Ready to act? Get ACB Breakout Arrows Indicator Now

Breakout Continuation Strategy: Master the Setup That Fuels Big Moves

Breakout trading is the heartbeat of momentum-driven markets, where the real profits are made by those who spot decisive moves before the crowd.

Mastering the breakout continuation strategy means you’re anticipating and positioning yourself at the frontlines of powerful trend surges.

In this article, you’ll unlock expert-level insights that go beyond cliche textbook patterns. We’ll dive deep into proven continuation setups, advanced volume and order flow techniques, and multi-timeframe confirmations.

This is a detailed guide packed with actionable tactics, risk management wisdom, and little-known market nuances designed to make your breakout continuation patterns profitable.

What Is a Breakout Continuation Strategy?

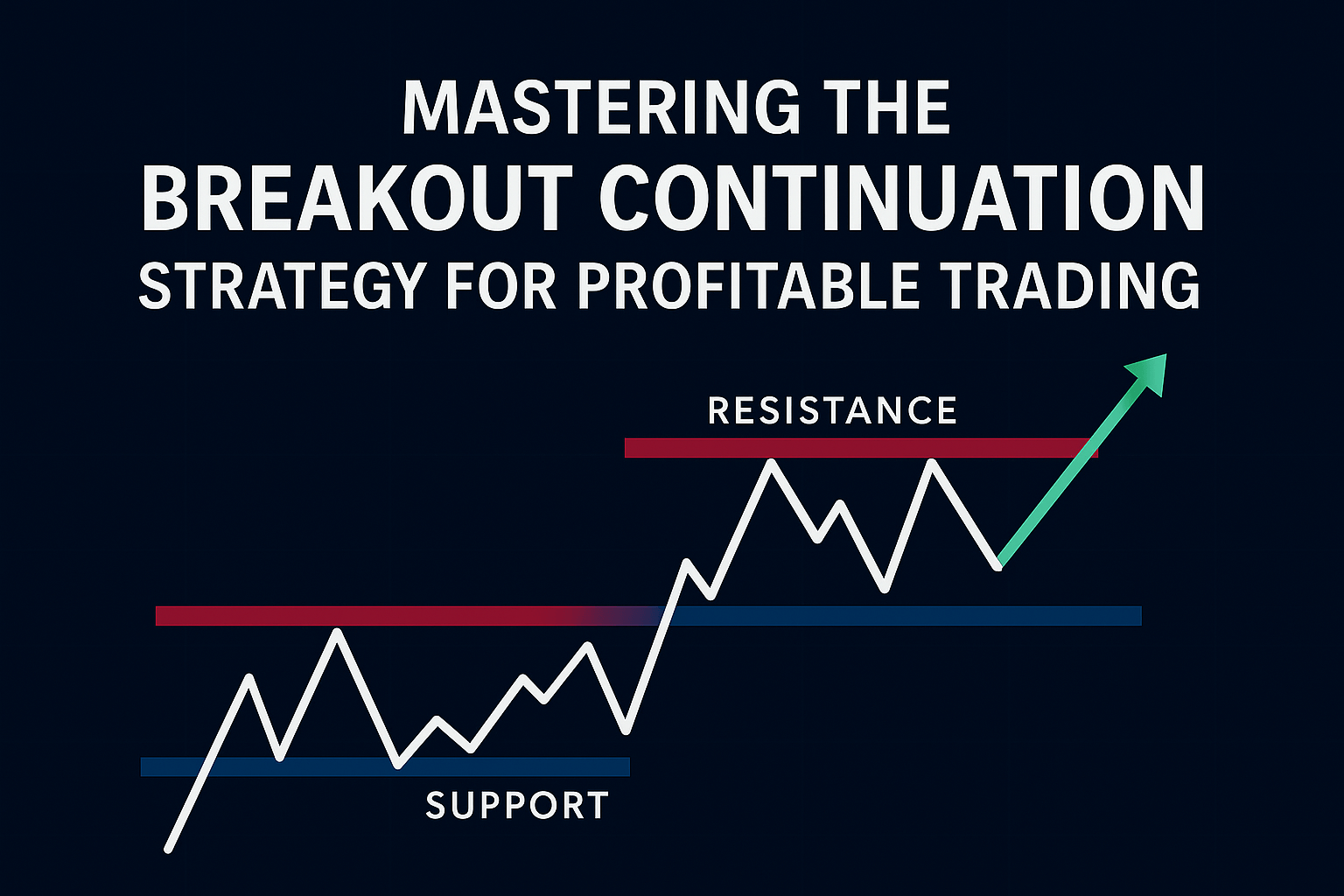

A breakout continuation strategy aims to identify moments when the price breaks through a well-established support or resistance (S/R) level, indicating that the trend is likely to persist.

Most importantly, these breakouts are validated by increased trading volume, hence the term high-volume continuation breakout strategy, which ultimately confirms strong market interest and reduces the odds of a false breakout or move.

This strategy stands apart from simple trend-following, which waits for broader trend confirmation across multiple time frames, or mean-reversion tactics that bet on price bouncing back from extremes. Instead, breakout continuation trading zeroes in on the moment price bursts forward, riding the momentum wave early to capture significant gains.

Somehow related are the trend continuation breakout strategy and momentum breakout continuation strategy, which emphasize aligning breakouts with the underlying trend direction and momentum strength.

Today's traders enhance their breakout analysis by using custom tools like momentum-based indicators that highlight high probability entries by filtering the noise, which improves accuracy.

These tools act as a tactical compass in the often unpredictable sea of price action.

Core Continuation Patterns Traders Rely On

Triangles (Ascending, Descending, Symmetrical)

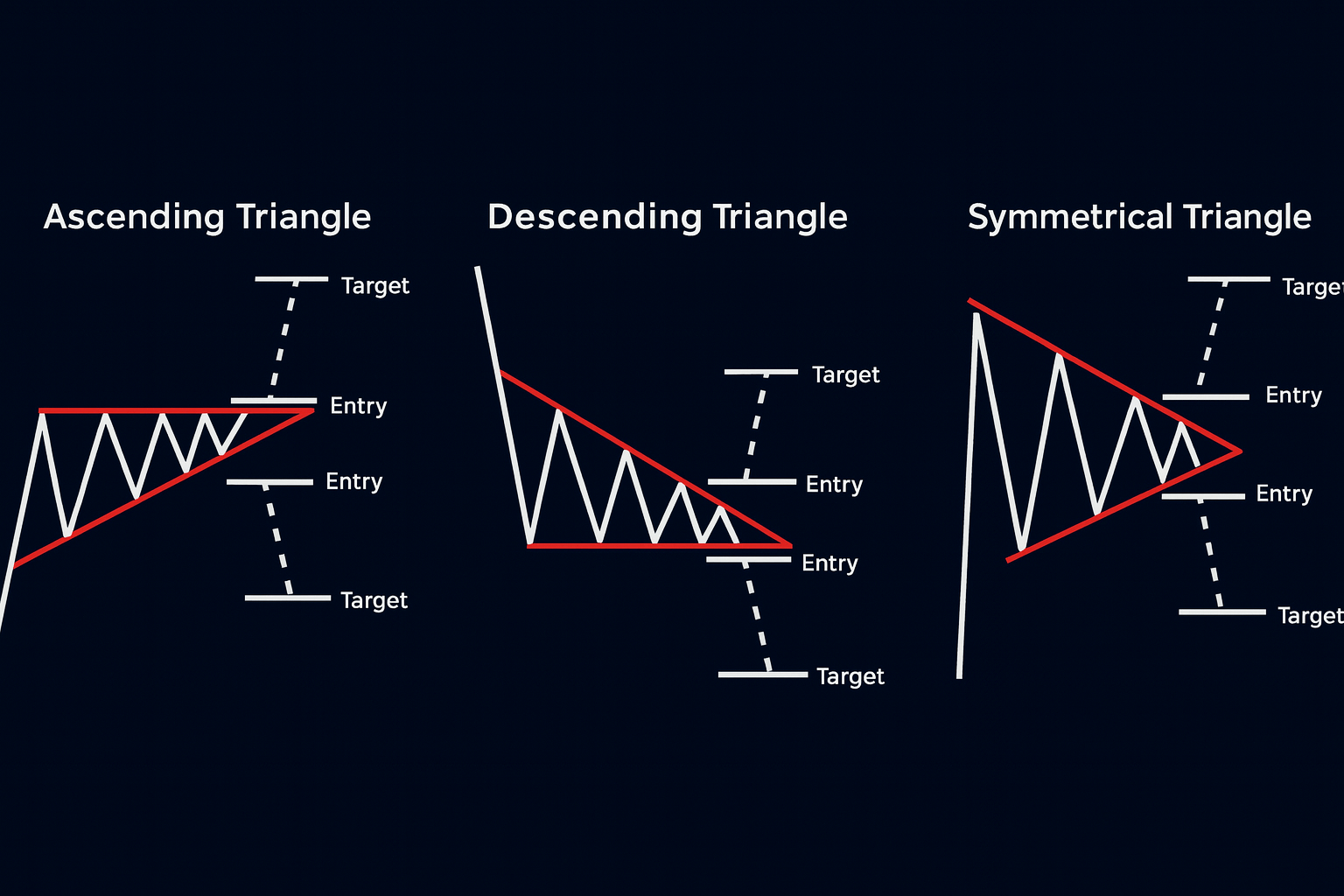

Triangles are among the most reliable and widely recognized continuation patterns, but you have to understand them well before setting any expectations:

- Ascending triangles have a flat resistance line paired with a rising support trendline. This setup shows consistent buying pressure, hinting at an imminent bullish breakout.

- Descending triangles are the opposite of ascending triangles; they have a flat support line and a descending resistance line, signaling that bears are taking control and will push the price further down.

- Symmetrical triangles are consolidation zones where price makes lower highs and higher lows, compressing before a decisive breakout either way.

The real magic happens when these patterns align with volume and trend context.

A triangle breakout accompanied by rising volume confirms strong buyer or seller conviction, dramatically increasing the odds of a sustained move.

In current markets, with a lot of whales and money movers globally, waiting passively isn't enough for traders to boost their accuracy in trading.

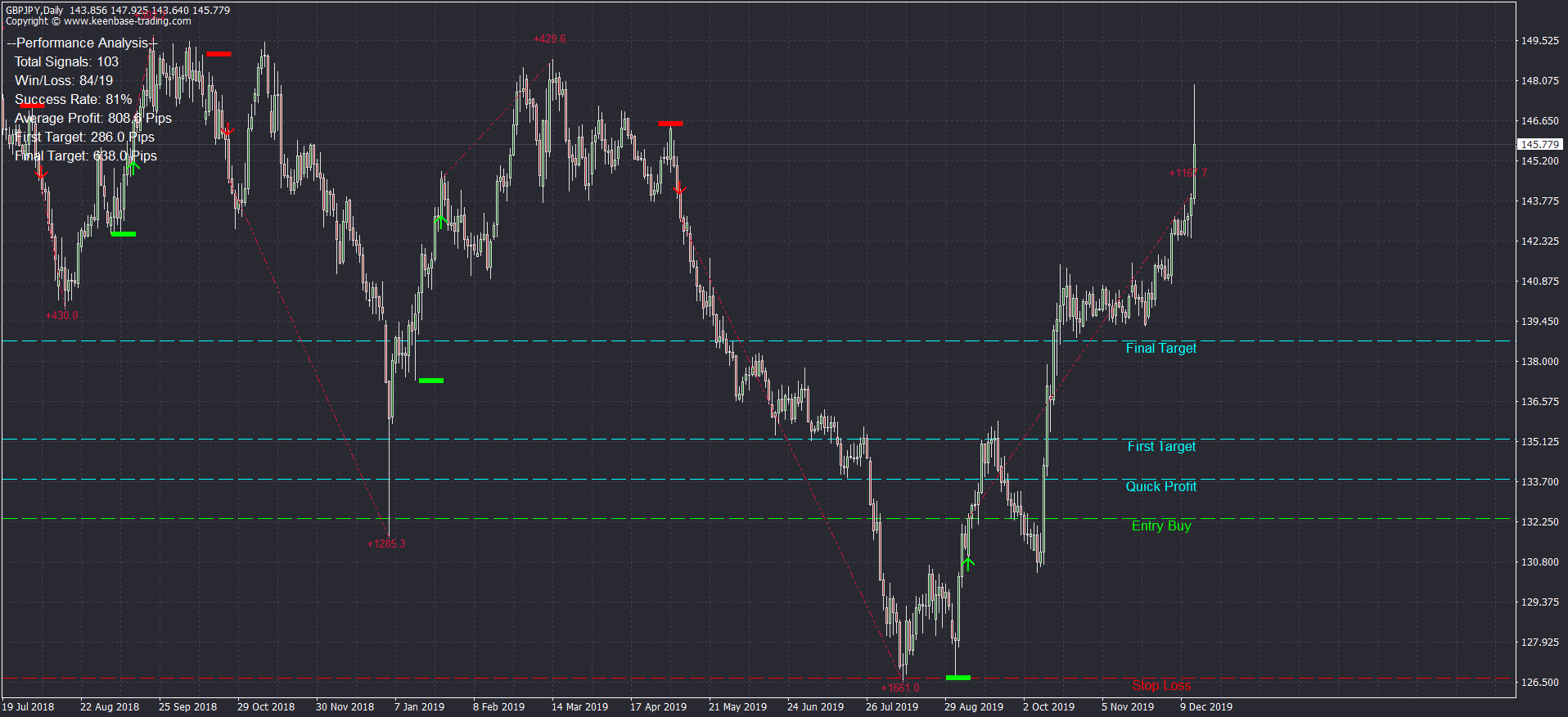

Tools like the ACB Breakout Arrows Indicator dynamically highlight these critical breakout bars, reducing guesswork and enhancing confidence for swift execution.

Flags & Pennants

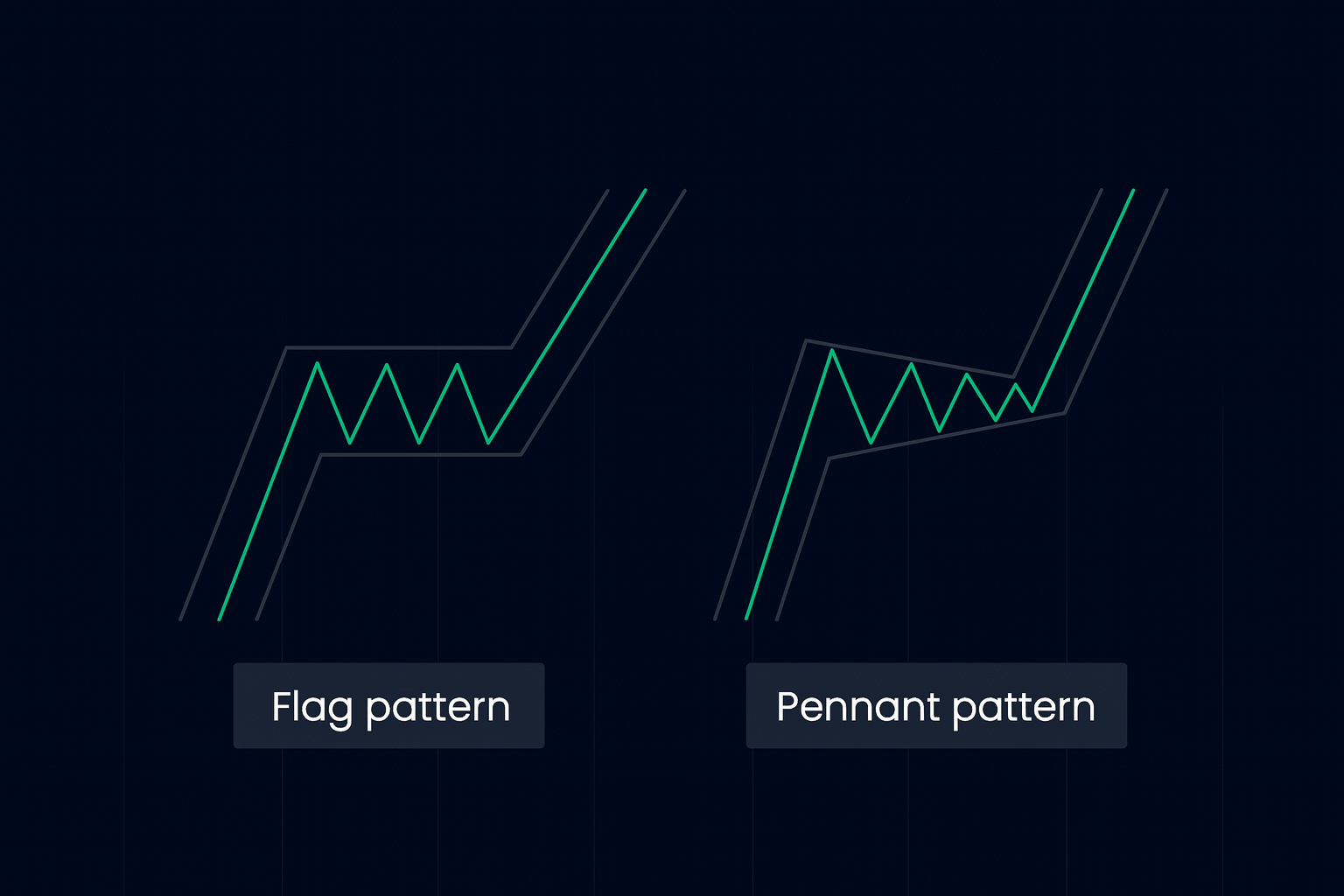

Flags and pennants are the market’s way of breathing during a high-velocity move brief pauses before the next rush.

- Flags are rectangular consolidation zones slanting against the prevailing trend, often appearing as tight price channels.

- Pennants look like small symmetrical triangles that form after strong moves, compressing price action before it rockets higher or lower.

Within a momentum breakout continuation strategy, these patterns serve as prime setups because they reflect the temporary sentimental equilibrium that participants are experiencing before momentum continues

Rectangles & Cup‑and‑Handle

Rectangles are sideways consolidation zones bounded by horizontal support and resistance, and you can spot them everywhere in a cool market. They represent indecision before the trend decides its next move. They lean bullish or bearish depending on who takes control before, and who decides what is a fair price.

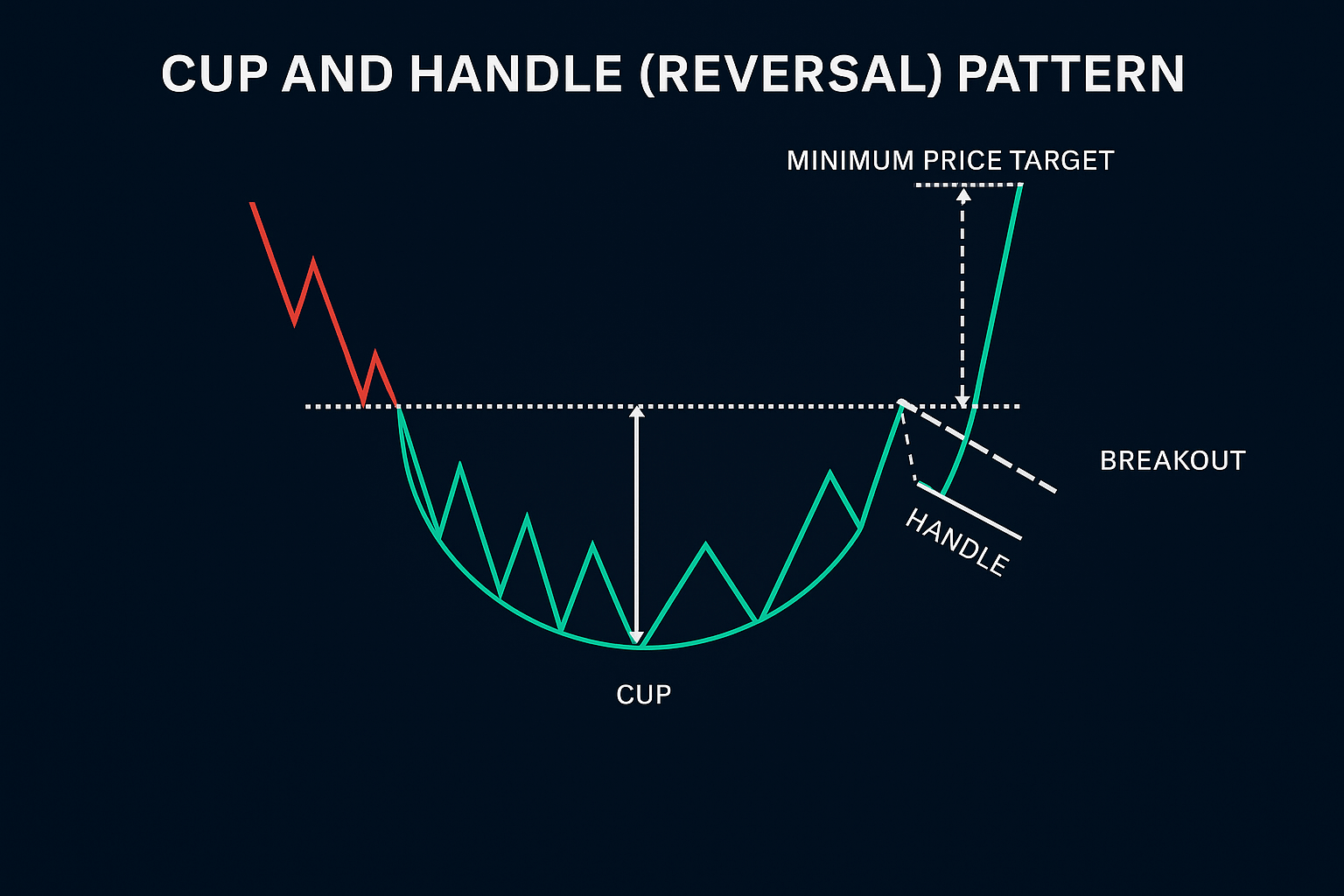

The cup-and-handle pattern, often revered in swing trading, combines a rounded “cup” formation followed by a tight “handle” consolidation.

It’s a textbook bullish continuation setup, but traders must watch for false breakouts, especially near key resistance.

Market Mechanics & Signals That Exceed Standard Advice

Volume Anomaly Clustering

Volume is about context, don't just look for big numbers and a major part in technical analysis to hit a profit target.

You have to detect volume anomaly clustering, where volume spikes cluster tightly over several bars, signaling a brewing surge in market participation that often precedes explosive moves.

Quantitatively, traders look for volume surges that exceed the recent 20-bar average by at least 150-200%, but the secret lies in clusters: multiple spikes above this threshold within a tight timeframe (say, 3 to 5 bars).

These clusters form what we call liquidity accumulation zones, hidden reservoirs of aggressive buying or selling that power trend continuation.

Advanced momentum indicators synthesize this raw volume data with price velocity to calculate a breakout strength index, which is a numerical score that weights volume intensity against price momentum.

Scores above 0.75 (on a normalized 0 to 1 scale) often predict high-probability breakout confirmations, reducing noise from isolated volume spikes.

These subtle volume clusters, when mapped on multi-timeframe charts, offer a near-crystal-ball insight into where the market is poised to ignite.

Order Book Imbalance & Flow Divergence

Behind every breakout lies a silent war in the order block: liquidity imbalances where buy and sell orders stack disproportionately.

Detecting this in real time can be a game-changer, but requires near-instant analysis of bid-ask data, something only a few elite traders can handle manually.

Here’s the kicker: a breakout’s strength correlates strongly with order flow divergence when the price pushes higher but large sell limit orders disappear from the book, or vice versa for short setups.

This indicates that opposing liquidity has been absorbed, leaving the path clear.

Technically, expert traders measure this via the Order Book Pressure Ratio (OBPR), a proprietary metric comparing the cumulative size of resting buy orders versus sell orders within the top 5 price levels.

An OBPR exceeding 1.8 on the buy side during a breakout signals dominant buying pressure; below 0.5 on the sell side flags aggressive sell exhaustion.

Multi‑Timeframe Confirmation

Trading breakouts on a single timeframe is the wrong choice; it often leads to fakeouts or fake signals.

The multi-timeframe confirmation is essential to increase the probability that the breakout you are watching is valid.

A common expert strategy is to first spot a breakout on the 1-hour chart, then check for confirmation on the 4-hour and daily charts.

When multiple timeframes align in the same direction and momentum, it significantly increases the likelihood of a sustained move, filtering out noise and false breakouts common on isolated timeframes.

Modern trading platforms now support advanced scanning and alert features that monitor multiple symbols and timeframes simultaneously.

Or even better, you can have our ACB breakout arrows scanner, which shows you what pairs and what timeframes are ready to breakout, giving you the edge that you need.

This capability allows traders to identify the strongest breakout continuation setups across their watchlist, streamlining decision-making and improving timing precision.

Momentum Confirmation and Precision Entry and Exit Strategies

Momentum is the lifeblood of breakout continuation strategies, confirming that price isn’t just moving, but surging with conviction.

Tools like MACD divergence, Relative Strength Index (RSI) threshold breaks, and volatility indicators such as the Average True Range (ATR) are essential to understand the market sentiment.

Detecting momentum alignment ensures you’re jumping onto a wave with enough force to carry you through the prevailing trend.

But momentum confirmation is only half the battle.

Executing your trade with precision, knowing exactly when and how to enter and exit the prior trend, is what matters.

Entry tactics often revolve around choosing between limit orders just beyond the pattern edge or market entries after a retest of the breakout zone.

Limit orders offer price control but require exact timing to avoid missed opportunities, while market entries ensure immediate execution but risk slippage.

Risk management is paramount: placing stop-loss orders using pattern structure and ATR-based buffer zones creates logical, market-respected safety nets that protect capital without being prematurely triggered.

Meanwhile, trailing stops help lock in profits as the trend extends, dynamically adjusting your exit point to ride the momentum without giving back gains.

You should project targets using the height of the flagpole or triangle pattern from the breakout point, but of course, after considering market conditions.

Smart traders consider scaling out portions of their position and employing dynamic trailing stops to maximize returns while preserving capital.

Some advanced tools streamline this entire workflow by providing automated stop-loss and take-profit suggestions as well as “Quick Profit” levels for partial exits, supporting a disciplined yet flexible approach to managing trades.

By combining rigorous momentum confirmation with disciplined, tactically timed entries and exits, you convert a good trade idea into a repeatable, profitable system.

But always keep in mind to set realistic profit targets and journal every trade you take, to ensure that your system stays profitable.

Psychology and Sentiment Overlay

Breakouts are more of a battle against market psychology and the collective sentiment.

Even during a brief consolidation period, sentiment can switch quickly, and a lot of traders can be victims of a false breakout.

Tools like the Trader Sentiment Index or monitoring social media volume provide real-time insights into how market participants feel about an asset.

For example, if price consolidates but sentiment is sharply bullish, the odds favor a strong upside breakout.

Conversely, if sentiment weakens or diverges from price action, a phenomenon called sentiment divergence can foreshadow a low-probability breakout or an imminent reversal.

Incorporating sentiment analysis allows traders to add a psychological layer to technical setups, giving a more holistic view of market dynamics.

Common Mistakes & Trader Pitfalls

Even the most skilled traders can fall into these common traps when trading breakout continuation strategies. Awareness and discipline are your best defenses:

- Trading during consolidation without confirmation: Entering too early in sideways price action often leads to false breakouts and losses.

- Over-trading breakouts: Chasing every minor breakout without selectivity burns capital on low-probability setups.

- Ignoring liquidity shifts: Breakouts in low-volume sessions or without volume confirmation are prone to sudden reversals.

How to fix these pitfalls:

- Exercise patience and wait for confluence: Only trade when multiple signals align: volume, momentum, price action.

- Set volume thresholds: Use minimum volume requirements to filter out weak or fake breakouts.

- Leverage indicators with alerts and analytics: Tools like the ACB Breakout Arrows Indicator help avoid premature entries by signaling only high-quality breakout setups.

By following these guidelines, you transform guesswork into a disciplined, data-driven approach that improves your consistency and trading edge.

Conclusion

Mastering the breakout continuation strategy is your gateway to capitalizing on the market’s most powerful momentum moves.

By understanding key continuation patterns, leveraging advanced volume and order flow insights, and confirming breakouts across multiple timeframes, you build a robust framework that separates profitable trades from costly false starts.

The journey doesn’t end with patterns alone; precision momentum tools, disciplined entry and exit tactics, and a keen awareness of market psychology all combine to give you a decisive edge.

Avoid common pitfalls with patience, confluence, and smart risk management ensure you trade with confidence and consistency.

Stay disciplined, keep learning, and leverage every tool at your disposal, including innovative breakout indicators, to turn momentum into lasting profits.

Frequently Asked Questions (FAQs)

1. What makes a breakout continuation strategy different from other trading strategies?

A breakout continuation strategy focuses on trading price moves that break through established support or resistance levels with strong volume, signaling the trend is likely to continue.

2. How do I confirm that a breakout is valid and not a false signal?

Valid breakouts are typically confirmed by increased volume, often 150-200% above recent averages.

3. Can breakout continuation strategies be applied across different markets?

Yes, breakout continuation strategies work across various markets, including forex, stocks, commodities, and indices. However, volume and liquidity dynamics vary.

4. What are the most reliable continuation chart patterns to watch for?

Triangles (ascending, descending, symmetrical), flags, pennants, rectangles, and the cup-and-handle pattern.

5. What risk management techniques should I use with breakout continuation strategies?

Use logical stop-loss placement based on pattern structure and volatility (e.g., ATR-based stops), employ trailing stops to protect profits, and set realistic profit targets derived from pattern projections.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: