We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Equity Stop Loss EA - The Best Tool to Maximize Capital Protection

In the volatile world of forex trading, a single unexpected market event can devastate an otherwise profitable trading account.

While most traders focus on entry points and profit targets, professional traders understand that comprehensive risk management particularly equity protection, is the true foundation of long-term success.

An Equity Stop Loss EA serves as the ultimate safety net for your trading capital, automatically monitoring your account equity and stepping in to prevent catastrophic losses before they occur.

This powerful automation tool removes emotional decision-making from the equation, ensuring your trading capital remains protected even during extreme market conditions.

Understanding Equity Stop Loss in Trading

Unlike standard stop-loss orders that protect individual trades, equity stop-loss protection monitors your entire account equity and takes action when predetermined thresholds are reached. This account-wide protection represents a crucial second line of defense against unexpected market movements.

How Equity Stop Loss Works

An Equity Stop Loss EA continuously tracks your account's floating equity, the sum of your account balance plus any unrealized profits or losses on open positions. When this value reaches predefined profit targets or falls to specified loss limits, the EA automatically executes protective measures.

These protective actions typically include:

- Closing all open positions to prevent further losses or lock in profits.

- Canceling pending orders to prevent new exposure.

- Optionally disabling auto trading to prevent other EAs from opening new positions.

- Alerting the trader via notifications, emails, or platform alerts.

This comprehensive protection ensures that a single unexpected market move or a series of losing trades won't devastate your trading capital, allowing you to preserve your equity and continue trading.

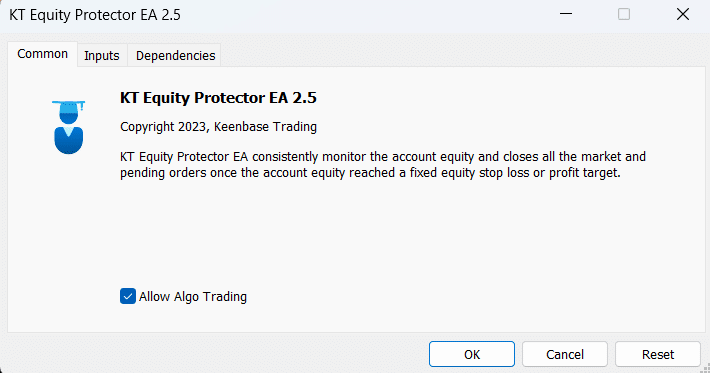

The KT Equity Protector EA: Your Personal Risk Manager

Among the many equity protection tools available, the KT Equity Protector EA stands out as an exceptional solution that provides powerful protection through an intuitive interface.

What Sets KT Equity Protector EA Apart

The EA functions as your personal risk manager, continuously watching your account equity and automatically stepping in to prevent losses or lock in profits.

Unlike many alternatives that prioritize complexity, the KT Equity Protector focuses on delivering reliable protection through a streamlined, user-friendly approach.

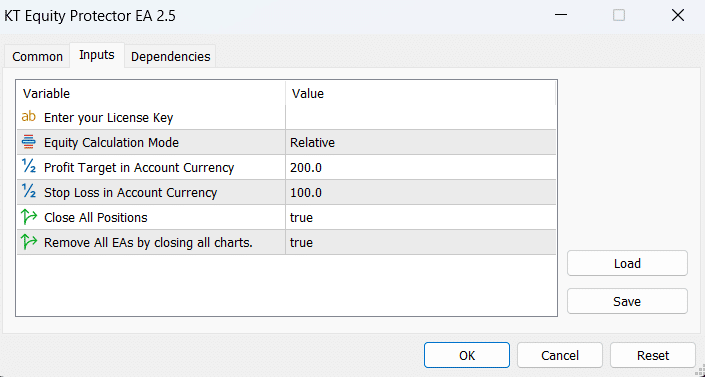

Key Features of the KT Equity Protector EA

The EA includes several powerful features designed specifically for comprehensive account protection:

Dual Calculation Modes: Choose between relative mode (percentage-based) or absolute mode (exact equity values) to customize protection to your trading style.

Complete Position Management: When equity targets are hit, the EA swiftly closes all open and pending orders, giving you immediate control over your trading exposure.

Expert Advisor Shutdown: For complete protection, KT Equity Protector EA can automatically close all open charts, stopping other Expert Advisors from placing any new trades after targets are met.

MT4 and MT5 Compatibility: Works seamlessly on both popular trading platforms, ensuring protection regardless of your preferred trading environment.

Simplicity Without Compromise: While some competing products offer complicated interfaces with dozens of confusing parameters, the KT Equity Protector EA delivers powerful protection through an intuitive interface that both novice and experienced traders can master quickly.

Practical Implementation Example

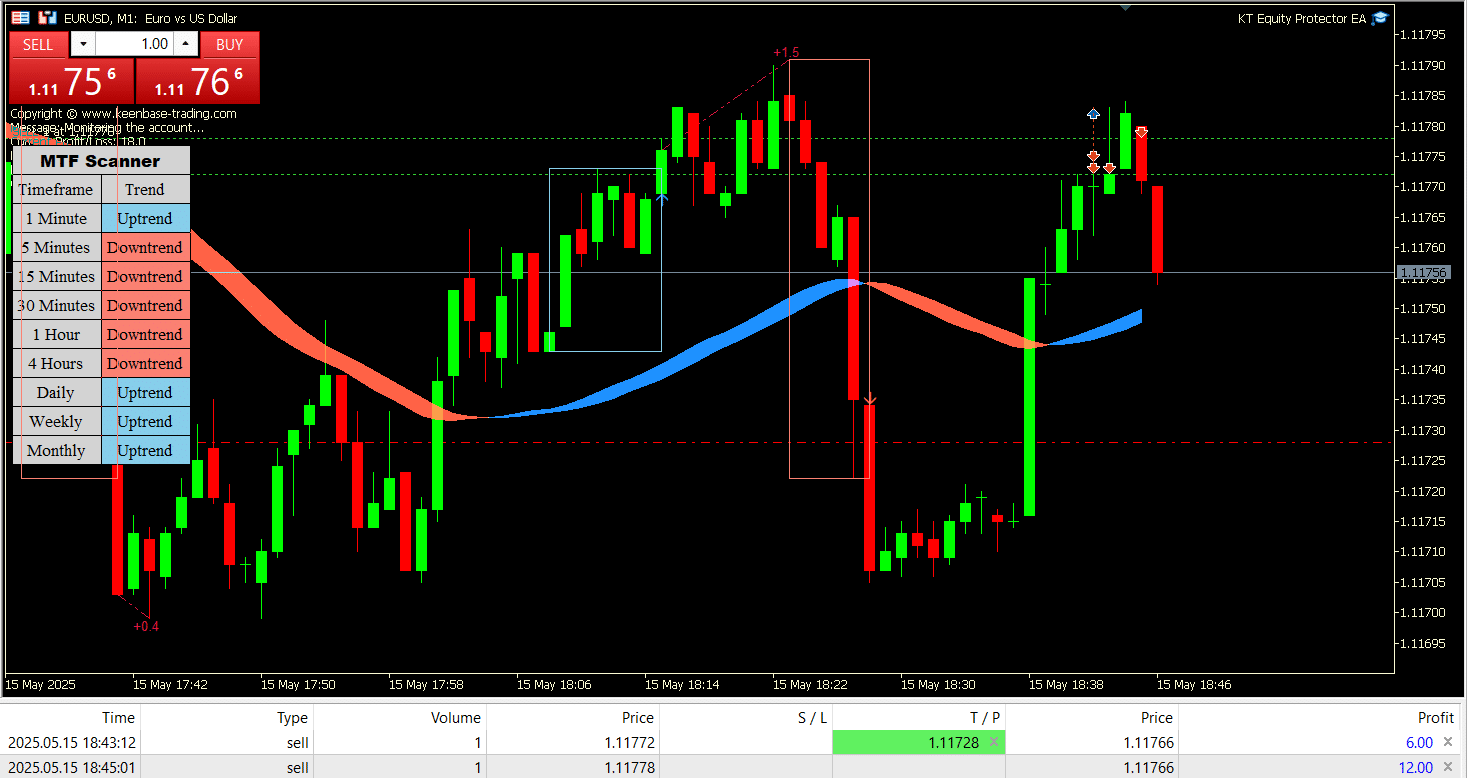

Here's how the KT Equity Protector EA works in practice:

Imagine you start with an account balance of $10,000. You set an equity stop-loss at $1,000 (relative), meaning if your equity dips to $9,000, KT Equity Protector EA immediately stops all trading activities, preserving your capital from further risk.

Similarly, set a profit target at $1,500, and the EA secures your gains as soon as your account equity hits $11,500. This ensures that profitable trading sessions don't turn negative due to unexpected market reversals.

With these settings in place, you can focus entirely on executing your trading strategy while the EA handles the critical task of protecting your account equity.

Real-World Performance

The EA has proven its value in various market conditions. One trader reports: "To test, I ran an EA in a demo account and purposely overloaded the lot size. The Equity Protector worked like a charm, exactly at the set amount drawdown. I am very confident that it will be just what I need for my live accounts."

Another user adds: "I just love it. It has made my risk management much easier." These testimonials highlight the EA's reliability and effectiveness in real trading scenarios.

The Critical Importance of Equity Protection

Without proper equity protection measures, traders face several significant risks:

Cascading Losses: A series of losing trades can quickly compound, depleting trading capital at an accelerating rate. Many traders have experienced how quickly a 10% drawdown can become 20% or more without automated protection in place.

Emotional Decision Paralysis: As losses mount, psychological factors often prevent traders from exiting positions that should be closed. An equity stop loss EA removes this emotional barrier by executing protection automatically.

Overnight Gaps: Major news events can cause currencies to gap significantly when markets reopen, potentially causing losses far beyond standard stop-loss levels. Equity protection provides an essential backstop against these unexpected events.

System Failures: For algorithmic traders, technical issues with trading systems can result in unintended exposure. An equity stop loss EA works as an independent safety system that intervenes regardless of other system problems.

Implementing reliable equity protection transforms your approach to risk management, allowing you to trade with greater confidence knowing that your account has definitive protection limits in place.

Key Features of Effective Equity Stop Loss EAs

Not all equity protection tools are created equal. The most effective solutions provide these essential features:

Powerful Equity Calculation Modes

Advanced equity stop loss EAs offer multiple calculation modes to suit different trading approaches:

Relative Mode (Percentage-Based): Calculates protection levels as a percentage of your account balance. For example, setting a 5% maximum loss would close all positions if your equity drops by 5% from the starting point.

Absolute Mode (Fixed Values): Allows setting exact equity values as triggers. For instance, specifying $9,500 as your absolute stop level for a $10,000 account.

Floating Mode: Adjusts protection levels dynamically as your account equity grows, allowing for trailing equity stops that lock in profits while maintaining protection.

Comprehensive Protection Options

Look for these critical protection mechanisms in any equity stop loss EA:

Equity Stop Loss: Automatically closes all positions when account equity falls to a predetermined level, preventing further losses.

Equity Profit Target: Locks in profits by closing positions when equity reaches your desired profit threshold.

Trailing Equity Stop: Adjusts the protection level upward as profits increase, securing gains while allowing for continued upside.

Maximum Drawdown Protection: Monitors drawdown percentage from peak equity, offering protection based on drawdown rather than absolute values.

Advanced Control Features

The best equity stop loss EAs offer these additional control features:

Selective Position Management: Ability to filter which positions are closed based on symbol, magic number, or trade direction.

Customizable Actions: Options for what happens when thresholds are reached, including position closure, pending order cancellation, and EA shutdown.

Multiple Notification Methods: Email alerts, push notifications, and on-screen alerts to inform you when protective actions are taken.

Session Management: Ability to activate or deactivate protection during specific trading sessions or days of the week.

Common Challenges with Equity Protection

While equity stop loss EAs provide essential protection, traders should be aware of potential challenges:

Position Closure Sequence

During high-volatility events, the order in which positions are closed can impact the final result. Some EAs close the most profitable positions first, while others prioritize the most losing trades. Understanding this sequence is important when evaluating protection outcomes.

Market Execution Realities

In rapidly moving markets, there may be slippage between when the EA triggers protection and when all positions are actually closed. The best EAs account for this reality with intelligent closure mechanisms and slippage tolerance settings.

False Triggers in Volatile Markets

Setting equity protection levels too tight can result in premature position closure during normal market volatility. Balancing protection with realistic market movement tolerances is essential for optimal results.

Platform Dependencies

Most equity stop loss EAs depend on the trading platform remaining operational. During extreme market events, platform issues can sometimes occur. Some advanced solutions include fail-safe mechanisms for these scenarios.

Setting Up Effective Equity Protection

Regardless of which equity stop loss EA you choose, these guidelines will help you implement effective protection for your trading account:

Determining Appropriate Protection Levels

The right equity protection levels depend on your trading style, risk tolerance, and account size:

Day Traders: Typically use tighter equity stops (1-3% of account equity) due to higher trade frequency and expectation of smaller daily fluctuations. This approach works well for traders using strategies like the London breakout strategy.

Swing Traders: Often set wider protection levels (5-10% of account equity) to accommodate normal market fluctuations over multiple days. This is especially important when using methods that involve supply and demand or other longer-term technical approaches.

Algorithm Traders: May implement tiered protection with different actions at various equity levels (warning at 5%, partial closure at 10%, complete shutdown at 15%).

As a general rule, never risk more than you can comfortably lose without affecting your trading psychology. For most traders, limiting maximum drawdown to 15-20% of account equity represents a prudent approach.

Testing Your Protection Setup

Before deploying any equity stop loss EA on your live trading account:

- Demo Testing: Thoroughly test on a demo account that mirrors your live trading conditions.

- Stress Testing: Intentionally create losing scenarios to verify that protection triggers work as expected.

- Platform Restart Verification: Ensure protection remains active after platform restarts.

- Multi-Asset Verification: Test with various currency pairs to confirm universal protection.

This comprehensive testing process ensures your safety net functions properly when you need it most.

Integrating with Your Overall Risk Management

Equity protection works best as part of a comprehensive risk management strategy:

- Individual Position Stops: Continue using traditional stop-loss orders on individual trades.

- Position Sizing: Limit exposure per trade to a small percentage of account equity.

- Correlation Management: Be aware of the correlation between open positions to avoid amplified risk.

- Regular Review: Periodically assess and adjust your protection parameters as your account grows.

This multi-layered approach provides optimal protection while allowing for profitable trading.

Conclusion: Securing Your Trading Future with Equity Protection

In the challenging world of forex trading, implementing reliable equity protection may be the single most important decision you make for your long-term success.

An effective equity stop loss EA transforms how you approach risk management by providing a dependable safety net that protects trading capital from devastating losses.

The KT Equity Protector EA offers an excellent balance of comprehensive protection features, reliability, and user-friendly operation at an accessible price point.

Its straightforward approach removes the complexity often associated with advanced risk management tools, making professional-grade protection accessible to traders of all experience levels.

With proper equity protection in place, you can focus entirely on identifying profitable trading opportunities while your EA handles the critical task of safeguarding your account equity.

This powerful combination of offensive and defensive trading tools creates the balanced approach needed for sustainable trading success.

Ready to secure your trading capital with reliable equity protection? The KT Equity Protector EA is available now for both MT4 and MT5 platforms with lifetime access and support.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: