Ready to act? Get ACB Breakout Arrows Indicator Now

The Proven 15 Minute Breakout Strategy That Actually Works

Intraday trading is the most popular mode of trading among the community, and catching momentum as early as possible is the key to hitting your targets and calling it a day.

A lot of traders use the 15-minute opening range breakout strategy to profit in these markets.

This strategy revolves around analyzing the high and low price points within the first 15 minutes of market activity and trading the breakout that follows.

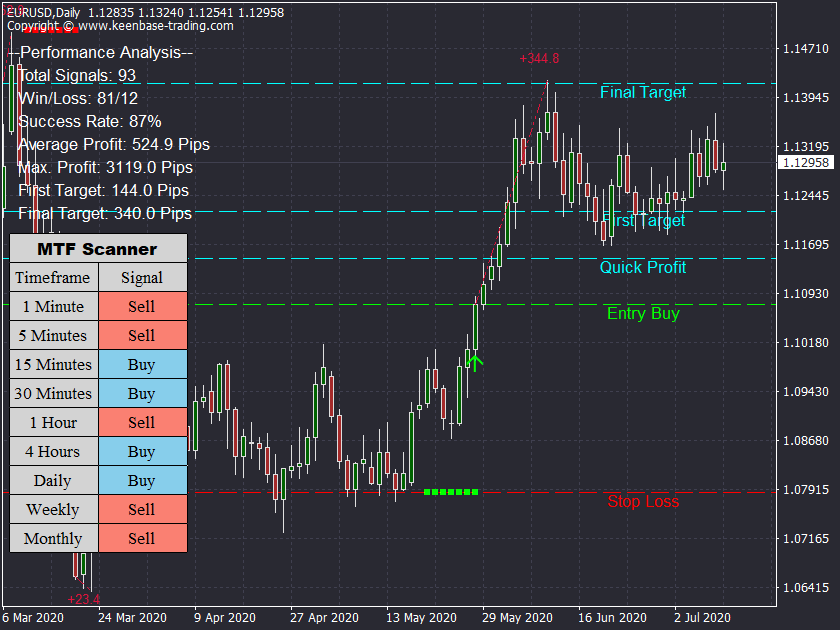

For traders aiming to sharpen their edge, indicators like the ACB Breakout Arrows can be a real deal. This indicator breaks down complex signals and a combination of market settings within its back-end to assist traders in the decision-making process.

It provides clear, real-time arrow signals that highlight potential breakout opportunities during the critical opening range.

It's highly capable of filtering out noise and pinpointing high-probability breakouts, making it an essential companion for anyone serious about mastering the 15-minute orb strategy.

At the core of success in any trading approach lies a firm grasp of technical analysis and risk management principles.

This guide will walk you through these essentials, demonstrating how the 15-minute opening range breakout strategy works to increase your chances of profiting in the market.

Breakout Trading Explained

At its core, any sort of breakout trading is solely about capturing moments when the market participants shift gears and a tug-of-war starts between buyers and sellers to move the price in a certain direction, out of the current trading range.

The 15-minute orb strategy zeroes in on these moments immediately after the market opens, leveraging the fact that early trading often sets the tone for the day.

But what truly distinguishes breakout trading from simply chasing price moves is the understanding that breakouts represent more than just price exceeding a level.

They reflect the total market sentiment beneath.

This conviction stems from traders digesting overnight news, reacting to economic data releases, or adjusting positions in response to global events that unfold before the market bell.

Imagine the opening range as a contained pressure cooker.

Price action within this range reflects hesitation and balance.

When price escapes this containment, it’s akin to releasing built-up steam, often propelling sharp, directional moves.

Experienced breakout traders understand that timing is everything.

Rather than jumping in at the first sign of breakout, the market shows, they wait and watch for the market's heartbeat.

The heartbeat is a mix of market conditions, including volume surge, rapid order flow shifts, and volatility spikes. These cues express the shift in the supply-demand curve that is occurring under the skin of the indicators and candles.

Beyond the technical part, breakout trading is also a psychological game.

It rewards patience to let the range develop and discipline to avoid false starts.

Demanding a keen sense of market sentiment and the humility to accept that not every breakout will lead to a home run.

For traders looking to deepen their mastery, exploring price action in context offers invaluable insights.

Our Price Action Breakout Strategy delves into the art of reading price structure and momentum nuances that bring breakout setups to life, complementing the fast and focused nature of the 15-minute orb approach.

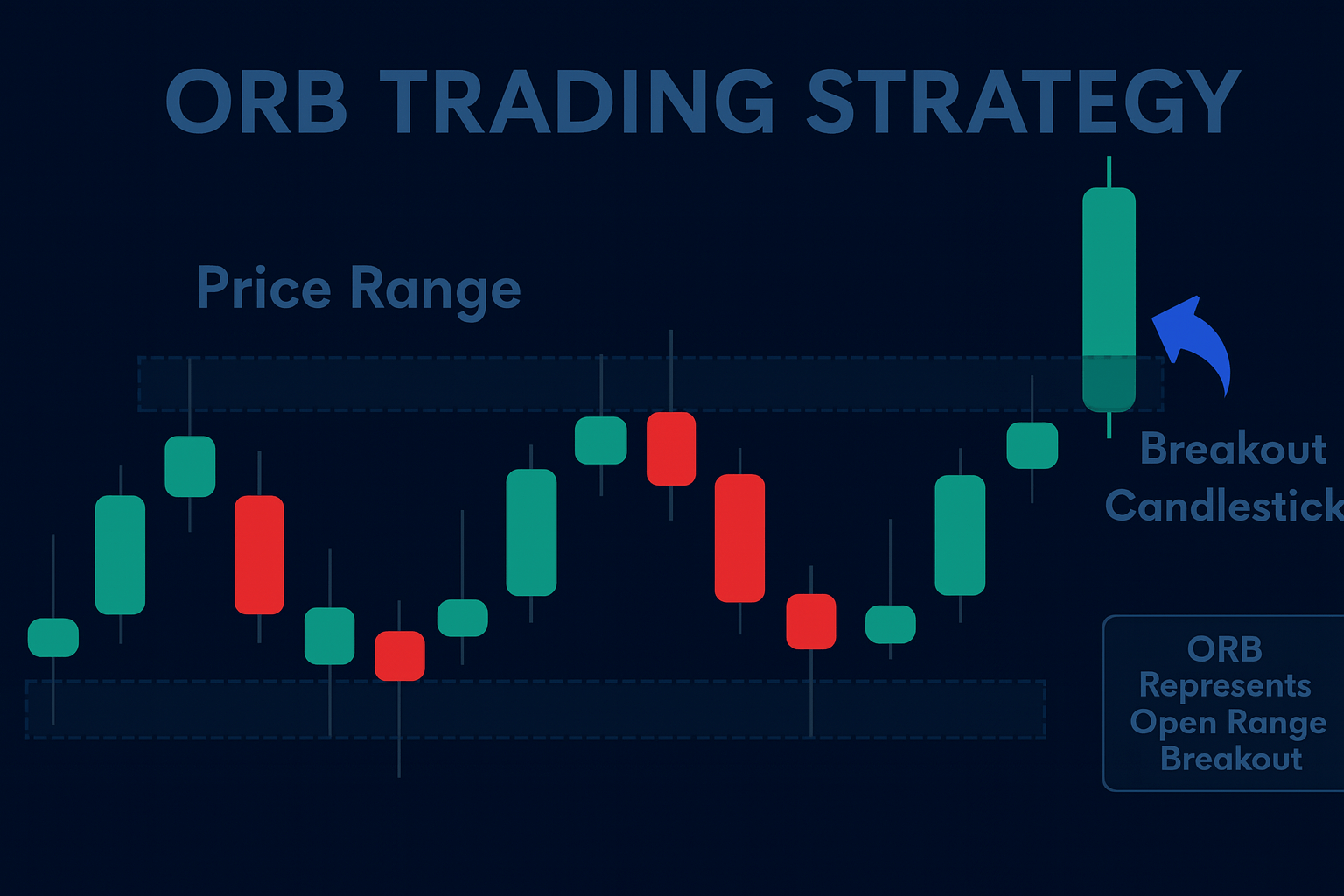

Trading with the ORB Strategy

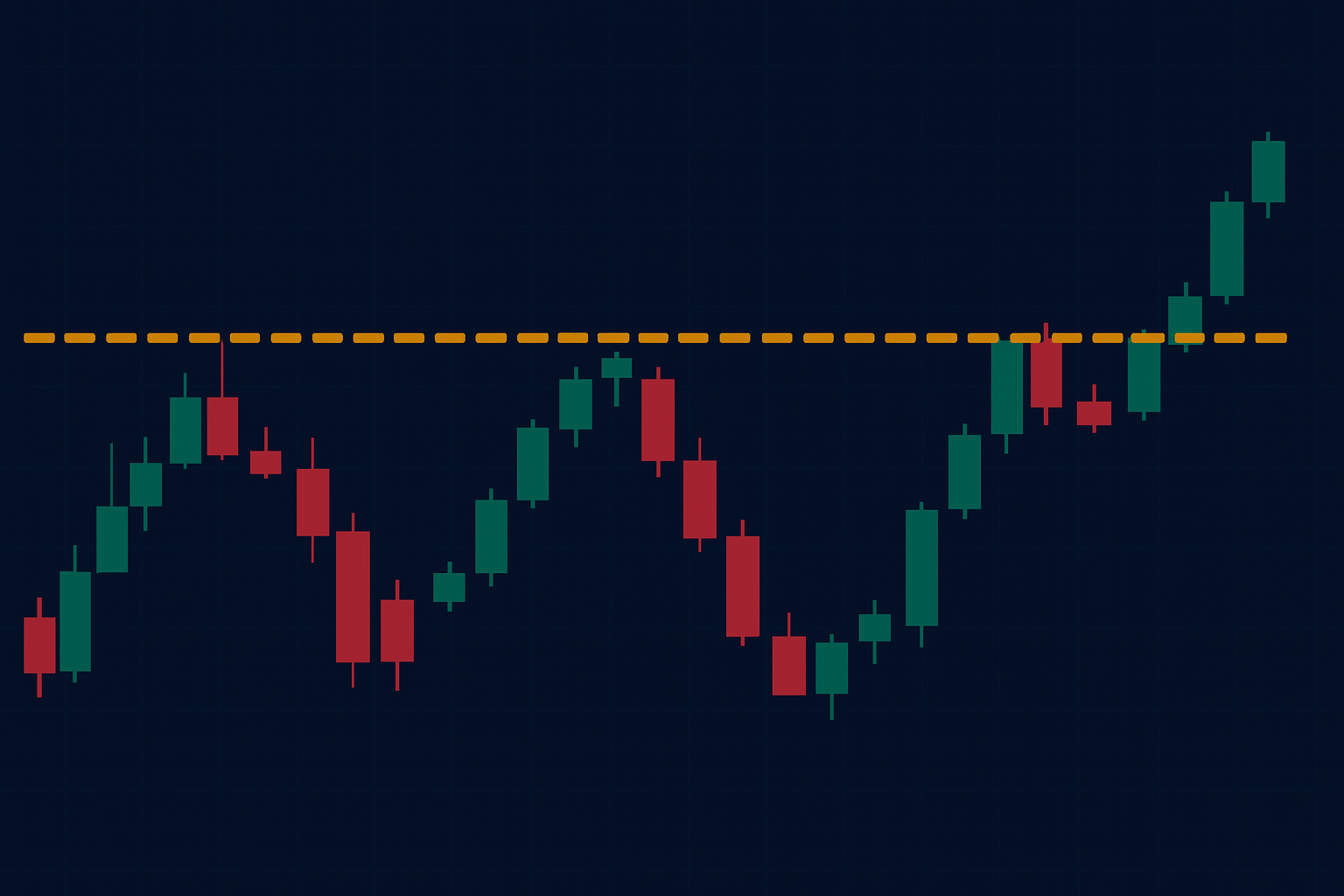

The 15-minute orb strategy might seem simple on the surface, but the book suggests identifying the high and low of the first 15 minutes of trading and highlighting the range. Once the range is highlighted, wait for the breakout.

But trading is not that simple, or else everyone would be doing it.

Beneath this very straightforward approach lies a countless number of tactics that separate an average beginner from George Soros.

First of all, the key that determines the success of the ORB strategy is not the breakout itself, but understanding the context around it.

The opening range reflects the initial balance of power between buyers and sellers after the market opens.

Within this range, traders are absorbing overnight news, positioning for economic reports, and gauging overall sentiment.

What we suggest our traders do:

- Range Width Analysis: Not all opening ranges are created equal. A narrow range often signals indecision or low volatility, which can result in false signals. Conversely, a wide opening range reflects higher volatility and greater market participation, often leading to more reliable breakout moves.

- Volume Dynamics: Volume within the opening range sets the tone. Pay close attention to whether volume spikes occur near the range boundaries, as this can indicate absorption or exhaustion of orders, providing clues on whether a breakout will sustain or reverse. Breakouts supported by a surge in volume, especially compared to the opening range volume, are statistically more likely to continue.

- Multiple Timeframe Confirmation: The ORB focuses on the 15-minute timeframe, but cross-referencing with higher timeframes, such as 30-minute or 1-hour charts, can confirm whether the breakout aligns with broader trends. If the breakout on the 15-minute chart syncs with that on higher timeframes, it is more likely to occur

- Re-entry and Pullback Strategies: Breakouts don’t always run immediately. Sometimes, the price will retest the breakout level. This “pullback” offers another entry opportunity with a clearer stop-loss placement.

- Session and Market Specific Adjustments: Different markets exhibit different opening behaviors. For instance, the U.S. equity markets may have strong volatility in the first 15 minutes, while forex markets, which operate 24 hours, may see varying activity levels depending on session overlap.

Amid all these complexities, traders often seek tools that simplify decision-making without sacrificing sophistication.

This is where the ACB Breakout Arrows Indicator shines.

It cuts through market noise by visually highlighting potential breakout bars in real time, flagging moments where price momentum aligns with volume surges and trend context.

By integrating the ACB tool with your ORB approach, you gain objective, data-driven entry and exit cues that improve timing, reduce false signals, and help manage risk more effectively.

Day Trading Factors to Keep in Mind

A rarely discussed advantage is developing a session-specific sensitivity.

This requires knowing how the Opening range breakout behaves across different sessions, geopolitical events, and economic calendar events.

Let's have an example of this,

At the start of the Ukraine-Russia conflict, combined with a higher-than-expected U.S. CPI report, the New York session opened with significantly increased volatility.

This caused the opening range to be much wider and more unpredictable than usual.

On a normal day, with CPI meeting expectations and no geopolitical tensions, the opening range tends to be tighter and more stable.

Understanding this difference is critical for traders using the 15-minute orb strategy, as wider ranges require more cautious risk management and confirmation to avoid false breakouts.

Pairing the orb strategy with contrarian intraday setups or volume-weighted average price (VWAP) reversion trades can provide a balance, offering alternative pathways when the breakout fades or stalls.

This multi-pronged approach reduces the emotional strain that comes from relying solely on one pattern or strategy.

Managing Risk and Directional Bias

Beyond the conventional wisdom of placing stops inside the opening range, expert traders employ dynamic stop placement techniques that adjust in real-time based on volatility and market context.

For instance, instead of static stop distances, some traders use volatility corridors areas derived from recent Average True Range (ATR) calculations combined with volume profiles to position stops in zones that provide breathing room during sudden spikes but remain tight enough to limit damage.

Understanding directional bias goes deeper than identifying bullish or bearish trends.

It involves interpreting market microstructure cues, such as order flow imbalances and participant behavior shifts within the opening range.

This allows traders to assess whether a breakout is likely to be supported by sustained buying/selling pressure or if it’s vulnerable to quick reversals.

Ultimately, risk management in this strategy is not about book rules but about adaptive discipline being flexible enough to respect market signals while maintaining the courage to act decisively when conditions align.

Analyzing Trading Performance

True mastery in trading comes from relentless self-evaluation and refinement.

To start, most importantly, is to put your ego aside and understand that you are a human who will make a lot of mistakes.

To elevate your 15-minute orb strategy, you must systematically track key performance metrics such as your win rate, average returns per trade, and maximum drawdown.

Are certain market conditions consistently yielding better results?

Do specific entry or exit techniques outperform others?

By asking these questions and rigorously analyzing your trades, you transform raw statistics into actionable insights.

Regularly reviewing your trading journal with a critical eye allows you to identify strengths to build upon and weaknesses to address.

This data-driven feedback loop empowers you to fine-tune your strategy, optimize risk controls, and improve decision-making under pressure.

Conclusion

The 15-minute opening range breakout strategy is a powerful way to catch early momentum, but success comes from understanding the market context, managing risk, and learning from your trades.

The more disciplined the further you will come.

For an extra edge, the ACB Breakout Arrows Indicator offers clear, real-time signals that help cut through the noise and improve your timing. Utilize smart tools in conjunction with your skills to make more informed, confident trades.

Continue to review your performance, stay flexible, and remember that every trade is a step forward on your trading journey.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: