We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

How to Trade XAUUSD (Gold) on MT4 and MT5

Gold has been the bedrock of wealth for centuries, a universal symbol of prosperity that has bewitched civilizations and captivated investors' minds.

In this article, we delve into trading the XAUUSD pair (Gold) on MT4 and MT5, exploring its significance and the factors that influence it.

Today, this fascination with the yellow metal has morphed into a dynamic financial instrument, personified by the XAUUSD (Gold trading symbol) pair.

By trading gold against the US dollar, traders harness this timeless commodity's liquidity, volatility, and safe-haven status.

The magnitude of XAUUSD trading is colossal, a testament to the insatiable global appetite for gold.

It is a key pair in the foreign exchange market and acts as a barometer for global market sentiment.

When economies tremble, investors rush to the stability of gold, impacting the value of the XAUUSD pair.

Understanding and navigating this multifaceted instrument is key to unlocking a world of potential profit and risk management.

Strap in as we embark on a detailed guide to trading XAUUSD on one of the world's most popular trading platforms - MT4 and MT5.

This comprehensive walkthrough will equip you with a fundamental understanding of XAUUSD and share strategies, risk management techniques, and tips to enhance your trading journey.

Step-By-Step Guide to Trade XAUUSD on MT4 & MT5

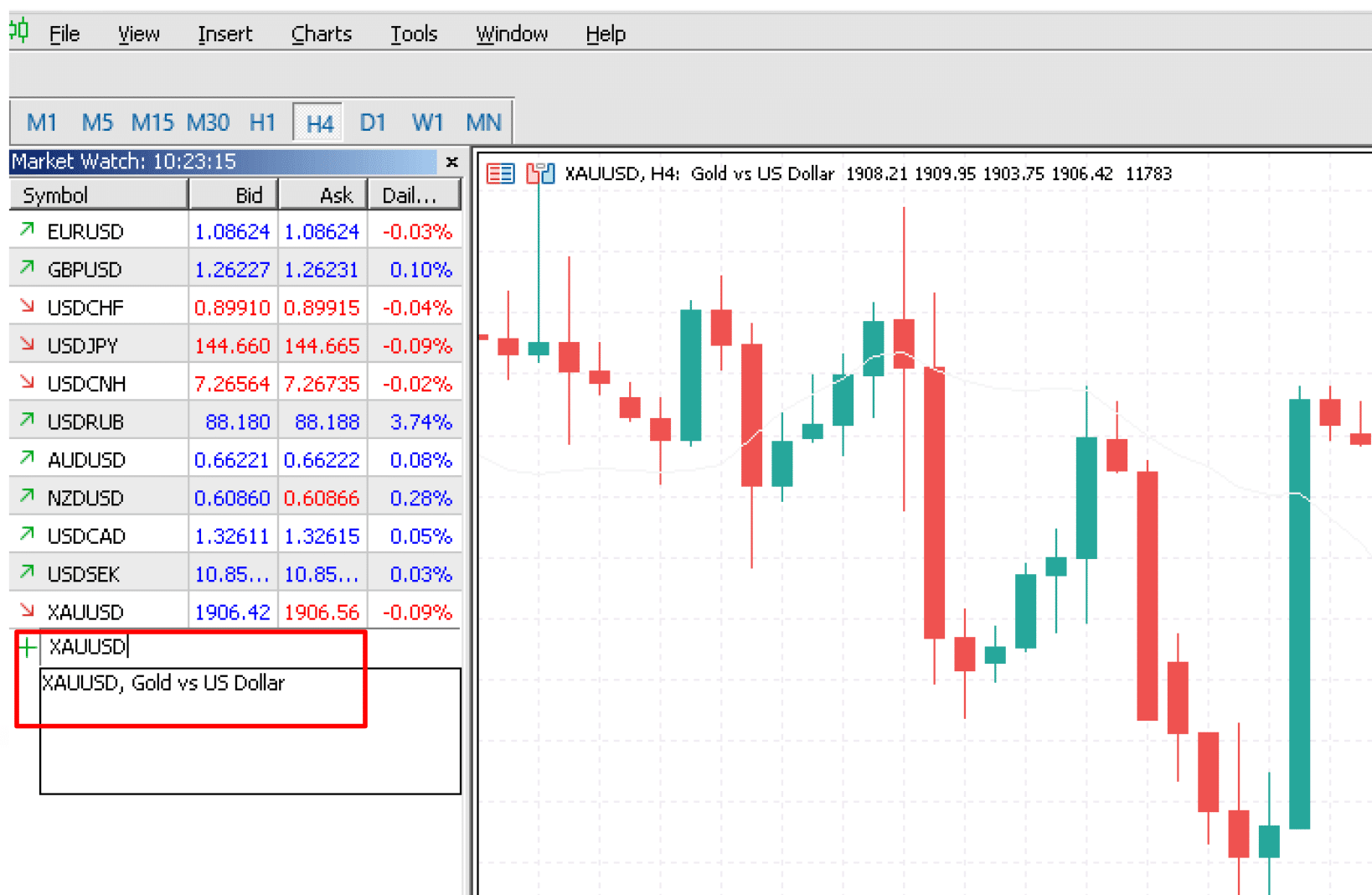

How to Add XAUUSD on MT5 & MT4

To start trading the Gold symbol (XAUUSD) on the Metatrader 4/5, you need to first locate this symbol in the 'Market Watch' window, a comprehensive list of all the available instruments you can trade with your broker.

If XAUUSD is not immediately visible, right-click anywhere in the 'Market Watch' window and select 'Show All.'

This will refresh the list and include all available currency pairs, commodities, indices, and stocks your broker offers.

Once 'Show All' is clicked, the XAUUSD symbol should appear in the list.

To open a chart for XAUUSD, drag and drop the symbol onto the main workspace or right-click it and select 'Chart Window.'

A new chart detailing the live Gold price action against the US dollar will be displayed on your screen.

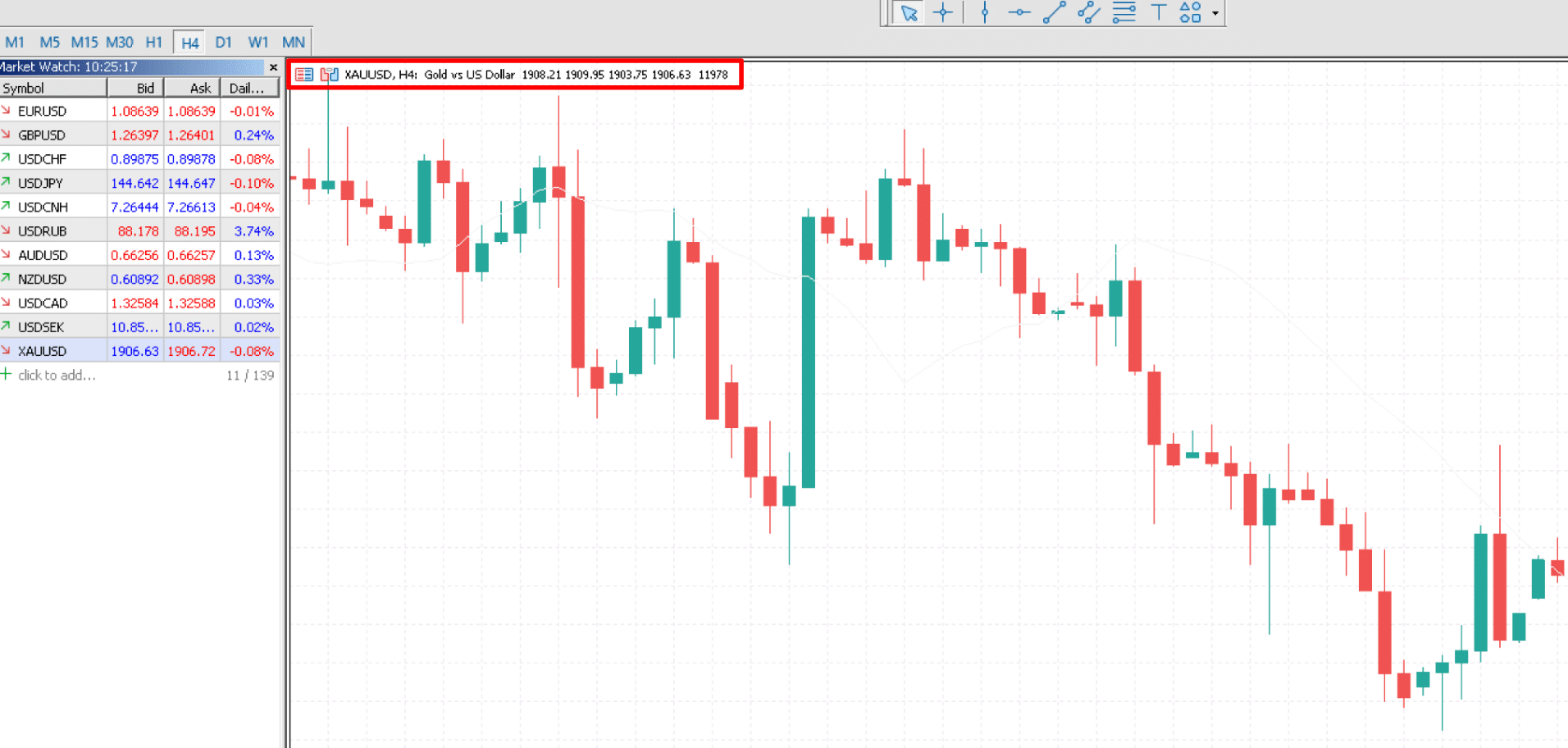

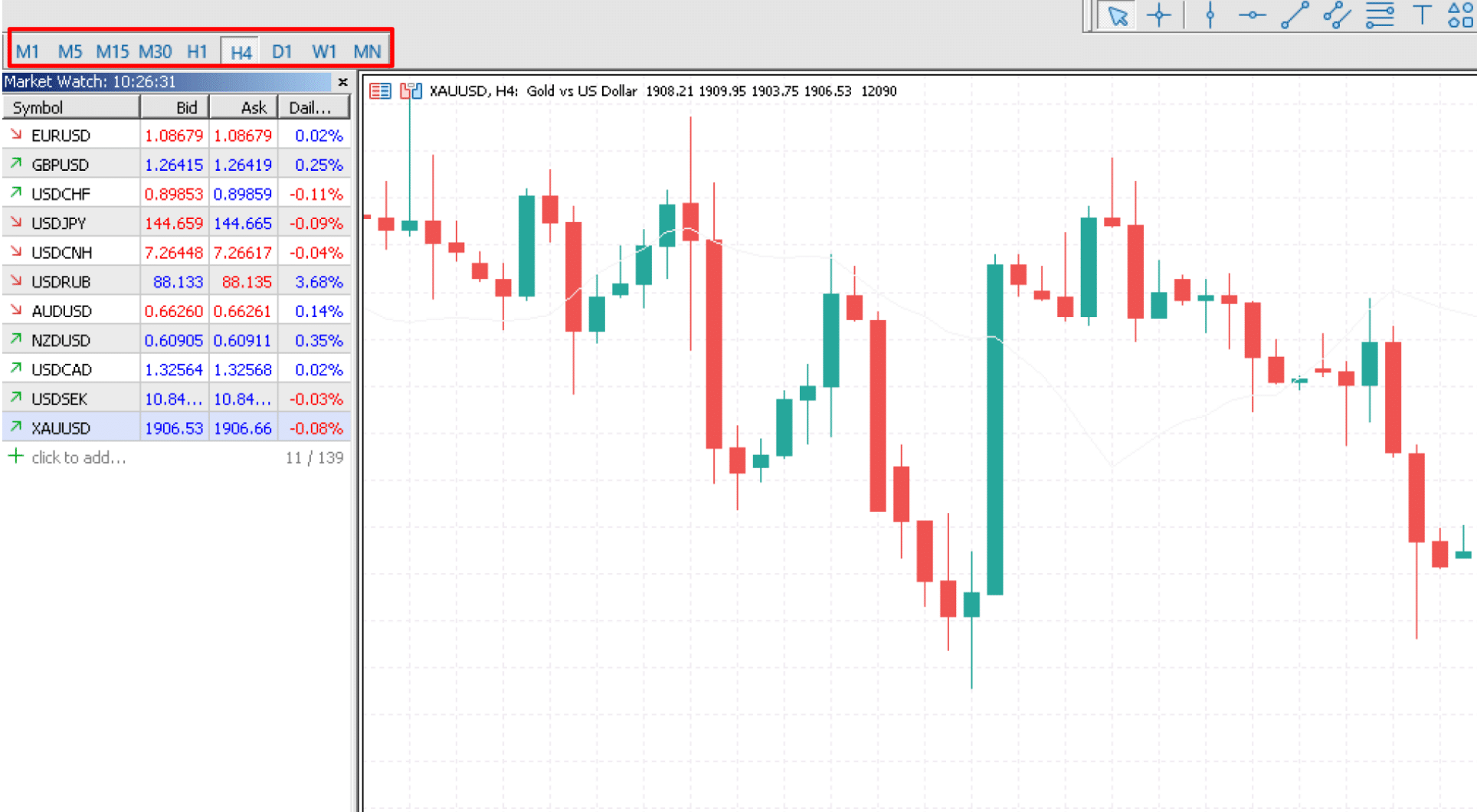

Understanding XAUUSD Chart on MT4 & MT5

A basic understanding of the XAUUSD chart is crucial to successful trading.

The vertical 'Y' axis represents the Gold price in USD, while the horizontal 'X' axis represents time.

Each point on the chart indicates the Gold price at a specific time.

These points are often linked as line, bar, or candlestick charts to showcase Gold price movement over time.

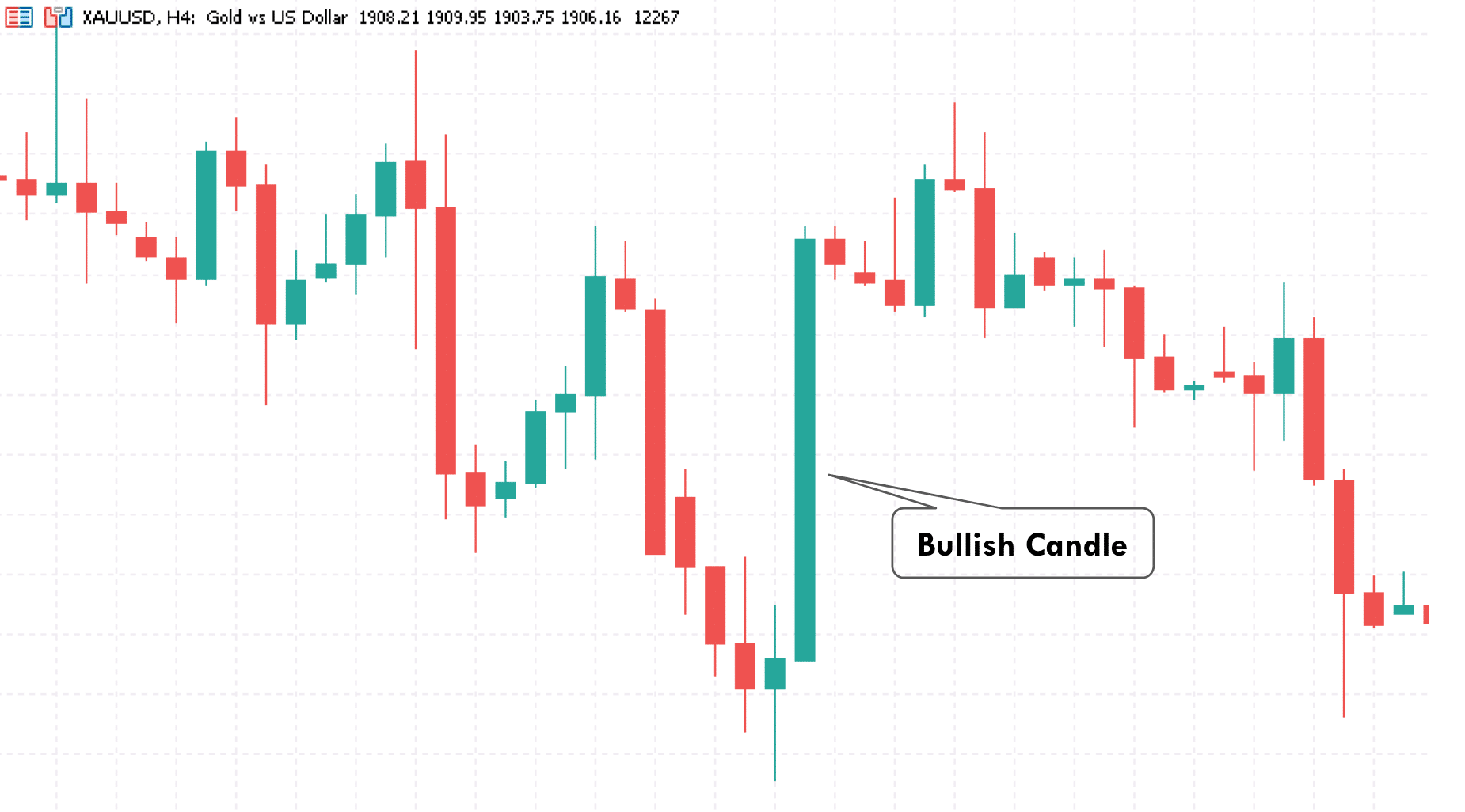

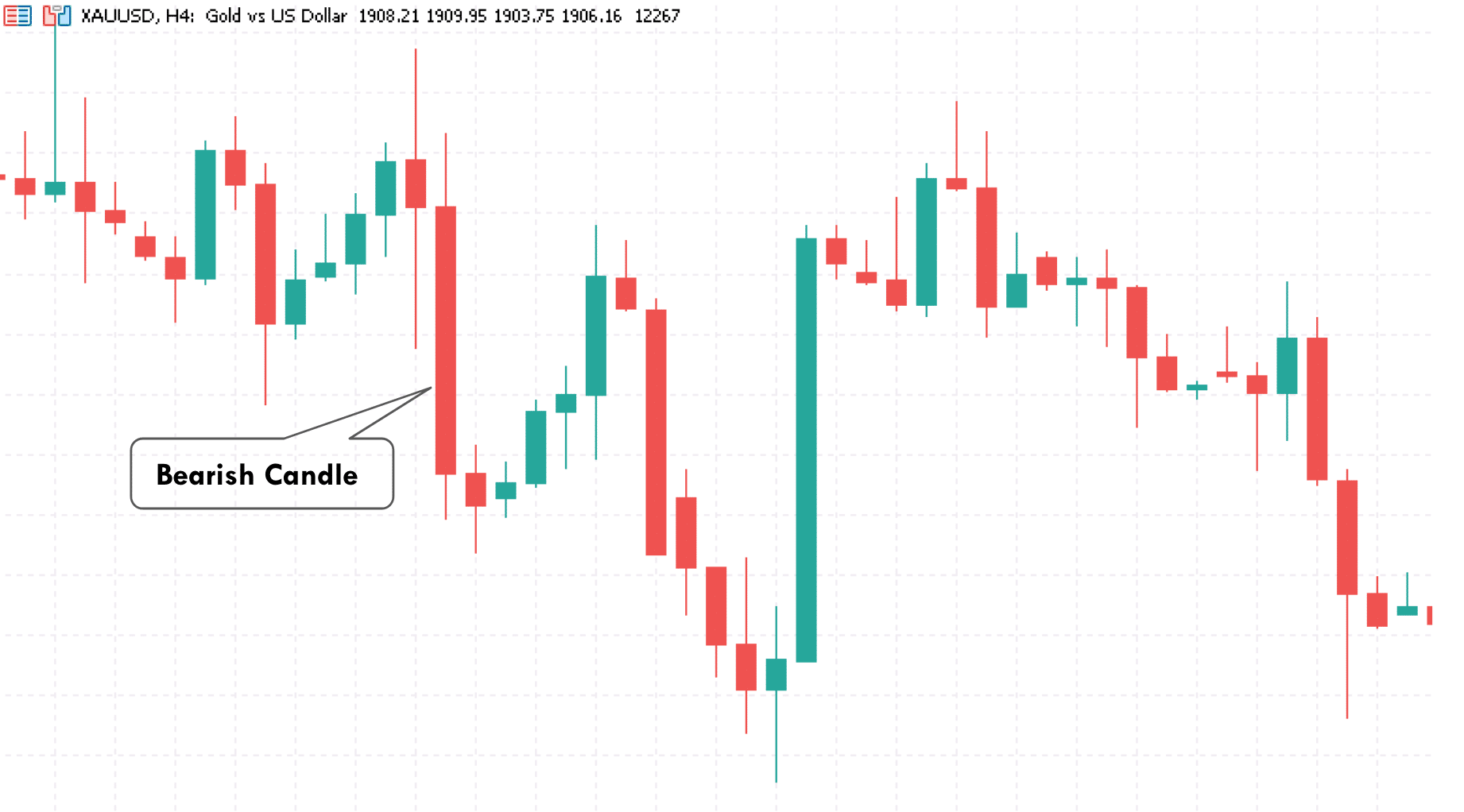

The most commonly used chart type is the candlestick chart, with each candle representing a specific time period, such as 1 minute, 5 minutes, 15 minutes, 30 minutes, 1 hour, 4 hours, one day, one week, or one month.

The candlestick's body shows the opening and closing prices for the period, and the wicks (or shadows) indicate the highest and lowest prices.

A Green candlestick denotes that the closing price was higher than the opening price, indicating a bullish (upward) movement.

Conversely, a Red candlestick signifies bearish (downward) movement, where the closing price was lower than the opening price.

One standard lot in gold trading is equivalent to 100 ounces. Once these parameters are set, click the 'Buy' or 'Sell' button to place your trade.

Setting Stop Loss and Take Profit Levels

Establishing Stop Loss (SL) and Take Profit (TP) levels is a crucial part of risk management in trading.

A Stop Loss is a predetermined level at which your trade will automatically close if the price moves against your prediction, limiting your potential loss.

Conversely, a Take Profit level is a predetermined level at which your trade will automatically close once your profit target has been reached.

To set these levels in MT4/MT5, go to the 'Order' window (the same window where you place a new order).

There are fields to input your desired Stop Loss and Take Profit levels. These are typically set in terms of pips away from your entry price.

Setting a Stop Loss and Take Profit doesn't guarantee a certain profit or prevent all losses.

If the Gold market experiences a price gap, your orders may not be executed at the exact levels you specified.

However, these tools remain essential to prudent risk management and trading strategy.

Analyzing XAUUSD for Trading Decisions

Making informed trading decisions requires a deep understanding of the various forces that can affect the price of XAUUSD.

Two primary forms of analysis are used in trading: Fundamental Analysis and Technical Analysis.

Both approaches offer valuable insights but differ in their focus and application.

Fundamental Analysis for XAUUSD

Fundamental analysis involves studying the broader economic and geopolitical factors that influence the price of gold and the USD.

This analysis often requires a keen understanding of macroeconomic indicators, market sentiment, and current events.

Key macroeconomic indicators include inflation, GDP growth, unemployment, and interest rates.

For example, high inflation or low-interest rates often weaken the USD, causing gold prices to rise and vice versa.

Similarly, global events like elections, wars, or economic crises can spur demand for safe-haven assets like gold, leading to price spikes.

Beyond macroeconomic data and geopolitical events, investors should also consider the US Dollar Index (DXY).

This index tracks the strength of the USD against a basket of other major currencies.

When the DXY weakens, gold often strengthens, and the XAUUSD pair tends to rise. Conversely, a strong DXY often leads to a fall in the XAUUSD pair.

Technical Analysis for XAUUSD

Technical analysis, on the other hand, involves examining historical price data to predict future price movements.

This approach is based on the principle that price patterns tend to repeat over time and that past market behavior can provide clues about future movements.

One of the most basic forms of technical analysis involves using support and resistance levels.

Support levels represent prices where buyers have previously entered the market in sufficient numbers to halt a downward trend. In contrast, resistance levels are prices where sellers have overwhelmed buyers to stop an upward trend.

Identifying these levels can help Gold traders determine entry and exit points for their trades.

More advanced technical analysis may involve the use of technical indicators like Moving Averages (MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Bollinger Bands.

These tools can help identify trends, measure market momentum, and signal potential reversals, aiding traders in making informed decisions on when to enter or exit trades.

Both fundamental and technical analysis play critical roles in trading XAUUSD.

While fundamental analysis explains the broader forces influencing the pair, the technical analysis offers insights into market behavior and potential future price movements.

It's recommended to use both approaches to make well-rounded trading decisions.

Understanding the Basics of XAUUSD Trading

To effectively trade XAUUSD, you first need to grasp the basics of this unique pair.

This section will provide a comprehensive overview, from defining the XAUUSD pair, to understanding its importance in the Forex market and recognizing the factors influencing its prices.

Defining XAUUSD: Gold against the US Dollar

XAUUSD refers to the trading currency pair of Gold (XAU) and the US Dollar (USD). In this pair, XAU, the ISO 4217 standard code for one troy ounce of gold, is the base currency, and USD is the quote currency. Essentially, the XAUUSD price shows how many US dollars you need to purchase one ounce of gold.

Trading XAUUSD essentially means buying or selling gold against the US dollar. When you believe that the value of gold will increase against the US dollar, you would 'buy' or go 'long' on XAUUSD. Conversely, if you think gold will decrease in value relative to the US dollar, you would 'sell' or go 'short' on XAUUSD.

Gold Trading in Futures

Gold futures are like a deal to buy or sell a certain amount of gold on a set date at an agreed-upon price. Traders and investors use this deal to protect themselves from gold price changes, make predictions about what gold will be worth later on, and spread out their investments by adding a valuable metal with a long history of being valuable.

Understanding the Importance of XAUUSD in Forex Market

XAUUSD is one of the forex market's most traded and important pairs.

Given gold's historic role as a store of value and a hedge against inflation, it holds a unique position in global economics and trading.

Trading XAUUSD offers you a way to diversify your trading strategy and portfolio.

Unlike traditional forex pairs directly influenced by economic indicators and policy changes, XAUUSD is often seen as a safe haven during economic uncertainty.

When confidence in traditional fiat currencies diminishes, investors often flock to gold, increasing volatility and trading opportunities in the XAUUSD pair.

Factors Influencing XAUUSD Prices

Economic Indicators: US economic data, such as GDP, unemployment, and interest rates, can influence the USD's value and thus affect XAUUSD prices.

Strong economic indicators usually strengthen the USD and could lower XAUUSD prices and vice versa.

Market Sentiment: During economic or political instability, investors often turn to gold as a 'safe haven' investment, driving its value against the USD.

US Dollar Strength: The strength of the USD against other currencies can affect the price of gold.

Gold prices often fall when the USD is strong, decreasing XAUUSD prices and vice versa.

Inflation: Gold is often seen as a hedge against inflation. When inflation rates rise, gold prices often increase, which can lead to an increase in XAUUSD prices.

Supply and Demand: Physical supply and demand for gold from industries such as jewelry, technology, and central banks can influence gold prices.

Increased demand or reduced supply can lead to higher gold prices, increasing XAUUSD prices.

Understanding these factors can help you anticipate potential price movements in XAUUSD and plan your trades more effectively.

Gold Trading Strategy for XAUUSD on MT4/MT5

Trading XAUUSD successfully on MT4 & MT5 requires a thorough understanding of the financial markets dynamics, a well-planned strategy, and effective risk management.

This section provides tips and strategies to enhance your XAUUSD trading journey.

Best Time to Trade XAUUSD

XAUUSD is traded 24 hours a day, five days a week. However, the pair's volatility changes throughout the day due to the opening hours of various financial and Gold markets worldwide.

The most volatile periods for XAUUSD generally occur when the London and New York stock market overlap, between 8:00 AM and 12:00 PM (Eastern Time), and when key economic data or news is released.

Additionally, XAUUSD can be sensitive to geopolitical events or crises that cause rapid shifts in market sentiment.

During such times, XAUUSD may experience increased volatility as investors turn to gold as a safe-haven asset.

Therefore, keeping abreast of the news and being ready to act at any time is crucial.

Common Mistakes to Avoid in XAUUSD Trading

Several common mistakes can hamper the success of XAUUSD traders. One of the biggest errors is neglecting risk management.

Trading without a stop loss or trading with excessive leverage can expose you to significant losses.

Always set a stop loss for each trade and ensure that your trade size aligns with your risk tolerance and account size.

Another common mistake is impatience and overtrading. It's important to wait for high-probability trade setups rather than rushing to enter a trade.

Overtrading precious metal like Gold can increase transaction costs and cause traders to miss better opportunities.

Finally, many traders neglect the psychological aspects of trading. Emotion-driven decisions can lead to disastrous trades.

Maintaining discipline, sticking to your trading plan, and avoiding letting emotions like fear or greed dictate your actions are important.

Effective Trading Strategies To Trade Gold

There are many strategies that traders can use when trading XAUUSD. Here are a few popular ones:

Trend Trading

This strategy involves identifying the direction of the current trend and opening positions in line with that trend. Traders may use technical indicators like moving averages or trendlines to help identify trends.

Swing Trading

Swing traders aim to capitalize on price fluctuations over several days or weeks. They typically use technical analysis to identify points where the price is likely to change direction, known as 'swings.'

Breakout Trading

Breakout traders seek strong price moves that break through key support or resistance levels. When a breakout occurs, it's often followed by increased volatility and heavy trading volume. Breakout traders aim to enter the market just as the breakout occurs to capture these rapid price movements.

Remember, no strategy guarantees success, and the best approach often depends on your trading style, risk tolerance, and market conditions.

It's also crucial to test any new strategy on a demo account before using it in live trading.

Risk Management in XAUUSD Trading

Effective risk management is the cornerstone of successful trading, particularly in the volatile world of currency trading, where swift price swings can erode profits.

This section will delve into the importance of risk management and practical strategies specifically tailored to XAUUSD trading.

Importance of Risk Management in Trading Gold

Risk management in forex trading is indispensable for preserving your trading capital and ensuring longevity in the market.

While all investments involve risks, the forex market's unique characteristics, including its high leverage and 24-hour trading cycle, can amplify potential losses.

Furthermore, many geopolitical and economic factors influence precious metals like gold and can exhibit intense volatility.

In such a scenario, neglecting risk management can result in substantial losses, even if you have a good trading strategy.

Effective risk management, on the other hand, allows you to cap potential losses, protect your trading capital, and navigate market volatility more confidently.

Risk management is also crucial in maintaining trading discipline and controlling emotions.

By setting predefined risk parameters, traders are less likely to make impulsive decisions driven by fear or greed, enhancing overall trading performance.

Practical Risk Management Strategies for Gold Trading

Risk management in XAUUSD trading involves a series of practical steps that help protect your trading capital. Here are some key strategies:

Risk-Reward Ratio

Always consider the risk-reward ratio before entering a trade. This ratio indicates the potential reward you can earn for every dollar risked.

A commonly used risk-reward ratio is 1:2, meaning the potential profit should be at least twice the possible loss.

Using this strategy helps ensure that even if you have an equal number of winning and losing trades, you'll still be profitable overall.

Position Sizing

Adjusting your position size is another important risk management tool.

The amount of capital risked on each trade should align with your risk tolerance. A common rule of thumb is to risk no more than 1-2% of your trading account on a single trade.

If your account has $10,000, you should not risk more than $100-$200 on any trade.

Diversification

Even when trading a single pair like XAUUSD, diversification can play a role.

This could mean diversifying across different trading strategies and timeframes or using a part of your portfolio to trade other pairs or assets.

If one strategy or asset is underperforming, others may help offset those losses.

Continuous Learning

The forex market is ever-evolving, influenced by numerous factors ranging from economic events to technological advancements.

Consistently updating your knowledge and adapting your strategies to the changing market environment is a crucial aspect of risk management.

Remember, risk management isn't about eliminating risks — it's about understanding and managing them effectively to balance potential rewards and acceptable losses.

As a XAUUSD trader, crafting a robust risk management plan and adhering to it strictly can be your best line of defense against the unpredictable forex market.

Bottom Line

In conclusion, trading XAUUSD offers a unique opportunity to participate in the dynamic forex market while tapping into gold's timeless value.

With its distinctive blend of economic, political, and supply-demand influences, XAUUSD provides many trading opportunities.

Remember, successful trading is not just about analyzing charts and predicting market movements; it's equally about managing your risks and continuously learning and adapting to the ever-evolving market conditions.

As you embark on your XAUUSD trading journey, we wish you the best of luck. May the market trends be in your favor and your trades be golden. Happy Trading!

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: