We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

What is Divergence in Forex? A Definitive Guide

Have you been searching for a way to grow your profits in the Forex market? If so, divergence trading could be your key to unlocking those elusive gains.

You can use Divergence as a strategy to benefit from high reward-to-risk trades. Look for differences between currency pair(s) and wait for confirmation.

This blog post will explore the power of divergence trading and uncover some profitable opportunities in today's Forex markets.

Ready to learn more? Discover how diving into Divergence Trading may be just what you need to leverage greater returns from your investment portfolio.

The Concept of Divergence Trading

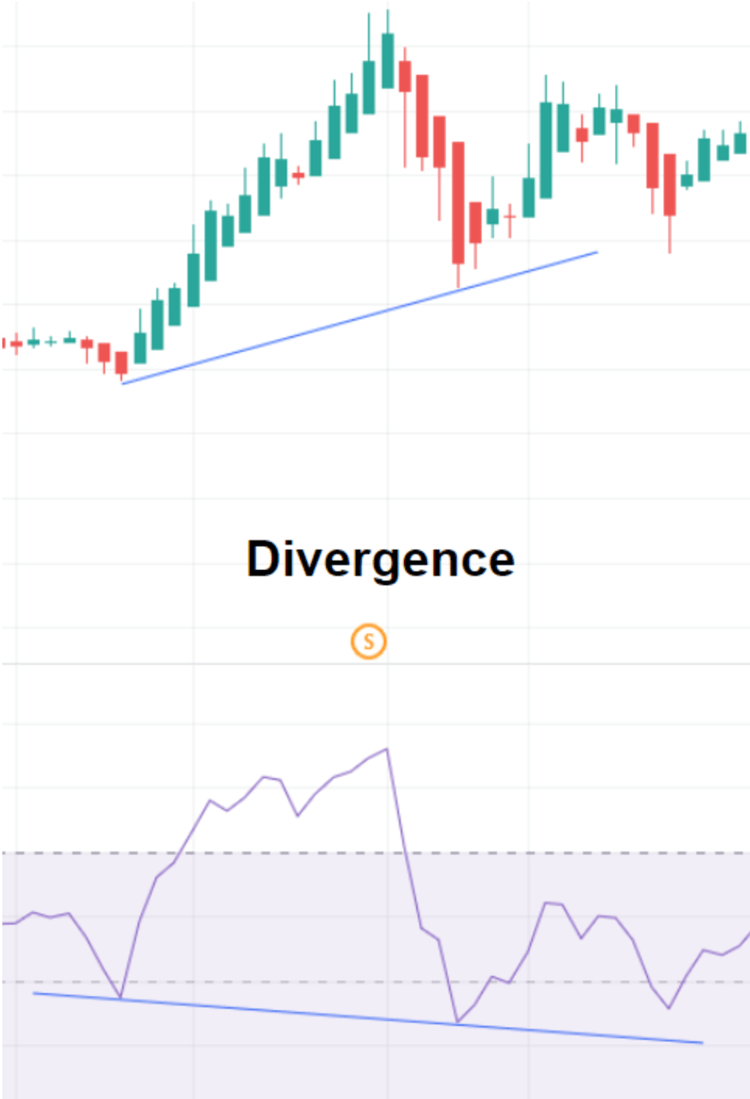

Divergence in Forex is a powerful trading concept that can help identify possible trend reversals. It occurs when the price moves in one direction and the oscillator/indicator moves in the opposite direction, signaling the potential for a shift in momentum.

This technical analysis strategy involves looking for discrepancies between two charts, usually the price chart and an oscillator such as the Relative Strength Index RSI.

Divergence is when the price action makes a new higher high, but the oscillator or indicator fails to do so. This indicates that momentum is waning, and a potential reversal may occur soon.

For example, suppose the price of a currency pair is increasing while its RSI indicator is decreasing. In that case, this could indicate that it has become overbought and potentially ready for correction.

Source: successacademy

Similarly, if the price of a currency pair is decreasing while its MACD indicator is increasing, this could indicate that it has become oversold and ready to move higher.

By watching out for these discrepancies, traders can take advantage of high reward-to-risk trades by entering short positions when the Divergence appears.

Bullish & Bearish Divergence

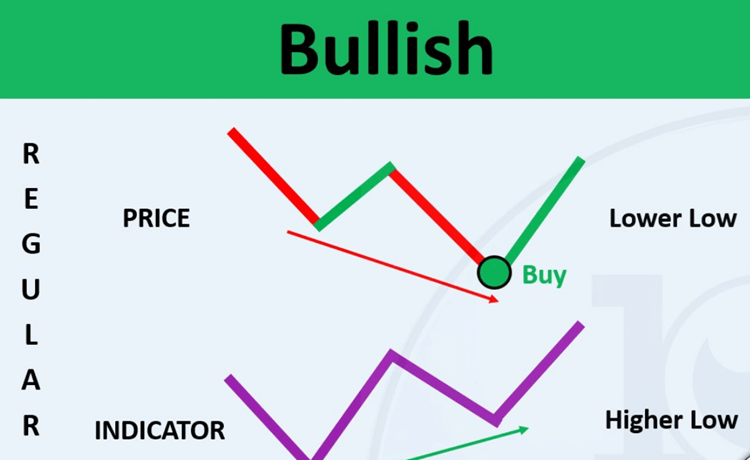

Bullish Divergence

Two main types of Divergence – bullish and bearish – present potential market trade setups.

A bullish divergence signal occurs when the price moves lower while an oscillator or indicator moves higher.

Source: 100-Eyes

It shows a weakening of bearish momentum and suggests a potential reversal to the upside.

To confirm the setup, traders should wait for a close above the previous swing high or look for other confirmation signals, such as a break above a resistance level.

Once confirmed, entry orders can be placed just above the high of the reversal candle, with stops below the low of that candle.

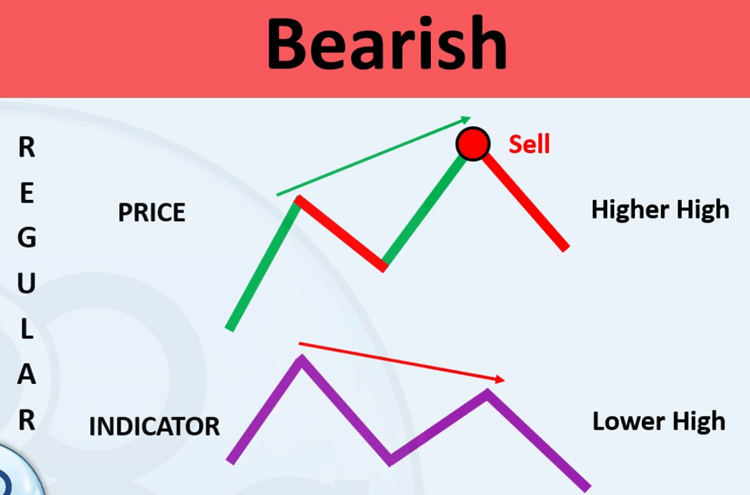

Bearish Divergence

A bearish divergence occurs when prices move higher while an oscillator or indicator moves lower.

This indicates weakening bullish momentum and suggests a potential reversal to the downside.

Source: 100-Eyes

To confirm this setup, traders should wait for a close below prior swing lows or look for other confirmation signals, such as a break below support levels, before entering any trades.

Like in bullish divergence trades, stops should be set just above the high of the reversal candle.

Regular and Hidden Divergence

Regular Divergence (regular bullish Divergence or regular bearish Divergence) is an indicator of possible price reversals and is recognized by comparing the momentum of an asset to its historical trajectory.

If the asset's momentum rises, then regular Divergence could signal a potential uptrend in the future.

On the other hand, hidden Divergence looks for discrepancies between market movement and previous market activity.

Hidden Divergence (hidden bullish Divergence or hidden bearish Divergence) may indicate that a reversal is about to happen against a current trend or that a new trend continues to form soon.

Therefore, traders can use regular and hidden Divergence as powerful tools to gain insight into upcoming price movements and take advantage of short-term profits or long-term investments.

Exploring the Benefits of Divergence Trading

You can use Divergence to capitalize on potential market opportunities more effectively. Below are a few of the benefits of Divergence.

Divergence Trading Provides an Edge

You can gain insight into the forces driving current and future prices by using technical indicators to recognize discrepancies between pricing activity and the underlying trend.

This information can be invaluable in helping you identify entry and exit points with the highest probability of yielding profits.

Identifying Overbought and Oversold Areas

Divergence trading allows you to quickly identify overbought and oversold conditions so they can take advantage of these opportunities with minimal risk.

By comparing recent chart patterns with more historical data, it is possible to determine whether prices are currently above or below what would be considered normal levels, allowing you to enter or exit positions accordingly.

It enables You To Remain Flexible.

When trading divergence in Forex, you can be flexible while applying your strategies by incorporating different forms of analysis into your decision-making process.

By combining fundamental analysis with technical analysis, you can identify potential opportunities from multiple angles to make informed decisions about when to buy or sell a particular asset.

Tips To Implement a Successful Divergence Trading Strategy

- Always wait for confirmation before entering any trade. The best way to confirm a divergence is to wait for the price to break through its previous low or high point.

- Always use stop losses to minimize your risk exposure.

- Combine Divergence with other forms of analysis, such as trendlines and chart patterns, to make more informed decisions

- Do your research before you start trading. Ensure you understand how different indicators work and which will be most beneficial for your situation.

- Also, look at the economic data available from different sources to know when to expect specific price movements.

- Please keep track of all your trades (which you took using divergence techniques) by logging them in a trading journal or spreadsheet.

Final Thoughts On What Is Divergence in Forex?

As a Forex trader, you can use divergence trading as an effective way to increase your returns on investment.

This strategy reduces risk by allowing investors to enter or exit positions at optimal times rather than trying to anticipate market movements that may not happen at all.

Additionally, because divergence trading is based on spotting minor anomalies in market movements rather than attempting to predict significant shifts in prices, it can provide more consistent gains over time with less risk involved than many other forms of investing.

Although it takes some practice to master divergence trading techniques, they are essential tools for any serious investor looking to unlock greater returns from their investments.

Research and careful consideration of market trends can help investors make more money with lower risk than traditional investing.

Divergence trading could be worth exploring if you're looking for a way to boost your profits in the Forex market.

We hope you enjoyed reading the article and found it informative. For more exciting trading education, follow our Blog. Happy trading.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: