We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Forex Market Hours - Understanding the Forex Market Sessions.

The Forex market is open 24/7, but retail traders can only trade during the business week, from Monday to Friday.

What Time do Forex Markets Open

Officially, the Forex market opens at 09.00 PM GMT on Sunday (5:00 PM Eastern Time (ET)).

What Time Does Forex Market Close

Officially, the Forex market closes at 08.00 PM GMT on Friday (4:00 PM Saturday, Eastern Time (ET)).

So trading in the Forex market begins at 09.00 PM GMT on Sunday and closes at 08.00 PM GMT on Friday. Note that the Forex Exchange opening times and close of all market hours adjust forward during summer by 1 hour.

Forex's trading day comprises several main Forex trading sessions that usually cover the Sydney, Asian, London, and New York market hours.

When the Forex market closed, traders can use this time to educate themselves further about Forex trading by reading books, attending webinars, or exploring educational resources.

Forex Trading Timetable and Forex Market Operating Hours in GMT

Market Session | Summer Hours GMT | Winter Hours GMT |

|---|---|---|

Sydney Open | 10:00 PM | 09:00 PM |

Sydney Close | 07:00 AM | 06:00 AM |

Tokyo Open | 11:00 PM | 11:00 PM |

Tokyo Close | 08:00 AM | 08:00 AM |

European Open | 07:00 AM | 08:00 AM |

European Close | 04:00 PM | 05:00 PM |

North American Open | 12:00 PM | 01:00 PM |

North American Close | 09:00 PM | 10:00 PM |

Forex Market Hours Chart EST

Pro Tips

- If you are often confused with different Forex market time zones, You can use the Forex time zone converter.

- The KT Forex Session indicator shows the different Forex market sessions with real-time alerts.

- It's crucial to set the correct GMT offset in your Expert Advisor.

Forex Trading Sessions Austraila

The Sydney session begins when the Australian Forex market opens at 9.00 PM GMT and closes at 5.00 AM GMT. The New Zealand session is also included in the Sydney session.

In New Zealand, the Forex market opening time is at 10.00 PM GMT and closes at 4.45 AM GMT.

Forex Trading Hours Australia vs GMT

The Australian time is 10 hours (GMT+10) ahead of the Greenwich Mean Time. For example, 9:00 am Sunday in Australia equals 11:00 pm Saturday, Greenwich Mean Time (GMT).

Forex Trading Times AEST Australia

Australian Eastern Standard Time (AEST) is GMT+10, which means it is 10 hours ahead of Greenwich Mean Time (GMT).

Forex trading sessions in Australian time begin with the Sydney session at 8 am AEST and conclude at 4 pm AEST.

Australian Forex Trading Closing Time

The Australian session concludes at 5.00 AM GMT, equivalent to 1:00 AM Eastern Time (ET). This timing signifies a significant transition point in the currency market as traders in Australia wrap up their day.

Sydney Session Forex Pairs

During the Sydney session, the best currency pairs to trade Forex are paired with the AUD since they are the most liquid pairs.

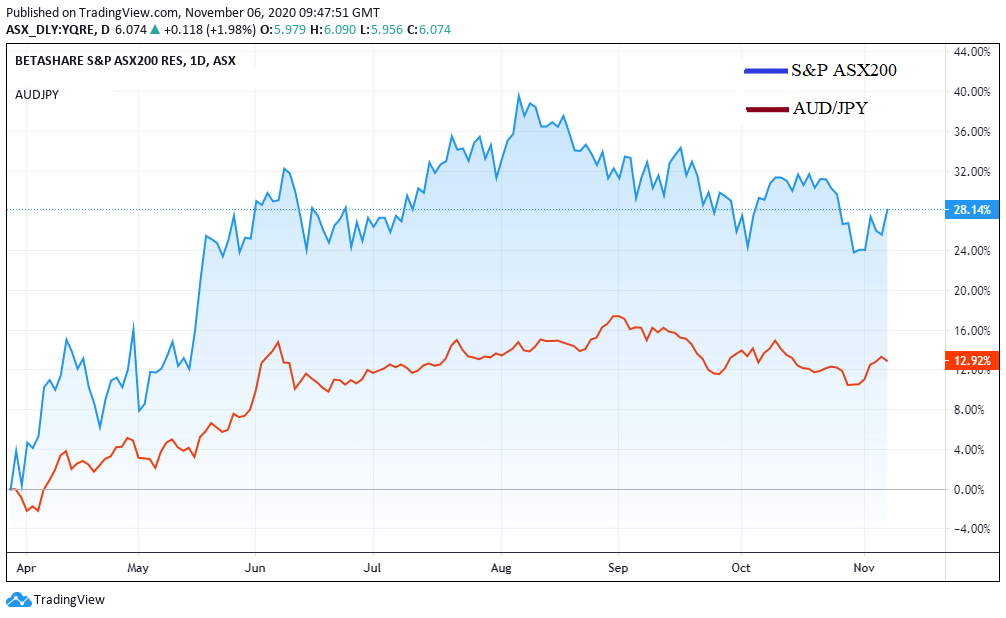

These pairs include AUD/USD, AUD/JPY, and EUR/AUD because the performance of the Australian stock market moves in tandem with the strength of the AUD.

Tokyo Market Hours (Asian Session)

What Time the Forex Market Open in Tokyo?

The Tokyo session starts when the banking hours begin in Japan. This period is between 11.00 PM GMT and closes at 7.00 AM GMT.

The Tokyo trading session encompasses most of the Forexmarket hours in Asia. It is thus commonly referred to as the Asian session.

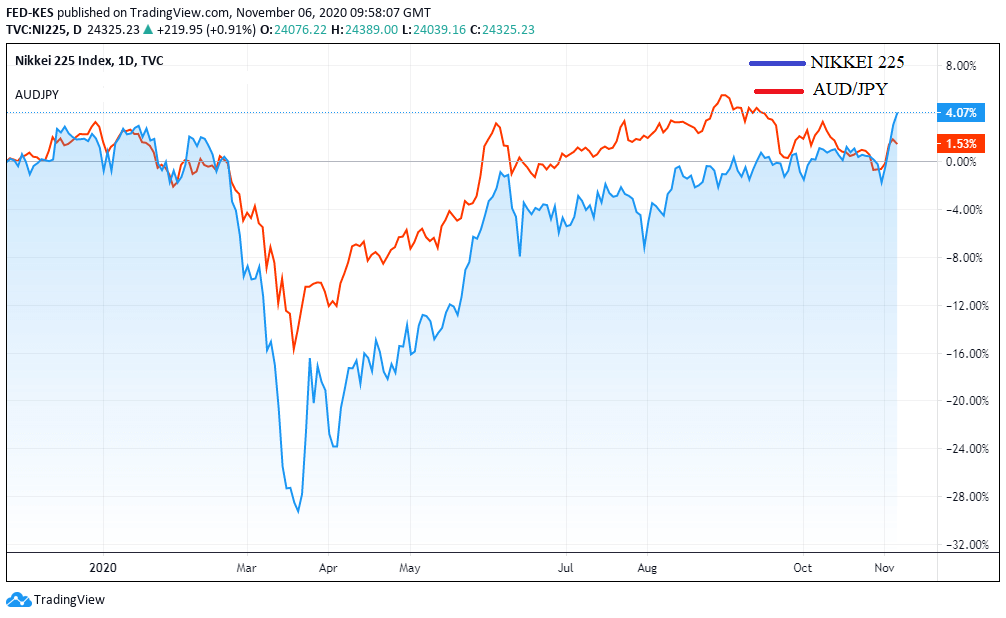

Since the JPY is the most traded currency during the Tokyo session, its strength is influenced by the Tokyo Stock Exchange's performance.

European Market Hours

The European session begins when major trading sessions and business hubs open in Europe. For example, in Frankfurt, Germany, trading sessions start at 6.00 AM GMT, while London begins at 7.00 AM GMT.

The Frankfurt forex trading hours end at 2.00 PM GMT while in London at 3.00 PM GMT.

Therefore, the European market hours span from 6.00 AM GMT to 3.00 PM GMT. Usually, when Forex traders talk of the European hours, they mainly refer to the London session.

Approximately 42% of the daily forex turnover is traded during the London session. That is why London is called the foreign exchange trading capital of the world.

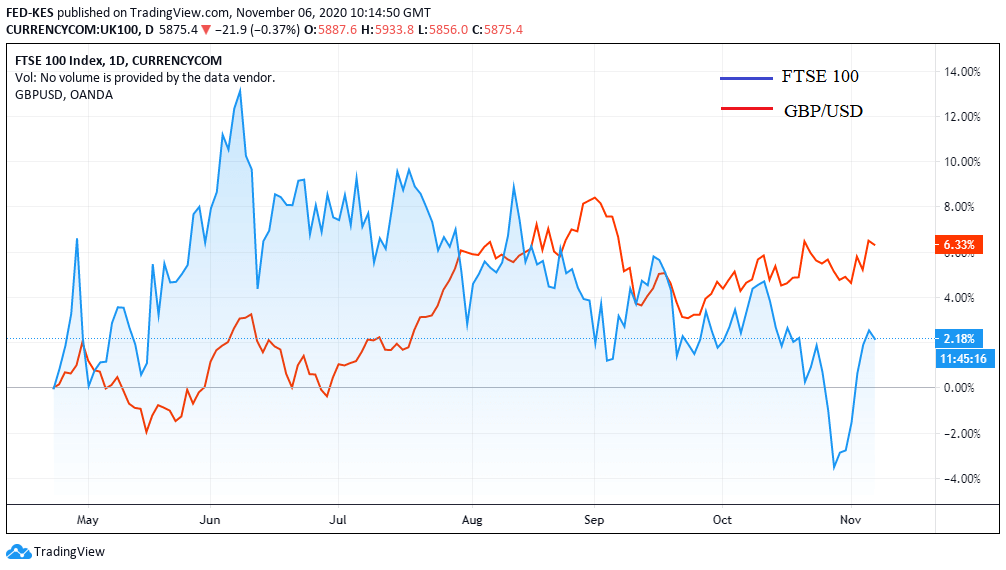

In the European trading session, the GBP is the most traded currency. Thus, the London securities market's performance heavily influences the GBP's strength.

When Does London Session Start

The London session starts at 7 am GMT and closes at 3 pm GMT.

US Session Forex Time

When people refer to the U.S. trading session, they generally refer to the New York trading session. The New York Forex trading session starts from 12.00 PM GMT to 8.00 PM GMT.

The trading activity covers Canada, Mexico, and most of South America during the NY session Forex time.

Forex trading in New York dominates the North American market hours. Overall, this session experiences the second-highest trading volume after the London session.

Currency pairs with the USD and the CAD are the most commonly traded in this session.

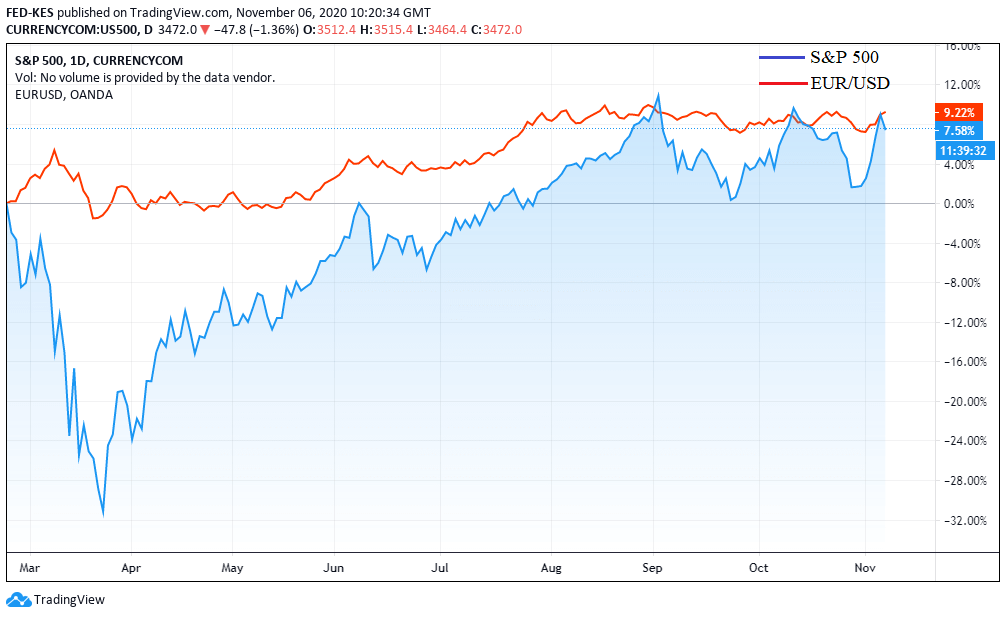

The fluctuation of the S&P 500 usually influences the EUR/USD.

New York Trading Sessions in EST

The New York trading session officially begin at 9:30 AM Eastern Time (ET) and continue until 4:00 PM ET, Monday through Friday.

The Forex market operating hours in the New York trading session is often marked by increased volatility and higher trading volumes as market participants react to the news, earnings reports, and economic data released overnight or early in the morning.

Forex Pairs and Their Sessions

- EUR/USD (Euro/US Dollar): European and U.S. sessions

- USD/JPY (US Dollar/Japanese Yen): Asian and U.S. sessions

- GBP/USD (British Pound/US Dollar): European and U.S. sessions

- USD/CHF (US Dollar/Swiss Franc): European and U.S. sessions

- AUD/USD (Australian Dollar/US Dollar): Australian and U.S. sessions

- USD/CAD (US Dollar/Canadian Dollar): North American and U.S. sessions

These pairs are among the most actively traded in the Forex market, and their liquidity and volatility can vary during different trading sessions.

Traders often monitor the overlapping sessions to take advantage of increased market activity and trading opportunities for a consistent growing equity.

The Australian-Asian Session Overlap

This Australian-Asian overlap is between 11.00 PM GMT to 5.00 AM GMT. It is the period between when the Tokyo Forex opening time and when the Australian market closes. As a result, there is an increased trading activity, with the AUD, NZD, and JPY being the most traded currencies.

The London-New York Session Overlap

The overlap is between 12.00 PM GMT (New York Market Opens) to 3.00 PM GMT (London Market Closes).

The London and the New York forex trading sessions are the largest in terms of volumes traded. Combined, about 70% of daily trading activity occurs during this overlap. The EUR/USD and GBP/USD are the most traded currency pairs.

The New York and London session overlap usually provides the best times to trade as they provide better liquidity and tighter spreads.

Forex Market Timings and Volatility

The trading volume increases during the overlaps because of increased demand for Foreign Exchange market when most international markets are active.

During the Sydney and the Tokyo session, the market has significantly lower liquidity. Since fewer sellers and buyers are in the market, abnormally large buy or sell orders can substantially impact the prices.

Notably, recent flash crashes in the forex market occurred during the Sydney session.

Trends are Created During Market Overlaps

In FX, the market trend is formed during the trading sessions overlap.

For example, the AUD/JPY trend is established during the Sydney and Asian session overlap.

Similarly, the EUR/USD and GBP/USD trends are formed during the European and North American overlap.

The trends are primarily a result of the demand. For example, if there is a net demand for the EUR, the EUR/USD pair will be bullish; similarly, if there is a net demand for the USD, the pair would be bearish.

Geopolitics and Economic News

Adverse geopolitical events tend to weaken the domestic currency in the forex market, while favorable ones will make the domestic currency stronger relative to other currencies.

Similarly, a series of positive economic news releases will make the domestic currency appreciate, while negative financial news will depreciate the domestic currency.

Forex Market Hours Easter

There are some changes in Forex trading hours during Easter. Usually, the market remains closed on Good Friday and Easter Monday.

During Easter, the trading hours can vary according to currency pair and Forex broker; that's why checking the trading schedule with your broker is advisable.

The Forex market remains closed on Good Friday, the Friday preceding Easter Sunday, and Easter Monday, the day after Easter Sunday.

This closure means that there will be no trading activity during these days. However, it's worth noting that Forex trading may resume as usual on the following Tuesday after Easter Monday.

Spreads Are Also Affected by the Forex Market Working Hours

During the busiest market hours, spreads are often tighter as there is more demand between the buyers and sellers.

FX brokers and liquidity providers can match the increased demand with adequate supply, so they must provide competitive spreads to attract more traders and participants.

Some brokers have provided as low as 0.1 pips spread for the EURUSD.

Market Volatility is also Influenced by the Market Hours.

A few high-impact news is announced during the start of a new market session.

For example, The Non-Farm Payroll (NFP) is always released on the first Friday of the month during the beginning of the New York session (8 AM EST).

When First Friday is the first day of a month, the NFP is released on the second Friday.

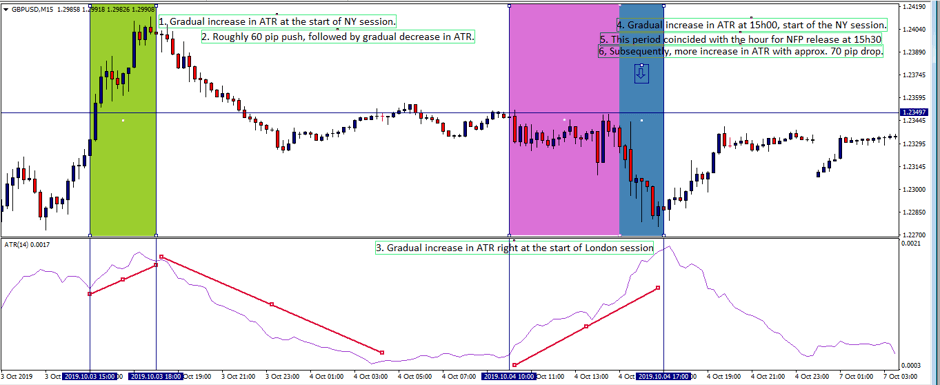

The below image shows the differences in the Average True Range (ATR) on GBPUSD M15 during different market hours. Interestingly, it also includes a period of NFP release, showing a sharp increase in market volatility.

Live Forex Market Hours Monitor

Are you looking for a reliable live forex market hours monitor? Here is a live Forex market hours tracker to help you plan your trading strategies effectively. It tracks the different Forex market hours in real-time.

Dealing with multiple Forex market time zone can be quite confusing. However, there's a helpful solution available: using a Forex market time converter. This tool can assist you in managing different time zones efficiently and effectively.

Conclusion

For a retail FX trader, the knowledge of Forex market hours is vital. It is helpful when creating your trading schedule by avoiding that are susceptible to extreme volatility.

Furthermore, it can enable you to lower costs by trading during periods of increased liquidity when large banks, businesses, and stock markets are open.

That ensures you get competitive spreads and stable volatility.

A very interesting article and I have learnt some new things.