We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Boom and Crash Strategy: Top Secret Tips on How to Trade Indices

Boom and crash trading is one of the most exciting - and dangerous - ways to trade Forex. The boom and crash markets offer both thrilling opportunities and significant risks. If you can master it, you can make some serious profits.

But if you don’t know what you’re doing, you could lose everything just as quickly.

This post will share tips and a top secret tips on how to trade boom and crash indices. We’ll show you when to exit and enter a trade, what indicators to watch out for, and how to incorporate proper risk management.

So whether you’re a beginner or a seasoned pro, read on for everything you need to know about trading boom and crash indices.

Introduction To Synthetic Indices

Synthetic indexes are a type of simulated trading instruments that are designed to reflect or imitate the behavior of real-world financial markets.

These indices are used to generate new prices for financial instruments, and they do so by employing a random number generator. This type of generator is created using cryptographically secure computer software.

This means the broker or trader has no way of predicting which numbers will be generated or influencing them in any way, ensuring a high level of transparency.

To ensure that the results of synthetic index charts are accurate and consistent, an external audit is conducted by a third-party auditor.

There are many types of synthetic indices, and some of the popular ones include Volatility Indices, Daily Reset Indices, Range Break Indices, and Boom/Crash Indices.

Most synthetic indices track the fluctuations of different currency pairs and allow investors to open smaller positions with a much lower upfront cost.

They measure multiple currency pairs' performance and offer various risk levels – from high-risk/high-reward shoots to more conservative approaches.

In this article, let’s talk about the Boom and Crash Indices and how to trade them effectively.

What Are Boom and Crash Indices

Boom and crash indices, offered explicitly by the Deriv broker, are a type of financial derivative that enables traders to gain exposure to the fluctuations of prices.

These indices are based on some of the most well-known markets, such as Forex, Indices, Commodities, and Cryptocurrencies.

They offer investors the opportunity to take advantage of fast-paced trading while constantly keeping track of market movements.

The Boom and Crash Synthetic Indices are volatile and can only be found at Deriv broker. Understanding the principles of trading synthetic indices like boom and crash indices is crucial for successful trading.

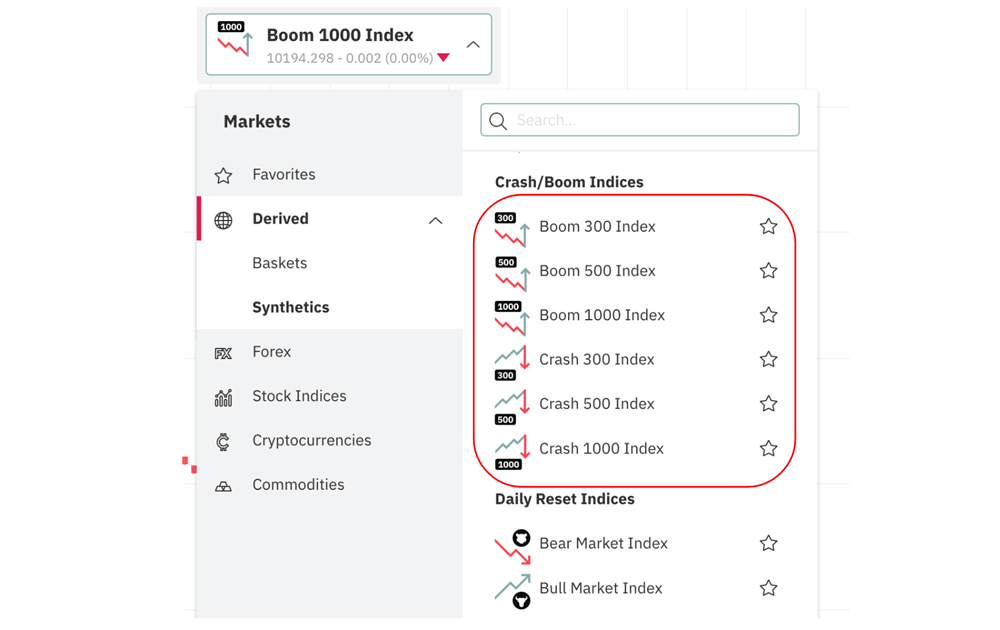

Unlike other instruments in the market, these do not follow the US dollar rate. Today, Boom and Crash indices typically come in six forms: Boom 300 index, Boom 500 index, Boom 1000 Crash 300, Crash 1000, and Crash 500 index.

Image Source: DTrader

A boom represents a sudden spike in the market structure, typically up to 50-60 pips, and a crash stands for a sudden breakdown of prices in the same range. These changes can occur within one-minute timeframe charts.

Top Secret Tips on How to Trade Boom and Crash Indices

Most Boom and Crash index traders scalp the markets to make quick profits.

Although it’s not a bad idea to scalp the Boom and Crash indices on a lower timeframe, it is not lucrative compared to the risk you put in. Choosing the right crash trading strategies is crucial for long-term success.

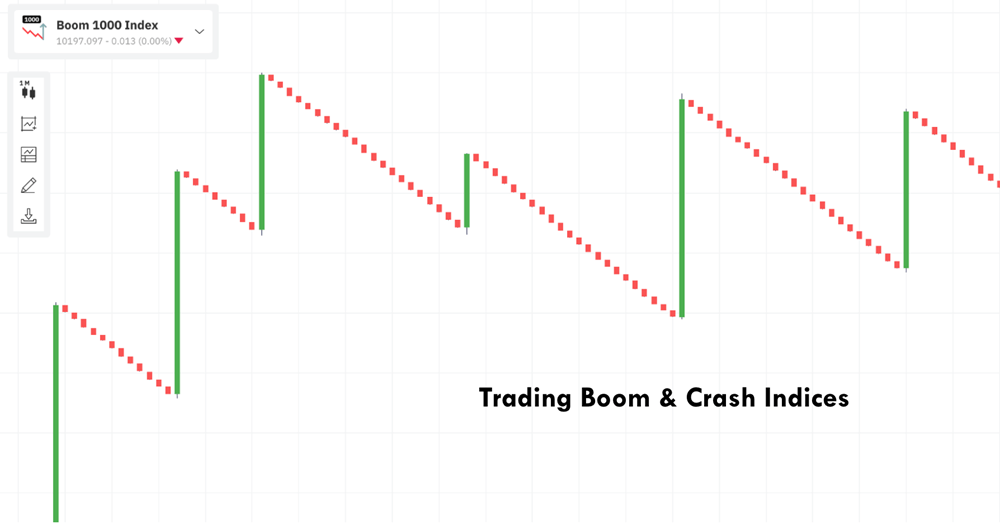

Let’s understand this with an example. Below is a Boom 1000 index price chart on the one-minute timeframe.

Each bearish candle here costs about $0.50 for every lot traded. So even if you managed to catch ten of these candles, your profit would be about $5.

Since the reward is low, novices tend to increase their lot size or the number of trades taken to maximize profits. But by doing this, they are also increasing their risk as the number of favorable outcomes should be more for you to make a profit.

Boom and Crash indices are highly volatile, and one move against you can take off all your profits and even liquidate your account.

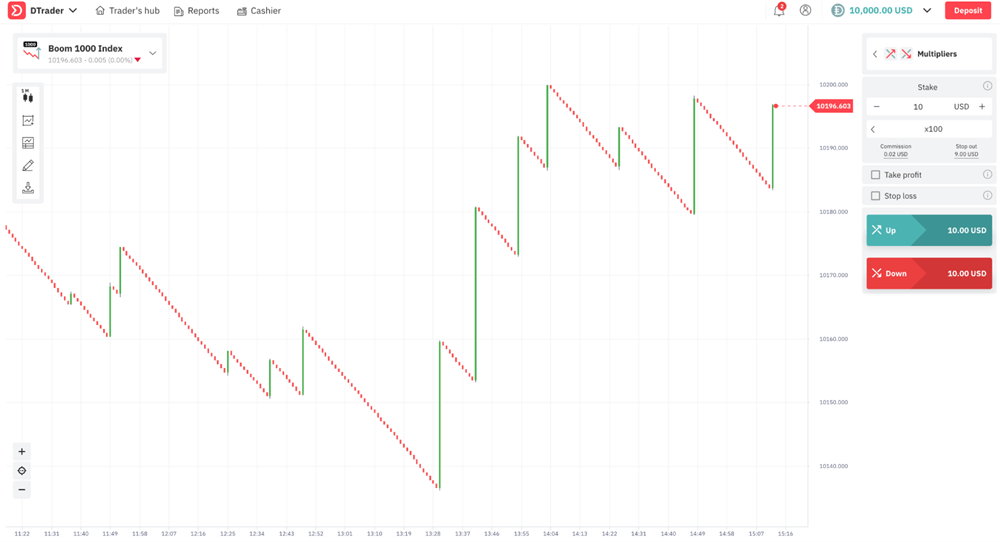

As you can see in the below chart, all the profits, you made by catching those bearish moves have been eaten up by one solid bullish move.

So what’s the top secret here to make the most out of Boom and Crash indices?

It is to trade these indices just like any regular Forex instrument.

Instead of looking for quick profits and trying to make the most in less time, zoom out and let the fundamentals of technical analysis work for you. Position trading can be advantageous in boom and crash markets as it allows you to hold positions longer to capitalize on major price movements.

The first step is to zoom out and go for bigger timeframes, such as one hour or four hours.

Then, look for a significant level, such as strong support and resistance. Then, wait for the price action to break the major level, look out for confirmation, and enter the market to ride the trend.

Swing trading is another effective mid-term strategy for boom and crash indices, focusing on capturing ‘swing highs’ and ‘swing lows’ in a trend.

Also, never forget that the trend is your friend. So always go long when trading Boom indices and short when trading Crash indices. Aligning your strategy with the trader's personal trading style is essential for consistent success.

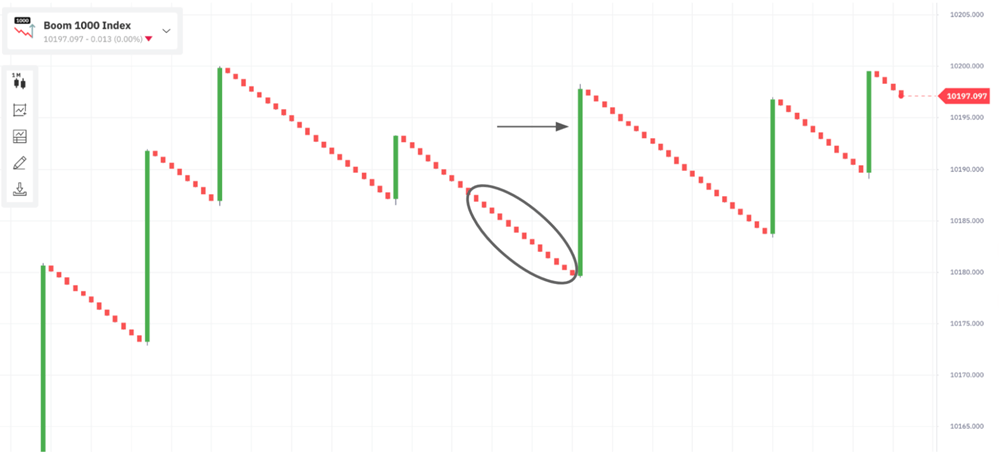

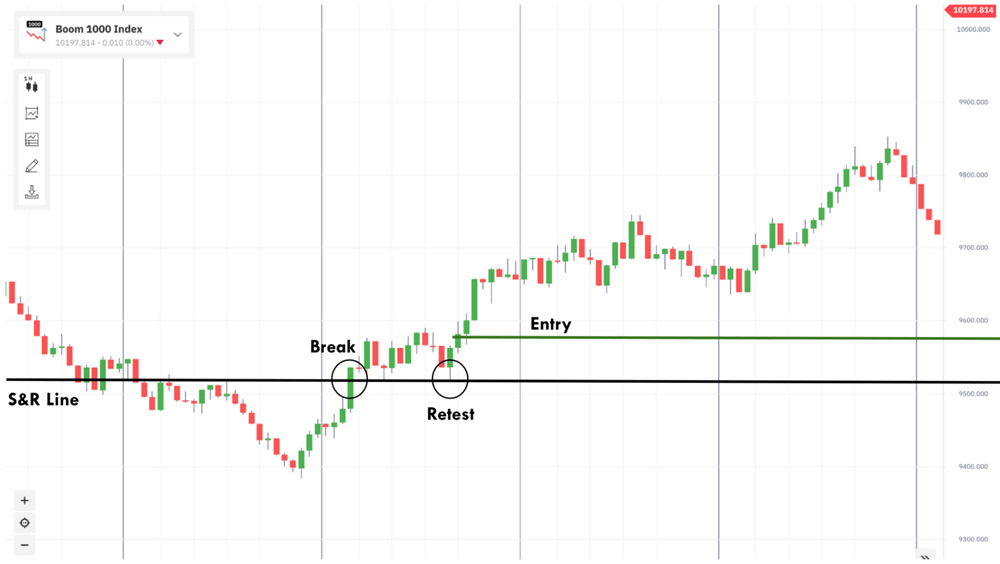

In the below price chart, let’s look for trading opportunities in the Boom 1000 Index.

The market is in an initial downtrend, and the price broke out from one of the most significant S&R levels.

As a confirmation, the price retested the support line and moved to the north. This indicates that the buying pressure is intense, and the probability of a price increase is higher.

We can see the price shooting up to the north as soon as we enter the market.

You can confirm this entry by pairing this trade with other reliable indicators like RSI, MACD, and Moving Averages.

You can go back to the lower timeframes to see how this trade played out and use a demo account to test this strategy on live markets with no risk.

Most trading strategies recommend high-stakes systems with immense risk, but this is the most logical way to make the most of this highly volatile synthetic asset. Choosing the right trading strategy based on personal trading style, psychology, and market exposure is key to success.

Pros of Trading Boom & Crash Indices

- Trading Boom and Crash Indices can be a great way to get your feet wet when investing in the Forex market.

- You can try small trades at low risks thanks to the short-term duration of the indices requiring a smaller capital outlay.

- A fundamental understanding of the market is not required to trade Boom and Crash Indices as it depends entirely on technicals.

- When trading these indices, there is no minimum deposit requirement (or very few), making this an excellent choice for novices.

- These indices are available around the clock, allowing for non-stop trading opportunities.

- Extremely low spreads, with some as low as one pip.

- Boom and Crash indices offer consistent volatility levels across different types of markets, ensuring that a trader has access to similar price movements.

- The potential for fast returns is high, which makes them an attractive option for risk-takers looking for quick rewards.

Bottom Line

Forex boom and crash market indices have been gaining popularity lately. If you are new to trading them, start with small amounts and increase your investment as you get more comfortable.

The most important thing is to have a solid plan and stick to it. Then, monitor your progress carefully while developing a strategy and adjust as needed. Finally, never forget to incorporate good risk management techniques in your strategy.

You can successfully trade Forex Boom and Crash Indices with some practice of the above strategy on a demo account. You can open a free demo account with any broker in a few minutes.

Never forget to keep an eye on your entry and exit points. Take into account the small details that could make or break a trade – know when to cut your losses and use analysis tools to determine when the market is shifting to act fast.

Doing this won't guarantee success every time, but it can be incredibly lucrative to make money if played right!

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: