We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

London Breakout Strategy - A Simple way of Day Trading.

The London breakout strategy, also known as the London daybreak strategy, is one of the most common and straightforward Forex trading strategies.

Fundamentally, it is a momentum trading strategy as we use the coiled-up energy from the Asian session to trade the London session.

This strategy is similar to the typical breakout trading approach, but the difference lies in the timing of its usage.

Understanding the London Session

Most professional traders, significant players, banks, and global institutions place their bets at the beginning of the London session.

That is why we often see a lot of trading activity in this session. Asian session ends just before the start of the London session.

Trading the London session can be highly profitable if we understand how to trade it correctly.

However, before directly jumping into the technicalities of the strategy, let's discuss what currency pairs are most tradable in the London session.

Suitable Currency Pairs

We should not be sticking to one or a set of currency pairs in any particular session.

Instead, our focus must be purely on which currency pair has a lot of action going or which pair is offering a lot of trading opportunities.

Hence, instead of restricting ourselves by sticking to a set of pairs, it is advisable to look out for pairs that offer great trading opportunities and then trade them.

EUR-USD and GBP-USD are two of the most common currency pairs traded during the London session.

Understanding the London Breakout Strategy

The trading time frame must be either 1-hour or 15 minutes.

The London session starts at 07:00 GMT, so we suggest you prepare yourself and be with a positive mindset just before the opening of the London market.

Follow the below rules of the strategy to make profitable trades:

- Find a currency pair that is trending. In our example, let's consider an uptrend.

- The instrument must hold at a significant resistance level in the Asian session.

- Open a long trade when the price move above the breakout line.

- Place the stop-loss just below the closing of the current candle.

- The profit target must be placed at the higher timeframe's significant resistance area.

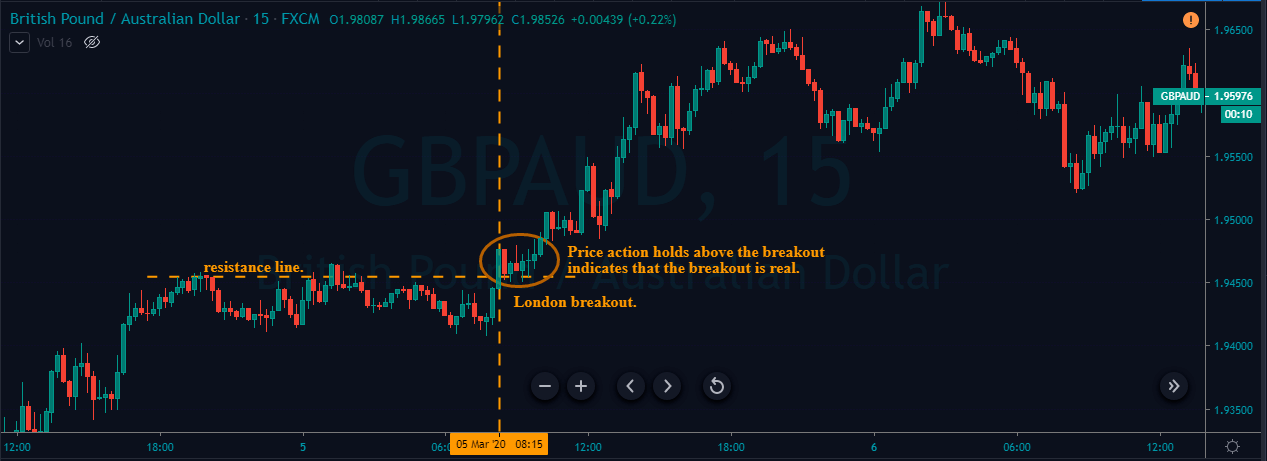

Live Trade Example 1

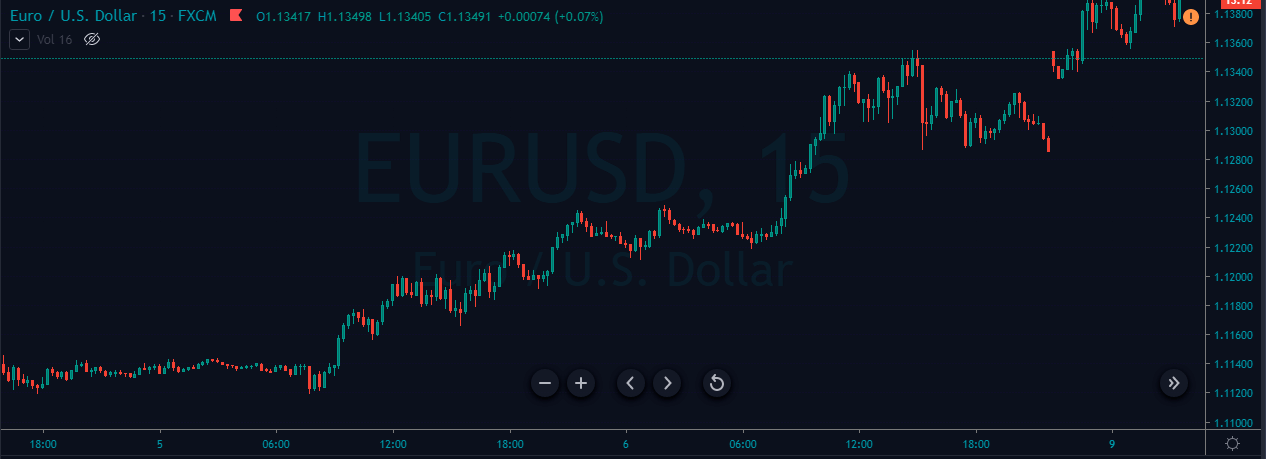

The Forex market EUR/USD pair is in an uptrend.

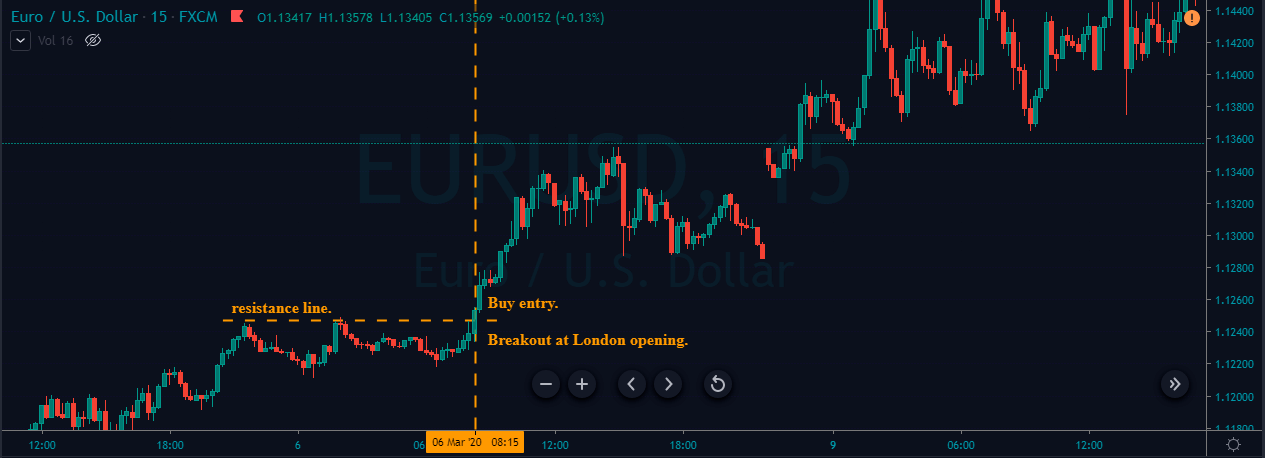

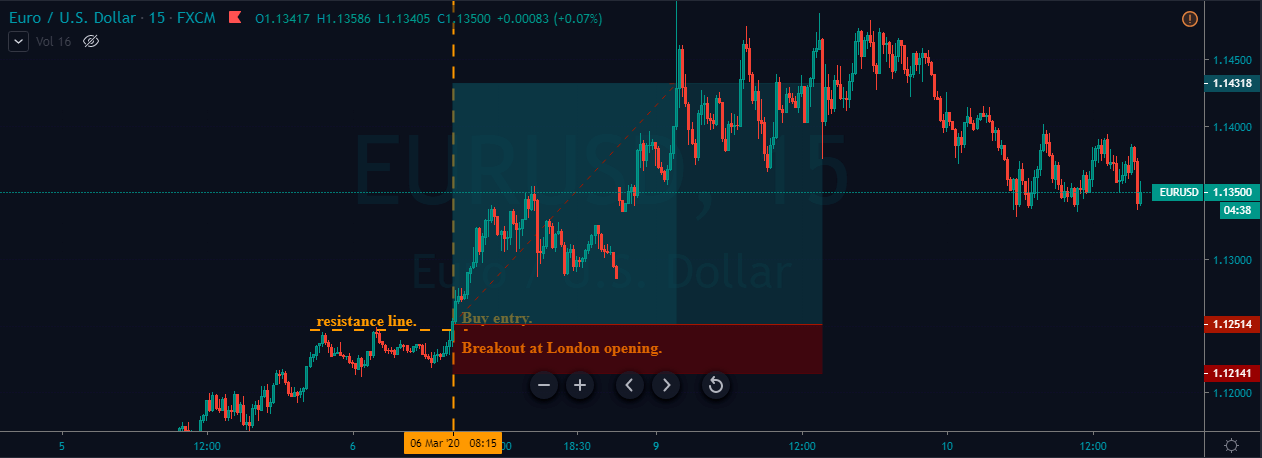

Buy Entry

The chart below shows that the London session opened at 07:00 GMT, and the price breakout at around 08:15 GMT, which is close to one hour after the London opening.

It's advisable to use the pending orders for optimal entry.

Stop-Loss and Take-Profit Placement

The stop-loss is placed below the most recent higher low. It is safe to go for a shallow stop-loss because the breakout is a major support area for the price action.

Most of the time, the volatility during the opening of the session spike significantly less.

Improving the Underlying Strategy

The strategy we have shared above is very well backtested, and without any doubt, it provides a considerable risk-to-reward ratio.

But we can improve the odds of this strategy working by waiting for additional confirmation.

- Find a strong uptrend in any volatile currency pair.

- The instrument's price must be held at the significant resistance level in the Asian session.

- Right after the breakout, look out for the formation of a few confirmation bullish candles.

- Use the buy stop order or sell stop order to enter the market.

- Remember, the price action must hold above the breakout line to confirm the buy entry.

- Place the stop-loss just below the close of the recent candle.

- The take-profit must be placed at the higher timeframe's significant resistance area or exit your positions when the buyers' momentum starts to die.

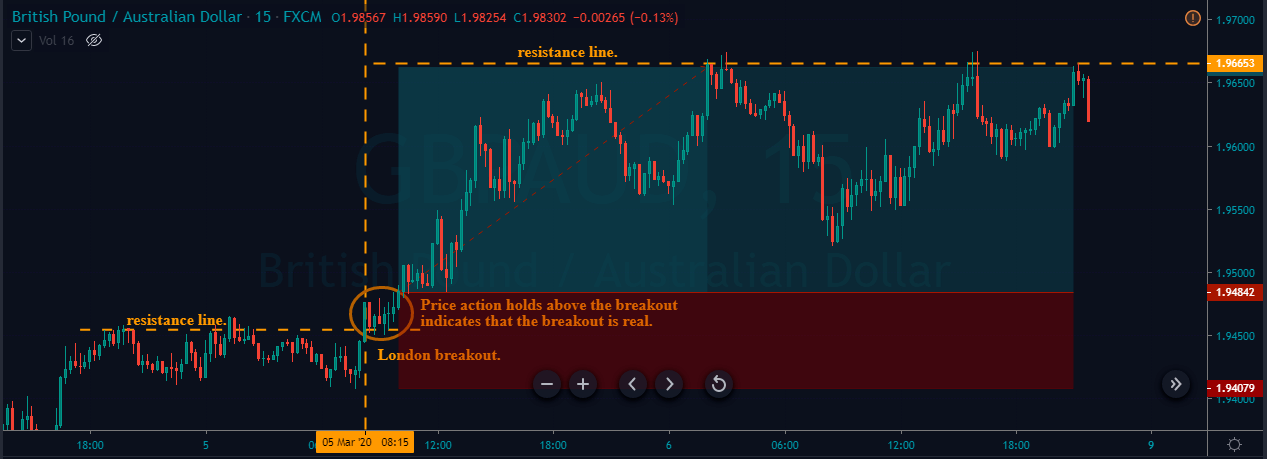

Live Trade Example 2

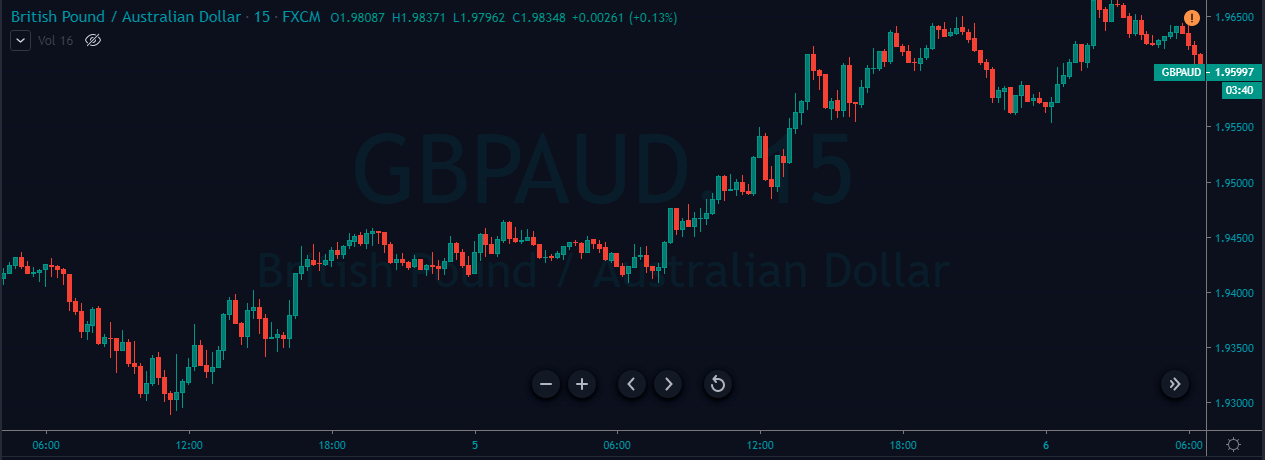

The below chart represents an Uptrend in the GBP/AUD Forex currency pair.

Buy Entry

The London session opened at 7:00 GMT, and the breakout in this pair happened one hour after the market opened.

Here, after the breakout, we can see the price break above the breakout line for a while and started printing bullish confirmation candles.

This confirms that the breakout is accurate, and we can confidently place our buy trades.

Stop-Loss and Take-Profit

As in the above strategy, we have placed the stop-loss below the breakout line. We held our position and placed the take-profit order at the higher timeframe's significant resistance line.

If you are in the US, the London breakout happens in the middle of the night. But the good news is that you can trade this strategy well during the London session's second half.

Pros

- No Complicated indicators are required to trade this London breakout Forex strategy.

- It offers a high risk-reward ratio from 1:2 to higher.

- There is no need to spend hours waiting for the perfect signal.

- An ideal strategy for day traders.

- You can easily target 30 pips during the session opening.

Cons

- High volatility during the London session can sometimes lead to price shocks and spikes.

- Widen spreads and slippage during the session opening.

- High-impact news during the London session sometimes creates panic among the market participants.

Conclusion

It is always advisable to test these strategies on a demo account first by following the game's rules.

This strategy's crux is finding out the proper breakout and checking whether the currency is volatile enough or not.

Also, it's advisable to use a trailing stop to capture more profits. Place the stop-loss at the breakeven as soon as the position hits half of your target.

P.S. You must check our automated expert advisor, KT London Breakout EA, based on a similar strategy suitable to trade the London session.