We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Best Daily Drawdown Limit EA to Protect Your Account and Trade Confidently

In the unpredictable world of trading, your account's survival often depends not on how much you make, but on how much you prevent yourself from losing.

While most traders fixate on entry signals and profit targets, the professionals understand that protecting capital through effective drawdown management is what ultimately leads to trading longevity and consistent success.

This is where a daily drawdown limit EA can make a real difference by enforcing strict risk controls automatically, even when emotions run high.

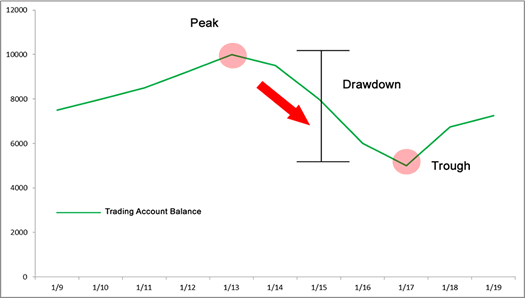

What is a Daily Drawdown Limit and Why Does It Matter?

A daily drawdown limit refers to the maximum percentage or monetary loss a trader is willing to accept within a single trading day. Once this threshold is reached, all trading activity stops, preventing further losses and protecting the remaining capital.

This simple yet powerful concept has saved countless trading accounts from devastating losses during volatile market conditions.

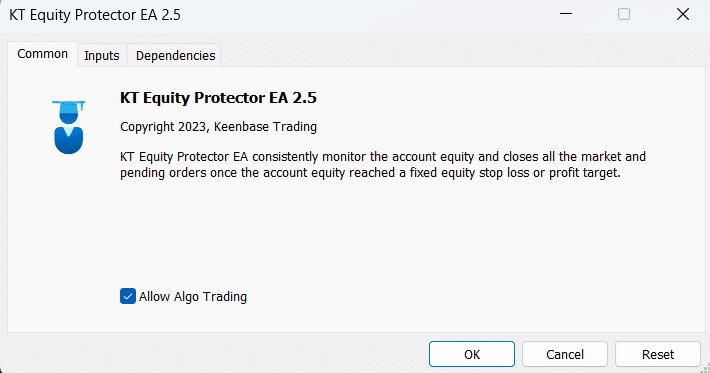

Implementing a drawdown limiter through an Expert Advisor (EA) automates this critical risk management function, removing emotional decision-making from the equation and ensuring consistent application of your risk rules, even during the most stressful market conditions.

KT Equity Protector - Your Reliable Daily Drawdown Limit EA

In the world of electrical systems, circuit breakers serve as the last line of defense against catastrophic damage. When current exceeds safe levels, they trip automatically, preventing fires, equipment damage, and potential disaster.

In the trading world, the KT Equity Protector EA functions in much the same way, providing an intelligent safety system that activates precisely when your trading account needs protection most.

Unlike conventional drawdown management tools that often require constant monitoring or complex setup, this ingeniously designed safeguard works silently in the background, like a vigilant guardian that springs into action only when danger threatens.

It's the trading equivalent of insurance that pays off before disaster strikes, not after the damage is done.

Five Ways the KT Equity Protector Transforms Risk Management

The beauty of this specialized EA lies not just in what it does, but how elegantly it accomplishes its protective mission:

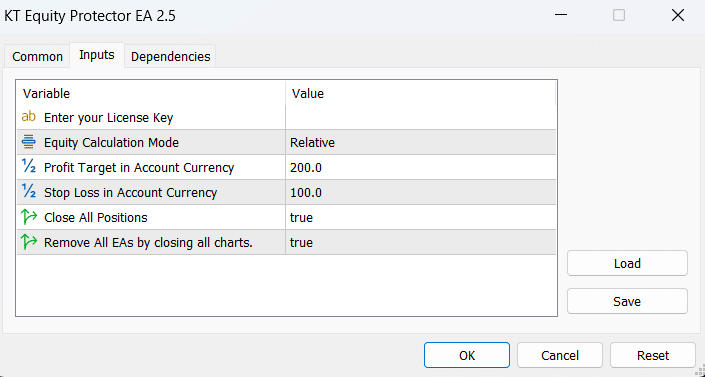

- Customizable Safety Thresholds: Whether you prefer percentage-based protection ("never lose more than 5% in a day") or specific dollar amounts ("stop everything if my account drops below $9,500"), the system adapts to your precise risk boundaries.

- Emergency Shutdown Protocol: When your predefined limits are breached, the EA executes a comprehensive emergency protocol, closing all active trades, canceling pending orders, and optionally shutting down other EAs that might attempt to open new positions.

- Dual Platform Integration: Seamlessly functions across both MT4 and MT5 environments, providing consistent protection regardless of which platform you've built your trading infrastructure around.

- Visual Alert System: Beyond just closing positions, the system provides clear visual and optional email notifications when protective measures activate, giving you immediate awareness of significant market events affecting your account.

- Prop Firm Compliance Automation: For traders working with prop firms, the EA can be configured with buffer settings that keep you safely within the firm's drawdown parameters, protecting not just your capital but your valuable relationship with the funding provider.

Understanding Risk Management in Trading

Successful trading is fundamentally about risk management. While potential profits might attract people to the markets, it's proper risk control that keeps them in the game long enough to become profitable. Here's why implementing a daily drawdown limit is essential:

Protecting Your Trading Capital

Your trading capital is your business inventory – without it, you simply cannot trade. By implementing strict drawdown limits, you ensure that a single bad day or series of trades doesn't wipe out your account, allowing you to adjust your strategy and continue trading another day.

Managing Psychological Pressure

Large drawdowns create enormous psychological pressure that often leads to even worse decision-making. By limiting daily losses to a predetermined level, you reduce this pressure and maintain a clearer mindset for future trading decisions.

Meeting Prop Firm Requirements

For traders working with proprietary trading firms, maintaining strict drawdown control isn't just good practice – it's a requirement. Most prop firms impose maximum daily and total drawdown limits that, if exceeded, will result in immediate account termination. The KT Equity Protector EA helps ensure you never breach these critical thresholds.

Trading with Prop Firms: Special Considerations

Proprietary trading firms offer excellent opportunities for skilled traders to access substantial capital, but they come with strict rules, particularly regarding drawdowns. Here's how a drawdown limiter EA becomes essential in this environment:

Understanding Common Prop Firm Rules

Most prop firms impose two types of drawdown restrictions:

- Maximum Daily Drawdown: Typically 4-5% of the account balance.

- Maximum Total Drawdown: Usually 10% of initial account balance.

Exceeding either of these limits typically results in immediate disqualification and loss of the account. The KT Equity Protector EA helps you stay well within these parameters by automatically stopping trading when your predefined risk-reward thresholds thresholds are approached.

Configuring Your EA for Prop Trading

When using the KT Equity Protector EA with a prop firm account, consider these settings:

- Set your daily drawdown limit at least 0.5% below the firm's maximum (e.g., 3.5% if their limit is 4%).

- Configure the EA to close all positions and disable further trading when this threshold is reached.

- Consider using the absolute mode for precise control over exact dollar amounts.

This conservative approach provides a safety buffer that helps prevent accidental threshold breaches due to slippage or rapid market movements.

Strategies for Consistent Trading Success

Implementing a daily drawdown limit EA, such as the KT Equity Protector, is just one component of a comprehensive approach to achieving trading consistency. Here are additional strategies that complement this essential risk management tool:

Position Sizing Based on Risk

Calculate position sizes based on the specific risk per trade rather than using fixed lot sizes. This ensures that each trade risks only a small, predetermined percentage of your account, regardless of the market you're trading or the distance to your stop loss.

Trading Multiple Currency Pairs

Diversifying across multiple currency pairs can help reduce overall drawdown, as not all pairs move in the same direction simultaneously. However, be aware of correlations between certain pairs that could amplify losses during market-wide movements.

Implementing a Grid Trading Approach

A grid EA strategy involves placing buy and sell orders at predetermined intervals above and below the current market price. This approach can help average out entries and potentially reduce drawdowns during volatile market conditions.

Best Practices for Automated Drawdown Management

To maximize the effectiveness of your drawdown limiter EA, consider these best practices:

Regular Monitoring and Adjustment

While automation handles the execution, regularly review your drawdown settings to ensure they still align with your current account size, market conditions, and risk tolerance.

Backtesting with Historical Data

Before deploying your drawdown strategy on a live account, thoroughly backtest it using historical data to understand how it would have performed during various market conditions, including periods of extreme volatility.

Combining with Technical Indicators

Use technical indicators to supplement your drawdown management strategy. For example, increasing your risk tolerance slightly during strong trending markets and reducing it during choppy, indecisive conditions.

Common Mistakes to Avoid

Even with a powerful tool like the KT Equity Protector EA, traders can make mistakes in their drawdown management approach:

Setting Limits Too Tight

Excessively tight drawdown limits can hinder your trading too frequently, preventing your strategy from adapting to normal market fluctuations. Find the balance between protection and functionality.

Ignoring the Impact of Open Positions

Remember that drawdown is calculated based on floating equity (including unrealized profit/loss on open positions). During volatile conditions, this can change rapidly and trigger your limits unexpectedly.

Failing to Consider Multiple Timeframes

Market volatility affects different timeframes differently. A strategy that shows minimal drawdown on daily charts might experience significant intraday drawdowns that trigger your daily limits.

Conclusion: Taking Control of Your Trading Future

In the challenging world of trading, implementing a reliable daily drawdown limit strategy with a tool like the KT Equity Protector EA can be the difference between long-term success and account failure. By automatically enforcing strict risk management rules, you protect your trading capital during inevitable losing streaks and market volatility.

This approach not only helps preserve your account balance but also provides psychological benefits, reducing stress and preventing the emotional decisions that typically follow large drawdowns.

For prop firm traders, it offers the added security of keeping you within the firm's strict guidelines, protecting your opportunity to trade their capital.

Remember that successful trading is a marathon, not a sprint. The traders who survive and thrive over the long term are rarely those who make the most in a single day, but rather those who consistently protect their capital from excessive losses. The EA provides the automated discipline to help you become one of these successful long-term traders.

Ready to implement professional-grade drawdown protection in your trading? Explore the KT Equity Protector EA today and experience the security and peace of mind that comes with automated risk management.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: