We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

What is Equity in Forex? A Detailed Explanation.

Most individuals who trade in Forex retail are typically conversant with the concept of balance in their margin trading account, as it's similar to the balance in their standard bank account.

However, they may not necessarily understand the definition of "account equity" or "equity" within the context of trading Forex.

In Forex trading, "equity" doesn't denote stocks, as some may presume. Instead, it's associated with the cash balance held in a Forex trader's account and any unrealized profits or losses linked to their open and closed positions.

Such unrealized profits or losses are occasionally termed floating profits or losses.

The account equity symbolizes the existing temporary worth of a trading account based on the prevailing market foreign exchange rates.

Similarly, expressions like Forex equity and trade equity point to the residual cash amount in your brokerage account, presuming all Forex positions are liquidated at the current market rates.

If you're intrigued about the concept of equity in Forex trading and want to understand how to compute the trading equity in your Forex account, continue reading until the end.

What Does Equity Mean in Forex

Equity meaning in Forex refers to the value you hold in your Forex trading account, which signifies the present total worth of your margin account.

This equity is your account balance, with any gains or losses from your ongoing open positions added or subtracted.

Equity in Forex meaning is almost the same as the cash amount you'd be left with if you sold off all open trading positions at the current market exchange rates.

If you don't have any open trading positions, your account equity is your account balance.

Unrealized Profits and Losses

If your open positions are making an unrealized profit, the equity value of your account is greater than its balance.

On the flip side, the equity value of your account is lesser than the balance if your open positions show an unrealized loss.

Source: https://www.educba.com/unrealized-gains-and-losses/

Unrealized gains and losses showcase the changes in value that open Forex trading positions undergo.

These are calculated by comparing the exchange rate at which the trade was entered to the current market exchange rate.

Unrealized gains and losses arise from positions whose value has shifted but has not yet been sold off. Once the position is closed, these unrealized gains and losses become realized.

Any resulting profits or losses are then viewed as realized and are displayed in the trading account's balance.

Free Margin & Equity

Free margin is the funds available in your trading account that can be used to open new positions. For example, after closing positions and collecting your profits, the increase in your account balance directly boosts your available margin.

This margin can then be utilized to open more positions, maximizing your trading opportunities.

However, always remember the risk of forex trading - the margin call.

What is Margin Call in Forex Trading?

Source: https://www.forextime.com/education/videos/what-is-margin-call

A margin call occurs when your account equity falls below a certain level, and your broker demands you deposit more funds.

You can prevent this call by efficiently managing your open positions and ensuring a reasonable margin level in your account.

For instance, making timely decisions to close positions when the market is in your favor can help increase your available margin and reduce the risk of a margin call.

How To Calculate Your Forex Account’s Equity?

The calculation is quite straightforward if you want to determine your Forex trading equity and have a system that tracks your unrealized gains and losses. To find out a trader's equity, we can utilize the following formula:

Equity = Balance + Unrealized gains or losses

While the balance reflects the cash credited to your account, the equity reflects your trading balance and any unrealized gains or losses.

When there are no active trades in your trading account, your trading equity aligns exactly with your account balance.

If your trading account has unrealized gains, then your equity is the sum of your cash balance and those unrealized gains. Conversely, if you have unrealized losses, your equity is your cash balance subtracted by those losses.

The Application of Equity in Forex Trading

Account equity indicates the real-time value of your trading positions in the foreign exchange market and your cash balance.

Forex traders can use their existing account equity as a guide to decide whether they should wisely take on more risk, hold steady, or close some positions to decrease their risk.

Online Forex traders must monitor their margin account's equity to ensure it doesn't reach a point where their broker might automatically liquidate their positions.

Some traders may base their decision to exit their trading positions on their account equity.

For instance, they might hold on to trade until the equity level hits $500 before closing a profitable position.

However, this isn't an optimal trading method, as your market analysis should be prioritized over simply observing your account or position equity figures.

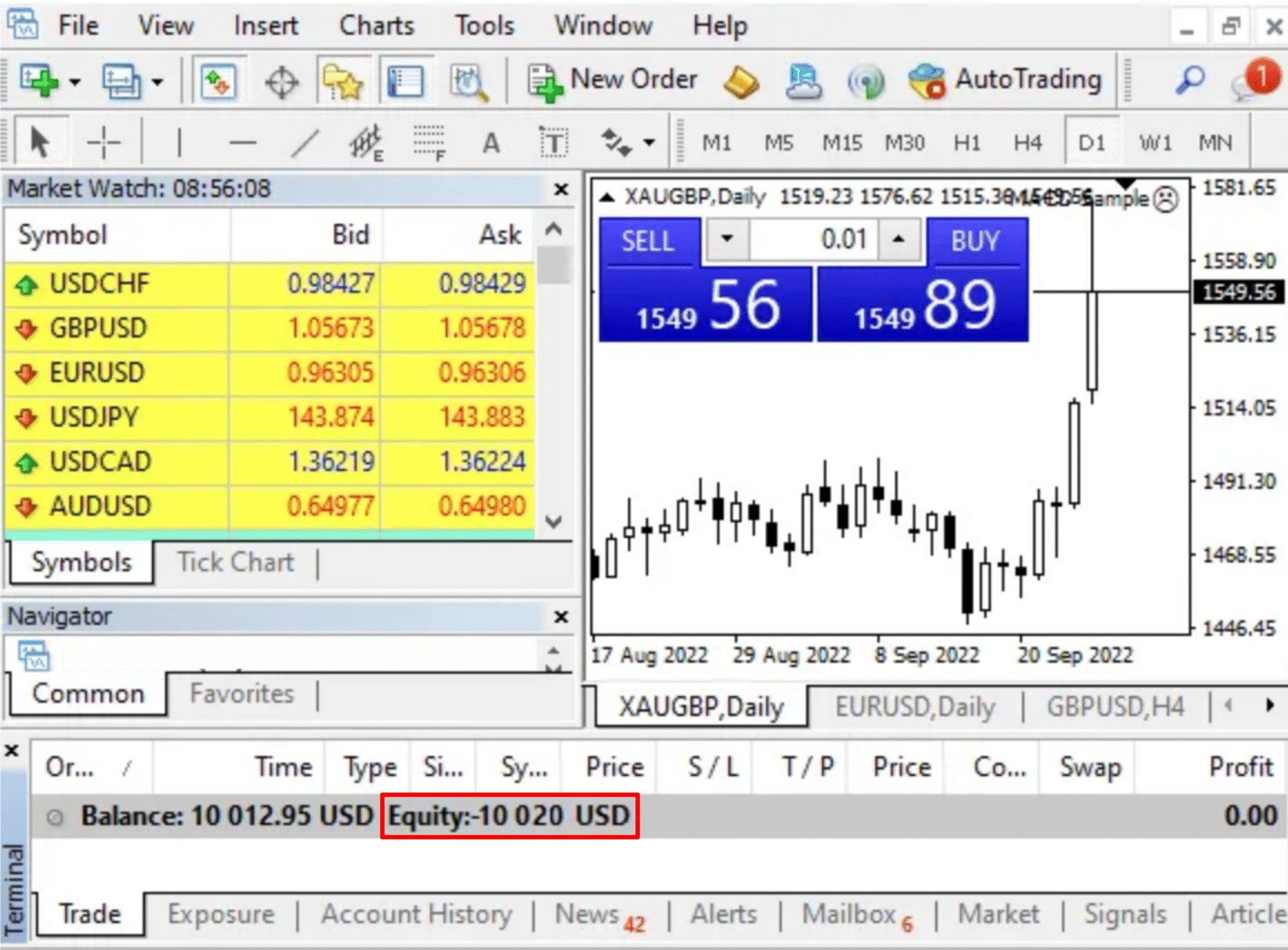

Many platforms offer this feature if you want to track your account equity in real time. They typically display it at the bottom left corner of the trading screen.

For instance, MetaTrader 4 (the most reliable online trading platform) displays your account equity in color next to your balance.

At the same time, MetaTrader 5 presents the equity on its Trade tab adjacent to your trading account balance.

Source: https://www.getknowtrading.com/mt4-negative-balance/

Example To Understand What is Equity in Forex

To help illustrate the calculation of Forex equity, imagine a scenario where a Forex trader deposits $3,000 into their margin account with an online Forex broker.

The trader then initiates two positions at the current market rates. After 15 minutes, one of their open trades displays an unrealized loss of $150, while the other position shows an unrealized gain of $250.

In this scenario, the trader's account balance remains at $3,000 as no trading gains or losses have been realized yet. However, their account equity would be computed as follows:

The trader's net unrealized trading gain of $100 is added to their account balance of $3,000 to determine their total trading equity of $3,100.

Bottom Line

Keeping a close watch on your total account equity is crucial to ensure your trading account doesn't slip into the red due to losing trades during volatile markets.

Such a scenario can lead to an ill-timed and typically disadvantageous liquidation of all your trading positions if your online broker has such protective measures.

Using the exact equity level tied to a position as a cue to exit that specific trade isn't as effective as employing market analysis and your chosen trading strategy for decision-making.

Instead, it's generally more beneficial to concentrate on chart points, patterns, technical indicators, and other technical and fundamental factors when determining the ideal time to exit a trade.

Please do not consider this as an investment advice. If you're keen on gaining experience with using the equity in Forex before venturing into trading with real money, consider practicing with a demo account to understand equity trading better.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: