We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Is Forex Recession Proof? Let's Find Out!

As a trader, you always seek new opportunities to make money from the global financial markets.

We all know that the stock market can be volatile, and we've seen first-hand how quickly an economy can change. So here’s the question - Is Forex recession proof?

The answer may surprise you. While no investment is 100% recession-proof, Forex trading comes close. This is because many Forex traders see recessions as an opportunity to make profits.

Learn how to make money from trading Forex during a recession, whether you are new to Forex or experienced.

The Fundamentals of Forex

Forex is a global market where traders buy and sell different currencies. This market allows people to capitalize on the fluctuating values of other nations’ currencies.

To profit through Forex trading, you must predict when one currency will rise or fall about another.

You can do this by closely analyzing economic news and using technical trading tools to gauge the market movement.

Successfully predicting these changes can lead to significant profits. However, trading on the Forex market requires that you understand strategies and use the right tools to help make intelligent investment decisions.

How Has Forex Performed in Past Recessions

Forex has withstood global market crashes and recessions over the years. Its liquidity and flexibility make it a popular choice for investors looking to diversify their portfolios when markets are turbulent.

The long-term performance of Forex during recessions is generally positive since its decentralized nature prevents any one central bank from manipulating the market.

Studies show that Forex trading increased during periods of volatility, like in 2020 during the Coronavirus pandemic.

This suggests that Forex trading not only stands up to recessions but may even benefit from them.

Factors That Make Forex Favorable During Recession

You can bet on both sides. When trading Forex, you can go long or short, allowing you to take advantage of bear markets.

Forex has low barriers to entry, high liquidity, and rapid responsiveness to global events.

Because of its decentralized nature, currency traders do not rely heavily on third-party intermediaries such as brokers or central banks but instead trade directly.

This is especially advantageous during a global recession, as currency and interest rates may suddenly spike or plummet due to international economic events.

Investors can quickly capitalize on dynamics like these by eliminating intermediaries' implementations and commissions.

No minimum deposit is required to begin trading on the Forex market, and the amount of leverage offered means that even a small initial investment can lead to substantial returns in an extended bear market.

Since there are so many buyers and sellers, it is easy to quickly enter or exit a position in the market without any noticeable effect on prices.

With its worldwide presence and connection to multiple economies, trading Forex provides instantaneous information about what's happening around the globe.

This can be used for informed decision-making to secure gains regardless of which way the economic winds are blowing.

Forex trading offers the chance for smart investors to make money in a difficult economy during a recession.

Why You Should Invest in Forex During a Recession

Recessions are notoriously unpredictable and can have a significant impact on your portfolio.

Therefore, investing in Forex during such periods can be a wise and potentially lucrative move.

Forex markets allow investors to capitalize on diverse currency fluctuations and cash in on new opportunities.

Since exchange rates often rise, fall, or remain relatively stable, it's possible to make money no matter how the market shifts.

There's also a low-risk factor associated with currency trading that makes it appealing for people looking to get into investing and trading without taking too many chances.

Therefore, whether you're an experienced investor or brand new to the game, getting involved in Forex could be an excellent way to weather the recessionary storm.

Best Forex Trading Techniques To Apply During Recession

Diversify Your Trades

Make sure to spread your investments across different currency pairs, hedging techniques, and trading strategies to reduce the risk of a single trade wiping out most of your capital.

This is especially important when trading during a recession, as market conditions can be highly volatile.

Image Credits: Vector Stock

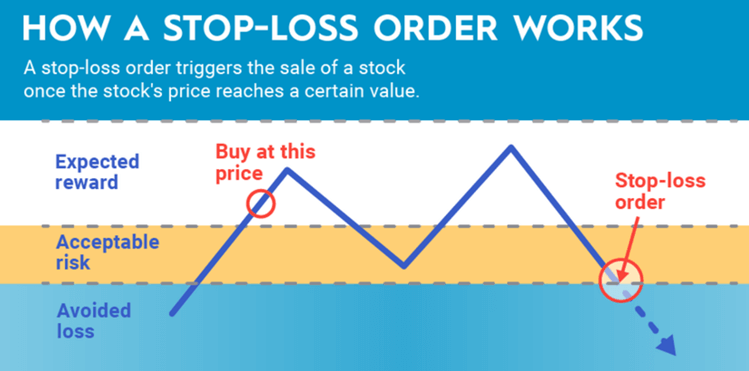

Use Stop Loss Orders

Stop-loss orders will help you limit potential losses if the market goes against you.

Also, consider setting trailing stops that move along with the price action so that you don't get stopped out prematurely.

Image Credits: Motley Fool

Utilize Leverage Responsibly

Leverage can give traders greater buying power, but it can also magnify losses if used recklessly.

Make sure to understand the risks associated with leverage before utilizing it.

Keep a Close Eye on the Market

The market can be unpredictable during economic downturns, so staying up-to-date on news and events that may impact your trades is essential.

Pay attention to technical indicators such as trend lines and support/resistance levels to understand where the market might turn next.

Take Long-Term Positions

Recessionary periods often bring uncertainty and unexpected market changes, so long-term trading strategies are usually considered safer than short-term ones.

Taking more extended positions will help you reduce risk while still giving you the potential for high returns over time.

Adjust Your Risk Tolerance

Adjusting your risk tolerance levels to account for the added volatility is essential when trading during a recession.

This means reducing your risk per trade and being more selective with which trades you take.

Avoid Trading if Conditions are Too Volatile

If market conditions are too volatile, making informed decisions and accurately predicting price movements can be challenging.

It may be best to avoid trading altogether until conditions become more stable.

Use Hedging Strategies

Hedging strategies involve taking two offsetting positions simultaneously to mitigate risk or protect profits from an existing position.

These strategies can help traders diversify their portfolios and reduce exposure to market volatility.

Risks Associated With Forex Trading During a Recession

Forex trading can be lucrative for investors during economic downturns, but it is not without risks.

- While Forex provides traders with colossal liquidity and relative stability, fluctuations in currency pairs can still lead to considerable losses if proper risk management principles are not followed.

- The leverage involved in Forex trading can magnify losses if investments move against the trader.

- Traders must pay close attention to geopolitical events that could abruptly change market sentiment, prompting wild swings in currency prices.

- Failing to apply appropriate risk management techniques, such as stop-loss orders and diversification within the portfolio, you can lose your entire capital in no time.

How to Get Started With Forex Trading

With tremendous opportunities for making returns, the foreign exchange market is a global marketplace that's always open.

Getting started with Forex trading isn't too challenging, as plenty of resources and tools are available.

Research brokers and platforms to ensure they give you the necessary info to make informed decisions based on market trends. Sign up with a reliable, regulated Forex broker and make the initial deposit.

You can also read up on strategies and tips from other traders before you start your journey.

Follow educational blogs to increase your knowledge dept. After all, the only way to find success in this market is to master the skills required; money will follow.

Summary

- The demand for currencies tends to be higher during periods of uncertainty and turbulence.

- This is because investors are looking for safe havens to park their money during volatile times.

- The US Dollar (USD), Japanese Yen (JPY), and Swiss Franc (CHF) are considered haven currencies.

- Forex trading provides opportunities to take advantage of currency devaluations that often occur during recessions.

- By understanding how the Forex market works and what drives it, investors can make informed decisions about whether or not to enter it - and how best to do so.

We hope you enjoyed reading this article. Also, don’t forget to follow Keenbase Trading Blog for more tips and tricks on making money through Forex trading.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: