We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

How to Backtest Multiple Currency Pairs Simultaneously?

Forex trading is all about making the right decisions at the right time. But how can you be sure that your choices are based on sound analysis? The answer is backtesting.

Backtesting allows you to test your trading strategies against historical data to see how they would have performed in different market conditions.

In this post, we'll show you how to backtest multiple currency pairs simultaneously so that you can quickly assess which ones are most likely to produce profits and provide consistent equity growth.

Why Backtesting Is Important

Backtesting is a critical part of technical trading for a good reason. By comparing strategies against historical data, traders can gain valuable insight into the effectiveness of their system.

Backtesting allows traders to test different aspects of their methods, such as entry and exit points, stop losses, profitability targets, and more – without the risk of real-world capital.

This can save traders an extraordinary amount of time and money in the long run when combined with other indicators to develop a robust strategy.

In short, backtesting is crucial because it gives traders the power to fine-tune their approach with confidence before making a trade.

How to Backtest Multiple Currency Pairs Simultaneously

Backtesting multiple currency pairs simultaneously is an excellent way to optimize your trading strategy.

It helps you observe how different market conditions impact the performance of your trading strategy, allowing you to make more informed decisions when placing trades.

To backtest multiple currency pairs at the same time, you'll need a comprehensive forex simulation tool that can recreate real-time markets and enable you to track variables like price movements, pivot levels, trading volumes, economic indicators, and more.

Such tools often come with pre-defined algorithms that instantly make it easier for traders to run simulations without complex instructions and configurations.

Nevertheless, it is essential to remember that backtests should only be used as one of several decision-making tools – actual results may differ from simulated ones due to variations in market conditions.

Here’s how you back-test multiple currency pairs on the MT5 platform:

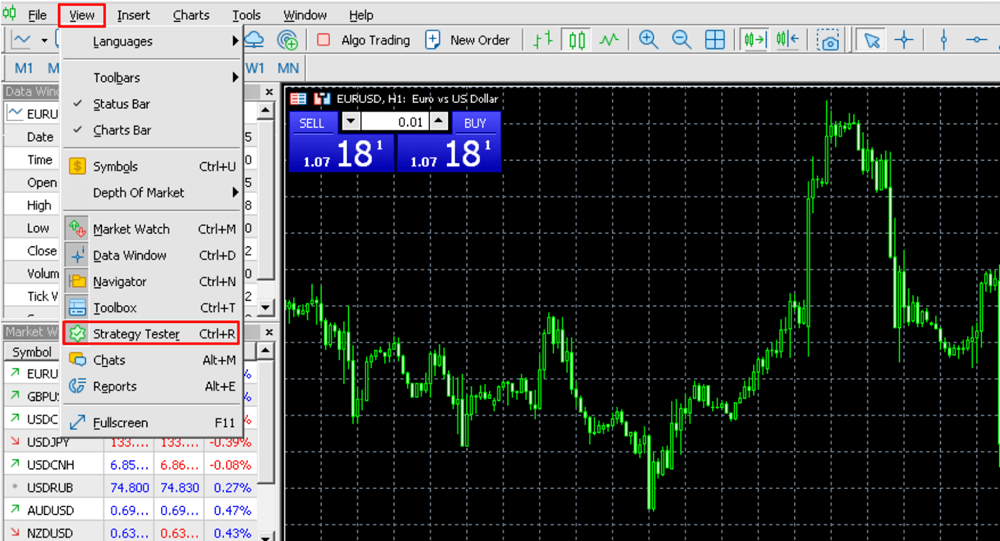

Open the MT5 trading platform, and click View > Strategy Tester on the top banner.

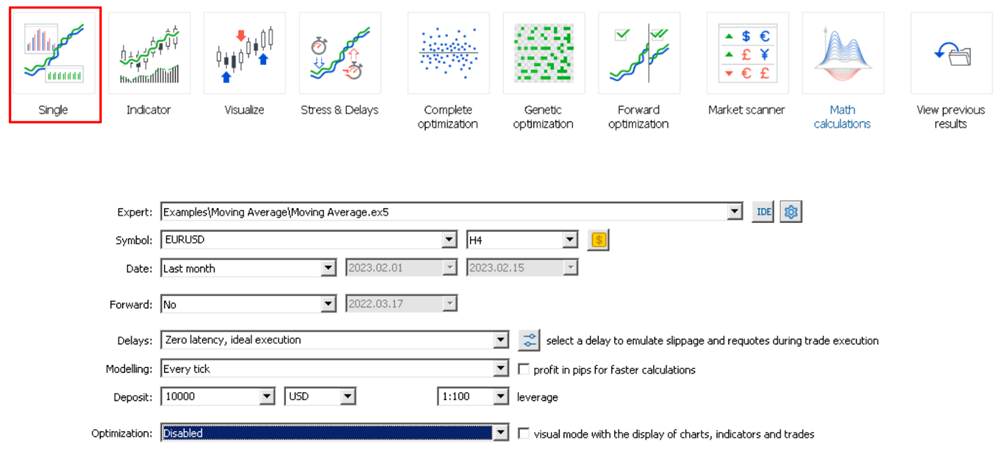

You will see the below screen where you can choose between various options. Since we are testing currency pairs, select the first option.

Make the preferred selections among the settings or replicate the same selections as in the above screenshot.

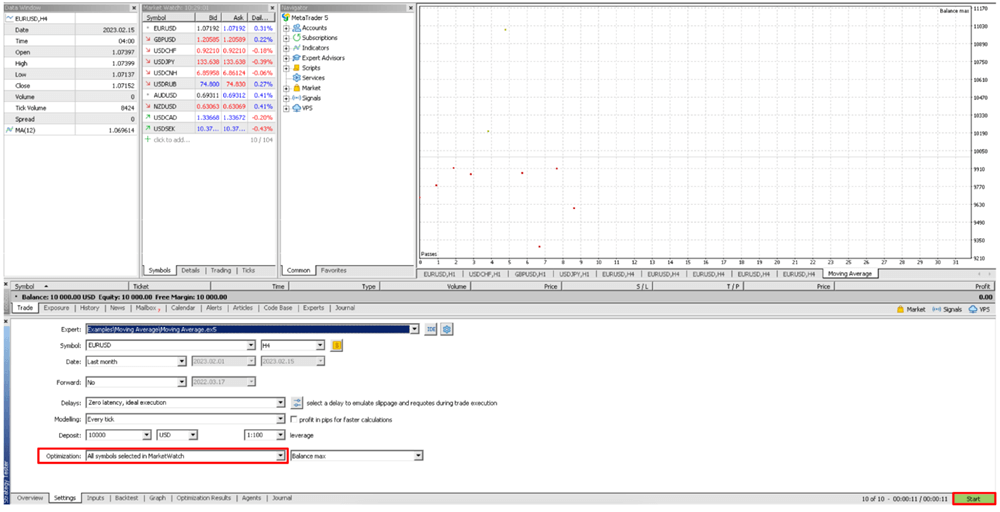

Under the “Optimization” drop-down, select “All Symbols Selected in the Market Watch.” By doing this, we can back-test all the pairs in your Market Watch.

You can add or delete pairs in your Market Watch section on the terminal according to your preference. Once done, click “Start” on the bottom right of the screen.

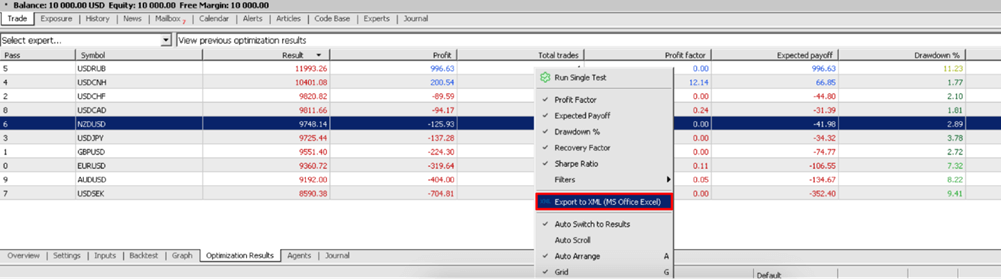

You will see the below table after a few seconds.

Right-click on the table and click Export to XML.

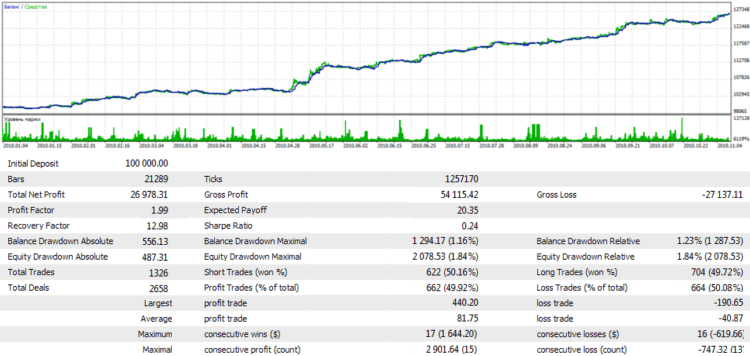

Now, using this excel sheet, you can determine the total profits and losses in each pair. To better understand your trading activities, you will also get information about drawdowns and total trades taken on each pair.

You can also see the correlation between the profits and losses you made between these pairs, giving you a deeper insight into your trading.

Backtesting multiple currency pairs simultaneously will help traders evaluate their strategies before diving into live markets.

Consider visiting this link for more information on how to backtest currency pairs.

Source: MQL5

The Benefits of Backtesting

Backtesting is a potent tool and can be a massive advantage in trading and investing.

It allows investors to review their strategy's performance before they commit to real capital, which can help them make smarter decisions on where to put their money and how to utilize it best.

Backtesting gives the investor data on how the strategy performed in different market conditions and insights into potential risks that may have been initially overlooked.

This can help mitigate losses should those risks suddenly become more relevant.

In addition, an investor who has done their due diligence through backtesting can be better equipped to handle difficult situations, giving them an edge over those who don't use this invaluable tool.

How to Get Started With Backtesting

Backtesting is a great way to gauge the potential performance of a trading strategy before risking real-world money. However, before you can start backtesting, there's some critical groundwork.

It would be best to decide what strategy you want to backtest and then identify the relevant financial instrument and timeframe.

You'll also need to identify historical market data that is comprehensive enough to cover your chosen periods of time.

Finally, set up a backtesting platform or program that will enable you to evaluate how your selected strategy would have performed during the chosen time period using past market data.

Once all these steps have been completed, you're all set to start backing testing!

Backtesting Resources

Backtesting resources have come a long way in recent years. Now more than ever, investors can access powerful tools which allow them to rigorously test their trading theories and ideas before entering a live market.

With the right backtesting resources, you can gain substantial confidence in your strategy, eliminating most of the guesswork and risk associated with investing.

Some of the notable backtesting tools are Forex Tester and MT5.

It's easy to find these helpful resources online, so why not arm yourself with the best knowledge? Then, research and get ready to take trading to the next level!

Bottom Line

Backtesting is essential because it lets you test your trading strategy on historical data to see if it has the potential to be profitable.

You can backtest multiple currency pairs simultaneously using a forex simulator, and this can give you a good idea of which pairs are worth trading and which aren't.

The benefits of backtesting include testing different market conditions and getting an objective view of how your strategy would have performed in the past.

If you're new to backtesting, start by downloading a free trial of a Forex simulator that will let you test more than two currency pairs for free.

Plenty of online resources can help you get started, so don't feel you have to do it alone. All the best.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: