilitates their swift style of trading and aids in prompt decision-making.

Conversely, swing trading may fine-tune the cloud components by altering the Tenkan-Sen and Kijun-Sen periods. By doing so, they enhance their ability to detect more substantial trends over longer terms, which better matches their intermediate-term trade planning strategy.

Backtesting for Confidence

Having faith in your trading strategy is essential for achieving consistent market success. Backtesting can be invaluable in building trust - it allows you to evaluate how your approach would have fared with historical data, helping you polish and perfect your tactics.

Developing a systematic strategy incorporating the Ichimoku indicator means selecting and rigorously examining elements such as the Tekan Sen and Kiju Sen crossover signal, Cloud breakout, or Chikou Span crossing through backtesting.

This process has benefits like minimizing potential declines in portfolio value (drawdowns) and reducing the duration of active market involvement while also enabling an assessment of its efficacy relative to standard buy-and-hold investment strategies.

Case Studies: Ichimoku in Action

Case studies from actual trading scenarios reveal the practical usefulness of the Ichimoku system across various asset classes such as forex, stocks, and cryptocurrencies. Its versatility is proven by its success in a range of market environments.

We’ll delve into several examples highlighting how the Ichimoku system has been utilized effectively to analyze trends within the forex market while executing trades in stock and cryptocurrency trading domains.

Forex Market Analysis: A Closer Look

The Ichimoku system offers a comprehensive tool for traders navigating the forex market's extensive liquidity and continuous trading cycle.

The indicator Ichimoku Kinko Hyo has proven its worth in varying conditions within forex market analysis, serving as an invaluable resource for making well-informed trading decisions.

By initiating trades through a live forex trading account, individuals can capitalize on the actionable insights delivered by the Ichimoku Kinko Hyo method.

For example, traders have observed significant benefits from employing the Ichimoku cloud during currency pair transactions, such as USD/CAD. It acted as an effective filter that enriched trade prospects, especially when a breakout level was around the 1.1450 price point.

Take note of how convincingly practical this framework was when tracking instruments like the S&P 500, which exhibited strong bullish signals amidst recovery post-April 2020’s downturn caused by COVID-19— Validating what makes utilizing the Ichimoku Cloud so impactful in forecasting movements across various sectors within Forex markets.

Beyond Forex: Ichimoku in Stock and Cryptocurrency Trading

The Ichimoku system is not confined to the forex market. It has significant applications in stock trading as well. Serving as a visual tool, the Ichimoku Cloud assists traders by delineating support and resistance areas that can suggest viable points of entry for trades.

This indicator comprises various elements that collectively offer critical insights to those engaged in trading activities.

When analyzing cryptocurrency volatility, the efficacy of the Ichimoku system becomes apparent. For instance, several key indicators were evident during Bitcoin’s surge to record levels in November 2020.

- The Chikou Span line positioned beneath price action hinted at diminishing momentum and potentially foreshadowed an imminent correction.

- A green-hued cloud emerged, indicating bullish trends.

- Conversely, a red cloud manifested, signifying bearish movements.

These components within the Ichimoku cloud indicator enable traders operating within digital currency markets to make more calculated investment decisions based on emerging trends.

Advanced Ichimoku Course: Taking Your Skills Further

Mastering the Ichimoku trading system goes beyond just grasping its fundamentals and utilizing them in your trading activities. Improvement is an unending process, and continually refining your skills through ongoing education is crucial.

Enrolling in advanced Ichimoku courses provides a detailed program to elevate the quality of your trading decisions.

This segment delves into selecting an appropriate learning platform for your advanced Ichimoku course while emphasizing the importance of relentless education and practice as critical components of becoming adept in trading.

Selecting the Right Educational Resource

Selecting an appropriate educational resource is vital in your journey as a trader. A top-tier advanced Ichimoku course must provide an extensive syllabus encompassing the trading system's essential and intricate aspects, guaranteeing a complete grasp.

The instructor's expertise and capacity to demonstrate sophisticated instruments and tactics should weigh heavily in selecting such a resource.

Aspiring participants ought to consider courses that offer continual support features like direct access to instructors and community discussion platforms, which are essential for sustained learning and enhancement of abilities.

Continuous Learning and Practice

Engaging in trading is an ongoing journey of knowledge acquisition. As the financial markets are in a state of perpetual change, it’s essential for traders who employ Ichimoku tactics to stay informed and adapt their strategies accordingly.

A sophisticated curriculum for mastering Ichimoku trading ought to cover strategies for steering clear of typical mistakes and avoiding standard snares within the Ichimoku system.

To refine skills in advanced ichimoku trading, one might consider engaging in activities such as:

- Participating actively on platforms discussing trade setups.

- Experimenting with applying techniques across diverse markets and time intervals.

- Keeping a detailed logbook of trades to analyze performance, which can then be critiqued.

- Scheduling dedicated sessions with mentors for personalized guidance.

All these endeavors contribute significantly towards enriching one’s competency within specialized courses focused on advancing skill levels in utilizing the Ichimoku system.

Conclusion

Ichimoku Kinko Hyo helps us capture almost 90 percent of the market moves by following the simple rules we explained above. The cloud acts as a dynamic support resistance level, whereas the Tenkan Sen and Kijun Sen lines confirm the trading signals.

No matter how good your trading strategy is, ensure your risk management is in place. That's why we have made sure to explain the placements of stop-loss and take-profit orders in every strategy.

We’ve embarked on an exciting journey of exploring the intricacies of the Ichimoku Kinko Hyo, a unique and comprehensive trading strategy rooted in the Japanese rice markets.

From understanding its five main components to customizing its settings to suit our trading style, from witnessing its effectiveness through real-world case studies to exploring the benefits of advanced Ichimoku courses - we’ve seen it all.

As we continue our journey in the trading world, let’s harness the power of the Ichimoku system, refine our strategies, and strive for continuous learning and improvement. Remember, in the dynamic world of trading, the sky’s the limit!

We hope you understand all those mentioned above Ichimoku trading strategies. Please let us know in the comments below if you have any questions.

Frequently Asked Questions

What is the best indicator to use with Ichimoku?

Regarded as one of the top indicators to pair with the Ichimoku Cloud, the Relative Strength Index (RSI) excels at spotting divergences and setups for high-probability reversals, along with identifying potential long-term trend reversals that can yield significant profits.

What are the five elements of Ichimoku?

In technical analysis, the Ichimoku framework is comprised of five distinct lines: the Tenkan-sen or Conversion Line, the Kijun-sen or Base Line, Senkou Span A, also known as Leading Span A, Senkou Span B referred to as Leading Span B, and the Chikou Span.

These components are instrumental in assessing momentum and predicting potential support and resistance zones in future market movements.

What is 9-26-52 in Ichimoku?

The default settings for the Conversion Line, Base Line, and Leading Span B within the Ichimoku indicator are 9-26-52. These figures establish the parameters that govern various components of the Ichimoku system.

What is the success rate of the Ichimoku strategy?

When utilized in bullish market conditions, the Ichimoku strategy typically yields a success rate of approximately 40 to 55%. Its effectiveness can diminish in bearish environments, where the average potential losses could reach around -25%.

As such, it’s crucial to thoughtfully evaluate the deployment of this strategy under varying market circumstances.

What is the best strategy for Ichimoku trading?

In Ichimoku trading, an optimal approach is to hold off until the price pierces through and closes beyond the Ichimoku Cloud. Following this breakout, one should seek a crossover point at which the Conversion Line surpasses the Base Line upward before initiating a purchase.

Setting a protective stop loss underneath the candle that marked the breakout is advisable for safeguarding your position.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: