We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Mastering Order Block Strategy: Essential Tips for Savvy Forex Trading

Trading successfully in the forex market hinges on decoding patterns, particularly ‘order blocks’ - the strategic markers left by institutional traders. Recognizing these zones is crucial for any trader aiming to align with powerful market forces.

We’ll show you exactly what to look for to identify these key order block zones and how to use them to fine-tune your trading strategy without overwhelming you with jargon or theory.

Key Takeaways About Order Blocks

- Order blocks are specific price areas where institutional traders have placed sizable orders, acting as significant levels for support or resistance, and their identification can serve as a strategic advantage in forex trading.

- Bullish order blocks indicate potential upward price movement, and bearish order blocks anticipate downward movement; recognizing and differentiating these can guide traders on market sentiment and potential trend reversals.

- For successful order block trading, combining order blocks with higher timeframes, price action analysis, and proper risk management practices, including stop loss orders and position sizing, is crucial for managing potential losses and refining trading strategies.

Understanding Order Blocks: The Basics

In strategically accumulating orders without significantly affecting market prices, banks, and institutions often generate distinct patterns called order blocks.

When trading these order blocks, one essentially follows the trail of these large financial players, seizing upon the supply and demand zones they establish for potential trade setups.

A series of steps characterize the formation of an order block:

- To subtly carry out their strategies, banks split their substantial orders into more manageable smaller units.

- During this time, it’s common for the market to exhibit sideways movement, creating an order block range.

- The majority of trading decisions occur within these defined limits.

After the completion of an order block range execution phase comes a decisive move in the market that usually indicates either a new trend initiation or its conclusion—often marked by sharp price movements.

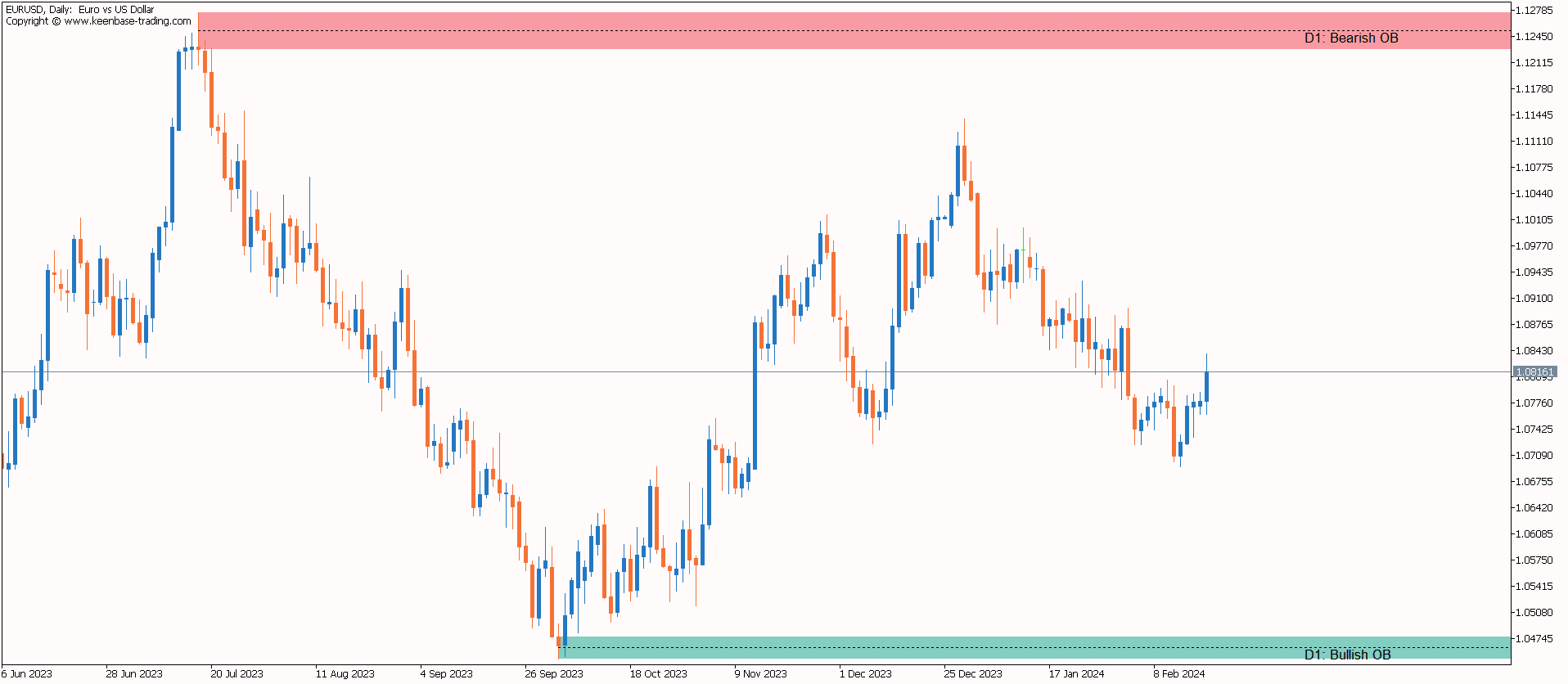

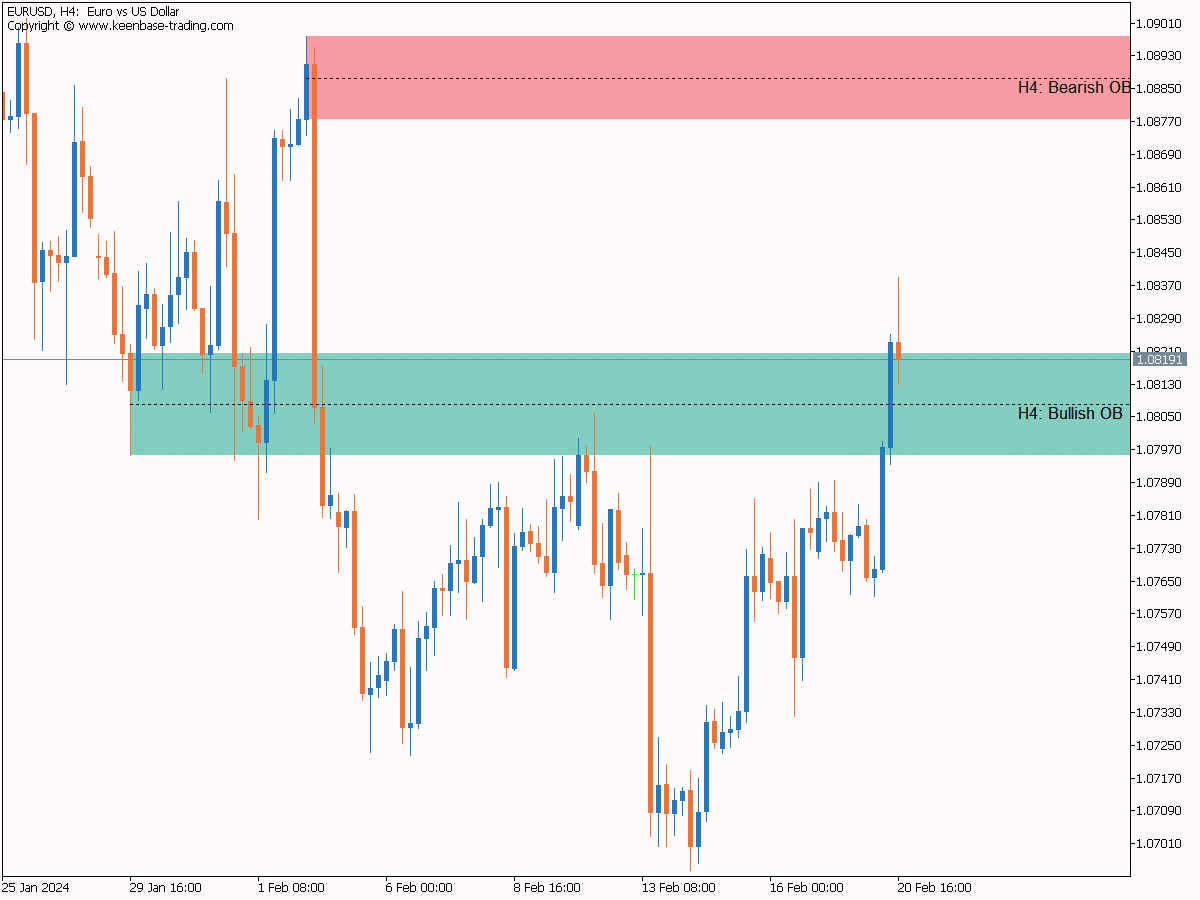

Identifying the correct institutional order blocks is a complex and challenging task. To solve this problem, we've developed the KT MTF Order Blocks indicator, which automatically finds and plots the substantial order blocks within a blink of an eye.

Definition of Order Blocks

To understand order blocks, first we should understand supply and demand zones. Supply and demand zones refer to areas on a chart where large market participants like institutional traders have previously executed significant amounts of buy (demand zones) or sell orders (supply zones).

These zones are monitored for indications of potential support in the case of demand zones or resistance with supply zones, as they suggest points at which these substantial players may again enter the market to place orders.

Order blocks represent precise price regions established before vigorous price movements, leading to extensive market shifts. They signal an area where prices might revert to and differ from more general supply and demand levels due not only to their specificity but also because they appear less frequently.

As such, they hold considerable importance for market participants who aim to trade alongside these impactful institutional forces.

Institutional Traders and Order Blocks

Institutional traders are considered significant players within the market due to their capacity to influence price fluctuations and market liquidity. They frequently divide their substantial buy or sell orders into smaller segments to secure more favorable pricing and minimize impact on the market balance.

This results in the creation of consolidation areas where prices temporarily level out.

Hence, these sections where large quantities of buy or sell orders from institutional entities accumulate are called order blocks. They establish robust zones that act as support or resistance, which other participants in the market tend to monitor closely.

A trader’s ability to make educated trading decisions can be substantially improved by gaining insight into these behaviors and recognizing their effects on overall market dynamics.

Types of Order Blocks: Bullish and Bearish

Understanding forex order blocks requires recognizing the two principal varieties: bullish and bearish. Such order blocks are distinguished by pronounced engulfing patterns on forex charts, denoting crucial zones where institutional traders have executed substantial buy or sell orders.

Ahead of a rising price movement, bullish order blocks develop and act as support. Conversely, bearish order blocks materialize, preceding a falling trend to provide resistance.

It’s vital to distinguish between consolidation areas—often associated with ongoing trends—and these crucial structures since order blocks indicate that a trend might reverse direction.

Bullish Order Blocks

Bullish order blocks can be identified by a final down (bearish) candlestick that is succeeded by an upward-moving (bullish) close, which exceeds the high of the preceding bearish candle, frequently resulting in an Engulfing pattern.

This suggests a zone where institutional buyers are engaged in significant asset purchases with expectations for its price to rise.

When a bullish order block emerges, it’s similar to sunlight breaking through overcast conditions—hinting at the possible conclusion of a downtrend and suggesting that market conditions may shift towards an uptrend as purchasing activity gains traction.

Bearish Order Blocks

During an uptrend, bearish order blocks are commonly spotted as the final bullish candle preceding a pronounced decline in price. These zones signify locations with heavy sell orders, distinguished by the concluding upward candles before a shift.

The emergence of a bearish order block acts as an ominous signal that suggests substantial drops in market prices could be forthcoming from where these blocks materialize.

A typical indicator of such formation is seen through the bearish engulfing pattern: this happens when a following large negative candlestick completely overshadows the body of its prior positive counterpart.

Identifying Order Blocks on Forex Charts

Discovering order blocks on foreign exchange charts can be compared to finding hidden gems. These key patterns may include dense price bars or candles groupings indicative of substantial buying or selling and periods of consolidation or sideways trading activity.

When high volumes of trades coincide with a specific price level and are linked with noteworthy price movements or abrupt shifts in direction, this, too, may signal the existence of an order block.

For traders observing these phenomena, when prices cut through a previously established order block level, it is essential to note that its role as either support or resistance might reverse. What once served as resistance could become new support and conversely.

Should there be a retest at the level of an order block accompanied by rising volume levels, it provides Validation for a trader contemplating market entry — underscoring the importance attached to such order blocks.

Analyzing Market Structure

Much like relying on a compass to navigate thick woodland, scrutinizing the market structure is essential for pinpointing order blocks.

Shifts in the market structure that lead to formations of patterns such as higher highs and lower lows are fundamental signals of emerging trends that play an instrumental role in recognizing order blocks.

When analyzing order blocks, it’s essential to incorporate psychological price levels, often aligned with round figures, because these levels denote critical points where major financial institutions may start or finish their trading activities.

A deep comprehension of the underlying market structure at pivotal moments—where order blocks emerge during key trend reversals or at the outset of price movements—is imperative for accurately assessing both overall market sentiment and that of significant players within the marketplace.

Using Technical Analysis Tools

Traders in the forex market can employ various technical analysis tools to identify potential order blocks, much like an experienced sailor would use a sextant to navigate through oceans.

Tools such as the Order Block Indicator, Order Block Breaker Indicator, and Order Block Edge are designed to spotlight specific candlesticks and areas on charts that may indicate the presence of order blocks.

Using the Accumulation/Distribution indicator alongside order blocks allows traders to detect phases of buying or selling pressure, which could signal the upcoming formation of order blocks.

By analyzing volume strength within an order block with something like an order block strength calculator, traders gain insights into how these zones might influence future market prices—this helps them set more precise stop losses.

Trading Strategies Using Order Blocks

After pinpointing the likely order blocks, it’s essential to integrate them within your trading approach using the order block trading strategy. Executing a trade with this method requires the following:

- Recognizing moments when the price surpasses an order block’s defined supply or demand zone.

- Placing pending orders that align with the trend indicated by an order block breakout.

- Arranging stop loss orders past recent price extremes to control possible losses.

Yet, traders frequently make the mistake of overly complicating their analysis by adding too many indicators in order block trading. A more straightforward and uncluttered analysis can often provide more precise directions for making trades.

Thus, embracing simplicity while thoroughly grasping how order blocks function can significantly improve your overall trading strategy.

Combining Order Blocks with Support and Resistance Levels

Integrating order blocks with support and resistance levels is akin to a chef skillfully blending ingredients to perfect a recipe. This synergy enhances your trading strategy.

By examining historical price movements, you can identify significant order blocks that often coincide with the chart's crucial support or resistance areas.

Combining these order blocks with established support and resistance levels creates zones of confluence that increase the likelihood of price movement reactions. This heightened interest at such junctures is especially pronounced among institutional traders.

Order blocks serve as tools for identifying potential retracement zones and determining ideal positions for stop-loss orders since high-volume regions may indicate strong support or resistance within supply or demand zones.

Integrating Order Blocks with Price Action Analysis

You might want to combine order blocks with price action analysis to refine your trading strategy and boost its accuracy.

Confirming that an order block is a reliable indicator for trend reversals by observing price movements—specifically through patterns like pin bars, engulfing candles, or dojis at the level of the order block—can significantly improve how you make trading decisions.

Paying close attention to how prices react upon retesting an order block can provide robust signals for entering and exiting trades. This method becomes even more powerful when coupled with confirmation of a trend reversal within a timeframe suitable for your particular style as a trader.

By spotting these signs and understanding actions taken by market makers with order blocks, traders who apply price action analysis will likely see an uptick in their rate of successful transactions.

Managing Risk with Order Block Trading

Risk management in trading with order blocks is as essential as the equilibrium a tightrope artist relies on while performing. Incorporating stop losses to mitigate risk is crucial when implementing order block strategies.

If one opts for a bullish order near a bullish order block, they should position their stop loss slightly below the lowest point of that block. Conversely, if executing a bearish order adjacent to a bearish order block, they should set it marginally above its highest peak.

An important consideration is that each time the price retests an order block’s support or resistance level, its reliability tends to decrease — highlighting the need for traders to adjust their stop-loss orders accordingly.

Flexibility and ongoing scrutiny of market conditions are imperative for adept risk control within order block transactions.

Setting Stop Losses

In order block trading, employing stop losses serves as a safeguard against possible financial setbacks.

When establishing a stop loss within this framework, one should utilize the previous peak or trough preceding a price surge as an anchor and position the stop loss marginally beneath or above the order block, depending on whether you are entering a long or short trade.

It is advisable to place your stop losses at points where it’s presumed that institutional traders have set their trades (typically just outside of the area demarcated by the order block) to curtail risk exposure.

It is also critical in order block trading to calibrate your investment size such that any incurred loss from an activated stop loss constitutes merely a fractional proportion of your overall trading funds.

This calculation must factor in how far off from your initial entry point up until where you’ve arranged for your stop-loss threshold.

Position Sizing and Risk Tolerance

In financial trading, understanding position sizing and risk tolerance is essential for crafting a successful trading strategy. Effectively managing these aspects ensures sustainable practices in order block trading, safeguarding one’s investment over time.

It’s essential to calculate how much capital you are prepared to put at stake on each trade based on your comfort with risk. This calculation should reflect your risk tolerance.

When you meticulously integrate this information into your approach, it enables assured participation within the ever-changing forex market landscape.

High Probability Order Blocks: Tips for Success

Traders hunt for high-probability order blocks with the same anticipation a skilled surfer has for an ideal wave, aiming to execute successful transactions.

In trending markets, these high-probability order blocks often command tremendous respect and offer a more robust indication that price action will adhere to the anticipated trajectory.

An order block characterized by swift price reaction and rapid departure from its range is considered highly probable. Combining such high-probability order blocks into a reliable trading strategy can enhance overall trading effectiveness instead of relying solely on order blocks.

Using Higher Timeframes

In forex trading, utilizing higher timeframes is akin to peering through high-powered binoculars—they provide a broader and more lucid view. This clarity stems from the significant impact that large institutions and seasoned traders exert on these timeframes due to their voluminous trading activities.

When an engulfing candle appears on these elevated timeframes, it typically signifies a dependable order block. Examining price movements across various time intervals can guide you toward making more precise and well-founded decisions in your forex trades by leveraging order blocks.

Analyzing Market Sentiment

Understanding market sentiment is comparable to discerning the direction of the wind before embarking on a voyage.

Traders can bypass choosing order blocks that align with areas targeted for liquidity collection by recognizing where prices are more inclined to congregate liquidity and pinpointing the fair value gap.

Should Order Order? Flows display bearish tendencies; it would be wise for traders to seek out bearish order blocks as prospective trading points. Conversely, identifying bullish order blocks becomes prudent when Order Flow exhibits bullish characteristics.

By considering the prevailing market sentiment indicated by Order Flow, traders have an enhanced capability of selecting high-probability order blocks that resonate with current market directions.

Common Order Block Misconceptions

There are several misconceptions surrounding the trading of order blocks. A standard error is to think that the presence of an order block will undoubtedly lead to a reversal in the market, but this isn’t always true.

It’s also often mistakenly assumed that when the price closes beyond an order block, it signals a significant move in the market. This implication may not necessarily materialize.

Confusion also arises from equating supply and demand zones with order blocks within forex trading — they are not the same. Unlike simple supply and demand scenarios, order blocks involve interventions and policies set by central banks.

The strategies based on these concepts remain relevant over time due to their association with the actions of large financial institutions, which maintain persistent influence within the forex market environment.

Incorporating Order Blocks into Your Trading Strategy

Incorporating order blocks into your trading strategy can substantially enhance its effectiveness. Nevertheless, not using them as the only basis for trading decisions is crucial.

A more robust approach amalgamates the insights from order blocks with additional analytical methods, including chart patterns and technical indicators.

When employing order block trading techniques, you should consider the following:

- Adjusting position sizes flexibly.

- Continuously evolving strategies in response to shifts in market conditions and personal trade experiences.

- Seeking points of agreement between order blocks and other key market elements like market structure and imbalances.

Adherence to these guidelines will help bolster order blocks' role in your comprehensive trading strategy.

Summary

In conclusion, order blocks provide insightful glimpses into the activities of large institutional traders. You can enhance your forex trading acumen by understanding their formation and characteristics, identifying them on charts, and incorporating them into your trading strategy.

However, remember that order blocks are one of many tools in a trader’s arsenal. Combine them with sound risk management practices, comprehensive market analysis, and continuous learning to successfully navigate the dynamic world of forex trading.

Frequently Asked Questions (FAQs)

What is an order block?

An order block refers to specific price areas where large market participants have previously placed significant buy or sell orders, impacting price movement, liquidity, and market sentiment.

What are the rules for a valid order block?

To ascertain a legitimate order block, one must gauge Fibonacci levels tracing from swing highs to swing lows, pinpoint the central point representing equilibrium, and verify that it is positioned at a premium higher than the 50-level during a bearish market or conversely at a discount beneath the 50 level within bullish market conditions.

Is Order Block a Good Strategy?

Indeed, utilizing order blocks as a trading strategy can yield gains. It’s crucial to undertake thorough backtesting and build confidence in your approach while effectively managing risk to achieve success.

How do you trade with order blocks?

First, trade with order blocks, identify order blocks, observe price behavior, look for confluence, set stop loss and profit targets, and carefully manage risk.

Continuously monitor and adjust your trading strategy to maximize success.

What are bullish and bearish order blocks?

Before a price ascends, bullish order blocks act as support, and bearish order blocks serve as resistance preceding a decline in price movement.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: