We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

5 Things to Learn From the Best Traders Out There

Some traders inspire many newbies to learn and become the best traders in the trading world.

We have analyzed these top traders and found 5 top lessons that enabled them to become well-known in the trading community.

These lessons emphasize the importance of having a disciplined mindset and systematic approach to trading. So let’s first quickly overview some top traders and then define 5 essential lessons every trader should learn.

Top Financial Traders of All Time

George Soros and Jim Simons are the most influential traders of all time on the list of top-rated FX traders globally.

Besides having different approaches and methods, they have several things in common, and we have uncovered their secrets.

The five most influential traders listed are George Soros, Jim Simons, Richard Dennis, Stanley Druckenmiller, and Pau Tudor Jones.

We would love to include Warren Buffet in this list, but he is an investor, not a trader.

So we will focus more on traders and the necessary skills in this guide. Let’s briefly overview George Soros, Richard Dennis, and Jim Simons as their stories stand out the most.

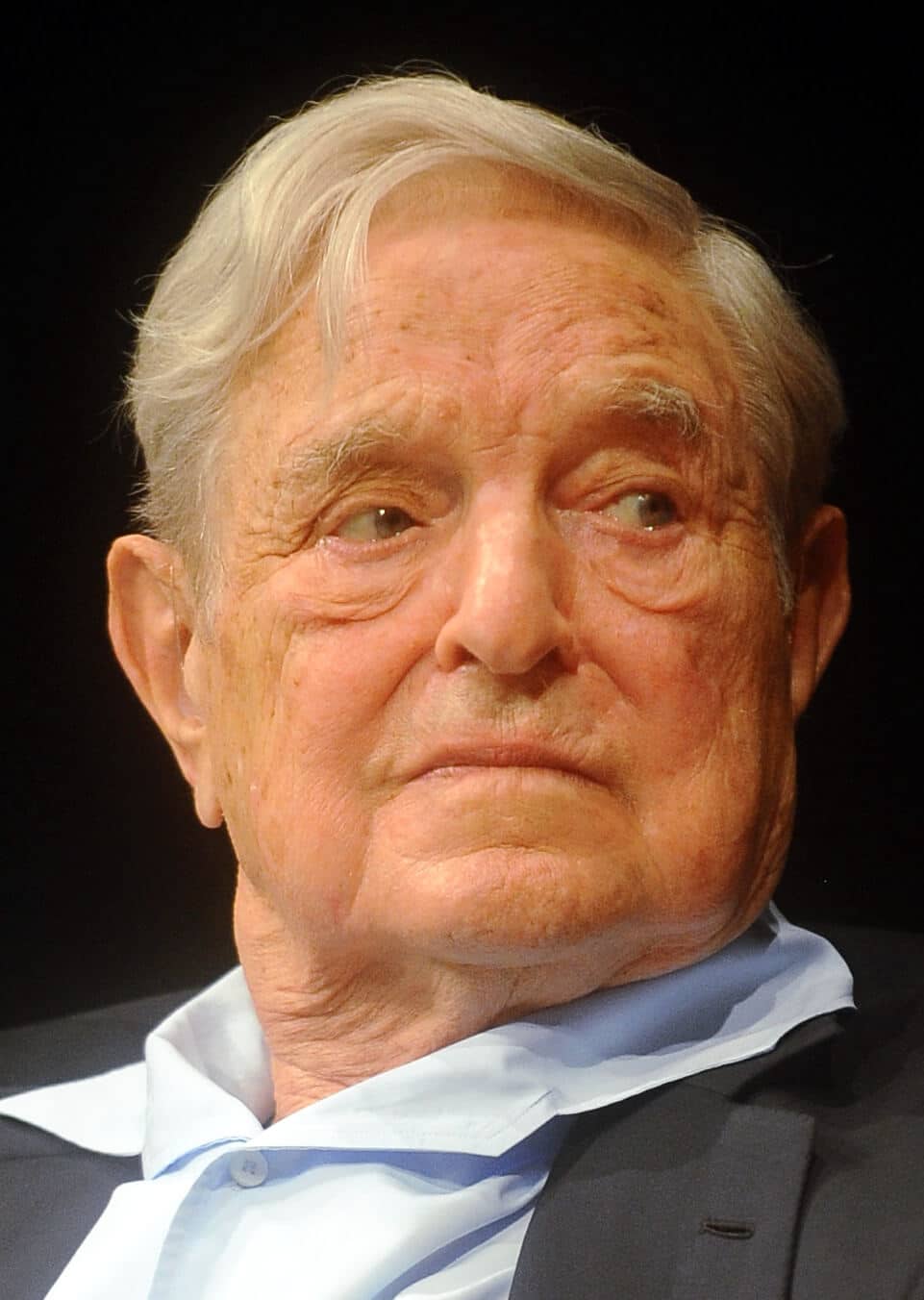

George Soros

Whenever thinking about Forex markets, the first name to come to mind is George Soros. He placed large bets against the central banks of several countries and made billions of dollars.

George Soros is known as the man who broke the Bank of England when his Quantum Fund placed prominent sell positions and caused 1 billion dollars in 1992 during Black Wednesday.

As of 2023, his net worth is above 8 billion dollars. He has donated over 32 billion dollars to foundations throughout his career, promoting liberal political causes worldwide.

Jim Simons

Jim is a professor of math and has won the Nobel Prize. Unsurprisingly, he managed to crack the financial markets and established several funds during his career.

His hedge fund, Renaissance Technologies, has attracted talented mathematicians, physicists, and coders. His hedge fund has shown consistent annual growth with profits for 30 years.

His primary focus is algorithmic trading by analyzing markets with super-powerful computers and advanced algorithms.

Their servers are closer to top exchanges to have lower latency and make trading decisions faster and more efficiently.

Richard Dennis

Although he made 200 million dollars from his borrowed 2k, he is well-known for another fact.

Richard Dennis, with William Eckhardt, created a turtle experiment where they managed to teach several traders who made more than 10 million dollars in trading. Dennis believed anyone could learn to trade, while Eckhardt thought it a special gift.

The results proved Dennis right, as anyone can learn to trade, and we will define the exact lessons that helped these traders achieve tremendous success in the trading world.

Top 5 Lessons from the World’s top traders

Let’s define five lessons from the world’s top traders that will help beginners succeed. Here is the analysis and summarization of the main lessons you can learn from top traders.

Consistency and Discipline

Every trader should seek to acquire two primary skills in their trading career: consistency and discipline.

Without constantly trying to improve and do the same thing every day until you get a pro in the trading business, success won’t be possible.

Discipline helps traders achieve their goals by constantly working on their education and trading skills. Top traders rigorously follow their strategies and stick to their rules and guidelines.

One key aspect of a successful trading career is to stick to your trading plan and execute it flawlessly. Only when you apply scientific methods to the trading process consistently do you become profitable in the long term.

Do you think George Soros or Jim Simons were not doing the same thing daily to make sense of financial markets? Be sure these guys were learning and improving constantly without hesitation or laziness.

Strong Risk Management Skills

The primary goal of every trader should be to stay in the game for a long time. In modern times the main objective for businesses is to remain in the competition in the long term, and they plan to do so.

Since trading is also a business, preparing for a long time is critical. The only tool helping traders not to lose too much too quickly and stay in the game is strong risk management skills.

In a trading business, losing a few trades is a cost of doing business, and it is critical to limit these losses. By preventing excessive losses, traders can maintain their capital and open trading positions to catch profitable trades.

Best traders managed to stay in the trading business for years, and they had a losing month in these years but still were able to achieve success.

Identifying Opportunities - Education and expertise

To become a profitable trader, you should identify when the market presents trading opportunities before you.

Top traders deeply understand financial needs and underlying economic principles and can translate this knowledge into profits by catching the opportunities.

George Soros is primarily known for his ability to identify when central banks of England and other countries would no longer hold their currencies, and he used these opportunities to generate massive profits of billions.

But he did this using his theory of reflexivity and had enough knowledge and expertise to develop his novel approaches and foresee opportunities.

Adapting to Market Conditions

Financial markets are like living organisms. They constantly change; they are dynamic. Like everything else, they continually evolve, and it is essential to adapt to these changes.

One of the best skills for top traders is adapting to these conditions and staying leading and profitable. Jim Simons was able to establish several profitable hedge funds, always remain relevant, and find new strategies and algorithms that would better recognize the market movements.

In today’s world, quick adaptation is critical to achieving success, as everything is changing so fast it takes great effort to follow significant trends and dynamics.

For example, the Forex market could cover hundreds and thousands of pips before the 2010s. Nowadays, the markets are more liquid, and such large movements rarely happen.

Staying profitable would be challenging without adapting to new terms and conditions.

Never Stop Learning

To stay ahead of the curve and be profitable in the long term, you need always to be learning. For adapting to ever-changing markets, the skill of learning constantly plays a crucial role.

Top traders were always trying to learn something new, discover new paradigms, and continuously develop and evolve their ideas about markets.

Many leading traders are also teaching trading to beginners and deepening their knowledge in return.

But the constant learning process is one of the main characteristics of top traders, and you should probably too.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: