We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

How Profitable Is Forex Trading? Here’s How To Maximize Your Profits.

Are you curious about how you can make money trading in the foreign exchange markets? Have you ever considered Forex trading and want to learn more about the potential benefits? If so, this article is perfect for you!

We will explore some of the surprising advantages of forex trading in this blog post, so if you're intrigued by what could potentially be a profitable venture, read on.

We'll discuss why novice traders can maximize their profits and look at techniques that experienced traders use to stay ahead of the game.

So join us now and discover fascinating ways that currency exchange markets have something unique to offer every level trader.

Introduction to the Forex Market

Forex trading, also known as Foreign Exchange trading, is a way of speculating on the movements of different international currencies.

It is one of the traders' most popular investment forms due to its liquidity and potential for significant gains.

Using technical analysis and Forex trading strategies, traders can identify potential trades in the market and capitalize on them quickly, as the opportunities in this market are endless.

Getting Started

To start Forex trading, you must first open an account with a Forex broker who offers access to the foreign exchange markets.

You will then need to decide what currency pair or pairs you want to trade, how much leverage you want to take on your trades, and how much capital you are prepared to commit.

Once these decisions have been made, you can begin researching the various currency pairs and start placing your trades.

Now we know that starting Forex trading is seamless compared to setting up your accounts with other markets such as Stocks, Futures, etc.

Is Forex Trading For You?

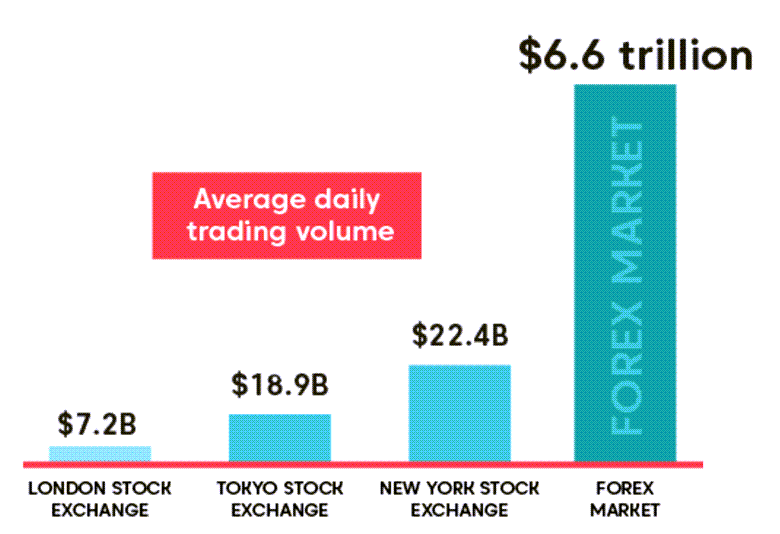

Indeed. The Forex market is highly liquid, with over $6.6 trillion daily trading volume. So the opportunities here are endless.

Source: Axi Education

This means you can buy and sell currencies quickly without waiting long periods for price action to occur.

There is no need for margin calls or waiting around for an order to be executed since all trades are conducted electronically through the broker's platform.

When trading Forex, you can use leverage which allows you to open prominent positions even with only a tiny amount of capital at your disposal.

Also, Forex markets never close (except for the weekends), allowing you to access the market 24 hours a day, five days a week - offering them more flexibility than other markets, such as stocks which typically close at certain times during the day or week.

Forex trading is an attractive option for traders looking to diversify their investment portfolios or those looking for fast returns in volatile markets due to its numerous advantages – making it an excellent choice for both beginner and seasoned investors.

Now The Real Question - How Profitable is Forex Trading?

Of course, the question is subjective, and the profit potential differs from person to person. But there are a few numbers to understand how lucrative Forex trading is.

- With an average salary of close to $100k plus an additional commission of $25k per year in the US, Forex trading is one job that will make you look forward to working each day.

- That’s not all; a few famous traders reported having earned as much as $200k in their first year on the job. But all this is on the corporate side of things.

As a retail trader, your profits trading the Forex market are based on your skill and capital. If you have significant capital, you can risk as little as possible to make a consistent income by trading a few selective pairs.

But if you have a minimum capital, you can still make huge bets using leverage and a considerable income. However, in this case, you must have a huge risk appetite.

With an initial investment of under $2000, decent Forex traders can expect monthly gains between 10-12%, minus any drawdown periods.

But if you're looking for more return on your capital, you can day trade or scalp the markets frequently to make higher-than-average returns. But, of course, you'll need discipline and technical know-how for your rewards to be much more significant.

Once you gain adequate experience and understand the Forex market dynamics, you can make returns above 20% each month using the proper risk management techniques.

Achieving a successful win rate of over 50% is achievable for most professional day traders, and the number can go beyond 55%.

Start with $10,000 and risk $100 per trade. Then, use a stop-loss order five pips away from the entry price and aim for a reward of 1.6 times the risk (eight pips away).

With two hours of trading during peak market activity, it’s likely that 5 “round turn” trades (entry & exit) will be made - if this happens every one of the 20 trading days in the month, then 100 trades would have been done overall.

Even if you miss 40% of these trades, you will still be profitable at the end of the month. Always remember - your winning trades should be more significant than your losing trades. You can quickly achieve this by placing proper stop-loss orders.

How To Make More Profits When Trading Forex?

Do you want to increase your odds of success when trading in the Forex market? There is a success formula for you to follow, which is the protect your capital.

As a Forex trader, your primary focus should be on protecting your capital before attempting to make profits.

This means that you should take the time to thoroughly research the market and perform both fundamental and technical analysis before entering or exiting a position.

Fundamental analysis involves looking at the economic and political factors that may affect the value of a currency. In contrast, technical analysis looks at the historical performance of a currency and attempts to identify patterns that can indicate the direction of future price movements.

By taking the time to analyze the market and understand the risks involved, you can make more informed decisions and increase your chances of success.

Having accurate market insights can be instrumental in boosting overall profits, especially if you are disciplined to minimize losses when an unexpected result occurs.

Also, sound money management, such as placing take profit/stop loss orders and having the right mindset for trading, are invaluable for achieving long-term success.

Bottom Line

Forex trading can be highly lucrative if done correctly and with a commitment to understanding the market's nuances. Understanding the various economic news releases and currency fundamentals that can impact the market.

Understanding technical analysis techniques, such as charting and indicators, is essential to inform decisions when entering new trades. Doing research and staying up-to-date on the market is key to success in the Forex market.

With enough time and effort to understand how this complex market works, you can undoubtedly realize some excellent returns by taking advantage of the leverage and liquidity of this market.

We hope you got an answer to the question, “how profitable is Forex trading.” If you enjoyed reading this article, stay tuned to this blog for more exciting trading education. Happy trading!

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: