Ready to act? Get ACB Breakout Arrows Indicator Now

Consolidation Breakout Indicator Explained: Unlock Powerful Trading Signals

According to a study by Thomas Bulkowski, author of the Encyclopedia of Chart Patterns, consolidation patterns, such as rectangles and triangles, precede major breakouts 67% of the time, with average post-breakout moves exceeding 40% of the pattern's range.

That highlights the fact that institutional positioning is being masked by silence.

The secret that no one tells you about?

In the Forex market, where price consolidates 70–80% of the time, most traders get bored or chopped. Smart traders are the ones who wait in low volatility sessions, because a breakout now or then is definite. That’s the edge provided by a consolidation breakout indicator that’s designed to detect accumulation before the explosion, not after.

Meet the ACB Breakout Arrows Indicator, your tactical upgrade in a market that rewards preparation, not reaction. It’s structured price action logic wrapped in automation and visual clarity.

If you’ve ever missed a move because it “looked boring” 10 minutes earlier, this guide and tool will retrain your eye and rewire your edge.

Let’s dive into the anatomy of consolidation zones and how the ACB system turns them into calculated breakout opportunities before the market even blinks.

Understanding the Consolidation Zone: Where the Big Moves Brew

A consolidation zone is the silence before the storm. These zones are where smart money accumulates and is positioned, while retail traders get chopped or bored out left and right.

But here’s the small piece of information everyone misses out on: the longer the consolidation, the more violent the breakout is.

During a consolidation phase, price action becomes confined within a clearly defined range as it moves between established support and resistance levels.

At the same time, the Average True Range (ATR) contracts, which signals a noticeable decline in volatility. This is often accompanied by a drop in trading volume, indicating that institutional players are either pausing or strategically accumulating positions behind the scenes.

As this stagnation persists, retail traders often lose interest or exit early, creating a cleaner and less contested environment for smart money. The longer this tightening lasts, the more explosive the breakout is likely to be once volatility returns and the market finds directional conviction.

The ATR(14) for EUR/USD averages around 59 pips on the daily timeframe. During consolidations, it often dips below 40 pips, which is an objective signal that the market is coiling. When that volatility reawakens, the move is rarely subtle.

Fact: The EUR/USD pair is the most traded in forex and can range between 70–100 pips per day on average in trending conditions. Spotting when ATR has dropped far below that range is your signal that expansion is due.

The ACB Advantage: Precise Breakout Detection Without Guesswork

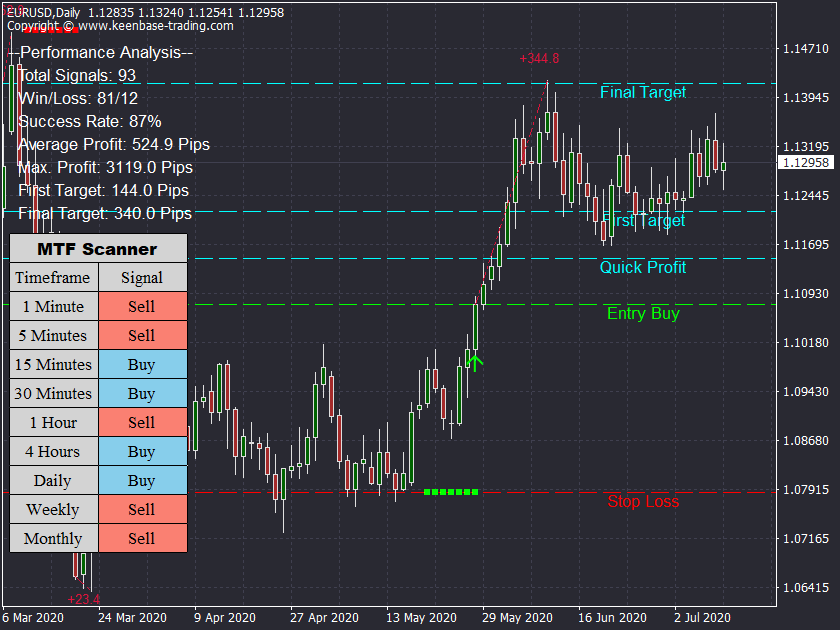

The ACB Breakout Arrows Indicator constantly scans these zones in real-time, measuring not only price compression but directional intent. Once the breakout conditions are confirmed, it fires non-repainting Buy or Sell arrows with auto SL, TP, and even a Quick Profit Line for scalpers.

No lag. No repaint. No second-guessing. It is essentially a mechanical execution based on real-world structures.

Superhuman Tip:

Focus on consolidation zones that form during the London–New York session overlap. This window (8 AM to 12 PM EST) generates the highest volatility due to maximum liquidity. That means breakouts triggered during this time have stronger follow-through, cleaner retests, and a high probability of reaching take profit levels (If you set them realistically)

Built-In Risk Control: Because Every Breakout Trade Deserves a Safety Net

Breakouts by nature are fast-moving and of high impact. They offer excellent reward potential, but they can also carry an elevated risk if not executed correctly.

The ACB Breakout Arrows Indicator is engineered to detect high-probability breakout setups but also to guide traders through them with precision and safety. It is a complete breakout trading system that integrates risk parameters directly into its logic.

Here’s how the built-in risk control features empower your trading:

- Automated Stop Loss and Take Profit Levels: These are calculated based on real market structure, not arbitrary values. This ensures each trade is grounded in price logic and not emotional bias.

- Quick Profit Line: Ideal for scalpers and short-term traders, this feature targets fast exits once a small profit is secured. It helps capture gains before volatility pulls back.

- Dynamic Signal Sensitivity: Adjust the indicator's responsiveness based on your preferred trading style. Whether you are scalping 5-minute charts or swing trading 4-hour setups, the ACB indicator adapts to your approach.

- Performance Dashboard: Monitor your metrics in real time. The system displays win rates, average profits, and equity growth trends so you can optimize and refine your strategy with confidence.

Strategic Risk Management Techniques to Combine

While the ACB Breakout Arrows Indicator provides a solid technical edge with its automated SL, TP, and breakout logic, the real alpha lies in how you integrate it into a broader risk architecture.

Think of yourself here as a sniper, and the indicator is your scope, but you still need the discipline to wait and execute when it is the right time

Below are refined risk management techniques that blend technical precision with trader psychology and dynamic market conditions:

Fixed Percentage Capital Risk: Controlling Emotional Exposure

Never let excitement override your capital preservation logic.

By limiting your exposure to 1% to 2% of your account per trade, you create a buffer against drawdowns that gives your edge room to express itself.

This is pure emotional control.

When your downside is capped, you’re less likely to interfere with a perfectly good setup due to panic or greed.

Advanced Tip: Use equity curve correlation. During drawdowns, scale risk to 0.5% or less. When you're in a statistically significant win streak, a controlled scale-up (e.g., 2.5%) can accelerate growth.

ATR-Based Trailing Stops: Volatility-Aligned Protection

Static stops are relics of a slower market. Use Average True Range (ATR) to dynamically shift your stop-loss level as volatility expands or contracts.

For example:

- Swing Trades: Trail at 1.5× ATR below a bullish breakout.

- Intraday Setups: Use 1.2× ATR for faster locking of gains.

This method responds to real market behavior instead of relying on arbitrary pip values. It preserves gains while allowing price to breathe, especially in trending conditions where false pullbacks are common.

Time-Based Exit Protocols: Managing Opportunity Cost

Every minute your capital is tied up in a non-performing trade, it is unavailable for stronger setups.

A time-based rule, such as exit after 3 to 5 candles post-breakout without significant movement, is not about panic; it is about protecting opportunity flow. Markets are probabilistic. If a breakout fails to follow through quickly, the odds of success diminish significantly.

Consider combining it with volume confirmation. If breakout volume dries up and price stagnates, that’s a stronger signal to cut early and redeploy capital.

These strategies, when combined, create a multi-layered risk defense system that complements the ACB indicator’s strengths to help you layer your risk like a hedge fund.

How to Spot Real Breakouts: No More FOMO Entries

You have to keep in mind that most breakouts are not good trading opportunities, simply because they won't fit your strategy in a certain way.

To consistently capture high-probability breakouts, you need to know what a true breakout structure looks like. Here’s the precise sequence professional traders watch for when using a consolidation breakout indicator as part of their edge to basically identify the anatomy of a real breakout:

- Range Formation: Price chops sideways within a defined horizontal zone. The highs and lows become respected, often bouncing within a 20–50 pip band on majors or 150–300 pips on gold (XAU/USD). This is the “consolidation cradle.”

- Pre-Breakout Volume Buildup: Before the breakout occurs, smart money often starts loading in. Volume begins to tick higher at a healthy pace, not spike, signaling that accumulation or distribution is underway.

- Range Breach With Full Candle Body: The candle that breaks out must close entirely outside the consolidation box. Wicks don’t count. Professionals look for full-bodied candles that decisively shift structure.

- Post-Breakout Momentum: Momentum follows structure. Once the range is broken and confirmed with volume, continuation often follows in the direction of the breakout. That’s your window.

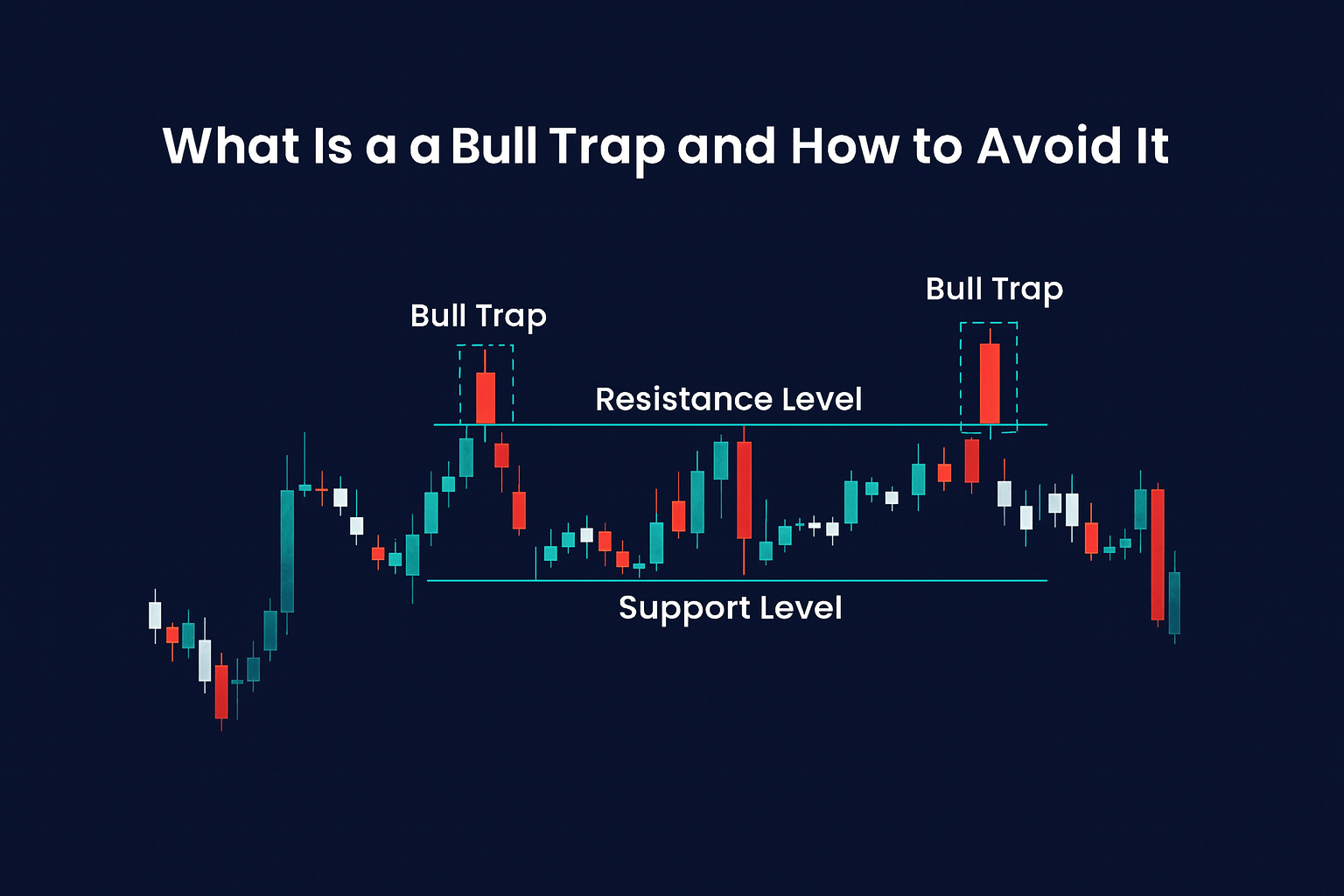

Breakout Traps: The Silent Killers of Trader Accounts

Most retail traders get faked out because they confuse noise with intention.

Here’s how to protect yourself and only engage when the math is in your favor:

Don’t Trust Price Alone

- Volume Precedes Breakouts: A valid breakout is supported by a gradual increase in volume. If price pops but volume doesn’t, it’s likely a liquidity grab, not a true move.

- Ignore Wick Breaks: A candle that spikes above the zone only to close back inside is a trap. A real breakout is clean, with a full body close beyond the range.

- Wait for Retest Rejection: Smart entries often occur on the retest of the broken zone. If price breaks out, returns to the level, and fails to re-enter the range, that’s confirmation.

Use Confluence Indicators

- Bollinger Bands: Tightening bands often signal pre-breakout compression. When they expand violently, it confirms the volatility release.

- TTM Squeeze / Volatility Metrics: When volatility drops below average and suddenly spikes, you're entering a window where breakouts statistically follow.

Winning in Low Volatility? Yes, But With a Tactical Advantage

Low-volatility markets aren’t dead zones; they're coiling snakes that move and eat your capital the moment you are the most exhausted. The trick here is patience.

Look for:

- Tight Bollinger Bands.

- Low ATR readings.

- Upcoming macro catalysts (e.g., CPI, NFP).

When the squeeze ends, moves are violent, often triggering new trends.

Your Trading Plan: Structured Execution Over Emotional Impulse

Consistency in profits comes from a codified execution model that eliminates discretion and thrives in volatility.

This is how professionals weaponize discipline:

Precision Entry Criteria

- Defined Compression Zone: The range should be narrow, with confirmed support and resistance levels. Avoid vague chop and look for a structure that has held for at least 15–25 bars.

- Confirmed Range Break with Volume Alignment: The breakout candle must close fully outside the structure. Partial wicks or premature spikes are invalid. Volume must support the move, ideally a 15–30% increase above the recent average.

- Time-Sensitive Breaks: Prioritize breakouts during session overlaps or high-impact news periods. These provide the volatility burst required to validate the breakout structurally.

Risk Parameters Backed by Math

- Dynamic Stop-Loss Logic: Set your SL using structural logic either at the opposite edge of the range or an ATR-based distance that accounts for the pair’s volatility regime.

- Capital Risk: 1–2% Rule with Volatility Calibration: Don’t just blindly risk 1–2%. Adjust position size to ensure that SL placement respects volatility but keeps dollar-risk capped. Use pip value calculators, especially for pairs like XAUUSD, where pip values vary.

- Synthetic Breakeven Adjustments: At specific RR milestones (e.g., 1.2R), consider adjusting SL to break even if volume doesn’t sustain. This prevents giving back slow-moving wins.

Exit Strategy Beyond Static Targets

- Multi-Layered Exit Logic: Take partial profit at the Quick Profit zone (first volatility expansion bar).

Trail the rest using dynamic tools like ATR(14) or structure-based lows/highs. - Momentum Exhaustion Filter: Monitor volume and candle spread. If momentum decays (e.g., inside bars, doji clusters) post breakout, consider force-exiting these, as they often precede reversals.

- No Progress Rule: If price fails to follow through within 3–5 candles after breakout, close. Sideways behavior post-breakout suggests absorption or an engineered trap.

Holistic Trade Management Protocol

- Multi-Timeframe Confirmation: Validate trade alignment using higher timeframe trend structure. For instance, only take M15 breakouts if H1 supports the trend bias.

- Scanner-Driven Trade Filtering: Use a real-time scanner to identify only setups that meet structural criteria. Eliminate low-conviction trades from the pipeline before they hit your screen.

- Pre-Trade Checklist Execution:

- Structural range validated?

- Volume and time aligned?

- Risk-to-reward ≥ 1.8:1?

- Higher timeframe confirms direction?

Final Note: Plans Prevent Panic

Your trading plan is a contract between you and statistical probability. Traders who lack one fall prey to noise, news, and emotion.

Those who execute a robust breakout plan with strict rules become asymmetric risk hunters consistently capturing large moves with minimal downside.

Structure Over Emotion, Always

In breakout trading, hesitation is expensive, but so is impulsive action without structure.

The real edge lies in preparation, not prediction. Mastering the use of a consolidation breakout indicator gives you more than timely entries; it transforms the way you interpret stillness, volatility, and opportunity.

By anchoring your trades in structural zones, aligning entries with volume and volatility logic, and backing each decision with disciplined risk management, you remove noise from your process and emotion from your execution.

You’re not chasing the market anymore. You’re positioning ahead of it with precision, patience, and purpose.

That’s how consistent traders survive the sideways and capitalize on the chaos.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: