We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Master Forex Funded Accounts with Smart Risk Management

Prop firms feel like the dream; they offer traders access to more than $200k in funding with an 80-90% profit split, and you can have access to that by achieving a certain profit target within an evaluation process. Sounds simple, right?

Well, no; in fact, more than 85% of traders fail the challenge in Phase 1 and Phase 2 due to poor risk management. Here comes automated risk management tools, such as KT Equity Protector EA, to increase the odds of your success in getting funded.

This tool will help you master the essential strategies that separate successfully funded traders from the rest.

Understanding Prop Firm Trading Programs

Prop firms or proprietary trading firms describe the activities where traders engage in trading activities using the capital of a prop firm or financial institution rather than their own capital. Trading activities may include shares, derivatives (CFDs, Futures, Options), commodities, and crypto.

While there are platforms and businesses today that only specialize in funding retail traders, it traces its roots back to Wall Street 1980s with the deregulation of the global financial markets, specifically in the United States following the repeal of the Glass Steagall Act restrictions, the door was opened for banks to engage in riskier activities.

What Forex Prop Firms Offer

The value proposition is compelling for serious Forex traders. Prop firms provide access to professional-grade trading platforms with institutional-level spreads and low commissions that individual retail traders rarely enjoy.

Most importantly, they offer attractive profit split arrangements where successful traders typically keep 80-90% of their generated profits while the firm retains the remainder as compensation for providing the capital and infrastructure.

The value proposition is attractive for serious and beginner Forex traders seeking to scale without a massive personal investment. For as little as $99-$599, traders can gain access to accounts worth $10,000 to $400,000 or more – a leverage opportunity that would be impossible through traditional means.

Beyond the capital access, prop firms provide professional-grade trading platforms with institutional-level spreads and low commissions that individual retail traders rarely enjoy.

These firms often partner with top-tier liquidity providers, ensuring traders benefit from faster execution speeds and tighter spreads across major currency pairs.

This model transforms trading from a capital-intensive endeavor into a skill-based opportunity, where a trader's ability to generate consistent profits matters more than their account size.

The Funded Trader Journey

One thing no one has told you about is that Prop firms operate like insurance companies; they profit primarily from the 85-90% of traders who fail challenges by exceeding drawdown limits or missing profit targets.

When traders violate risk parameters, they forfeit their challenge fees, creating the revenue stream that funds the successful minority. This business model explains why proper risk management tools are essential - the firms literally profit when traders make risk management mistakes.

Essential Risk Management for Funded Accounts

Knowing that prop firms make money from traders failing, mastering risk management and equity protection becomes a weapon for success. The high failure rate is not because of poor market analysis; instead, it's almost entirely attributed to risk management violations and emotional trading decisions.

Critical Risk Management Strategies

To succeed, you must treat every trade as a potential account killer. Position size must never exceed 1-2% risk/ trade, to make sure that no trade would put you on the margin.

Strict adherence to daily drawdown limits is non-negotiable – even approaching 3-4% on a 5% limit puts you in dangerous territory.

The Equity Stop Loss EA: Your Automated Account Guardian

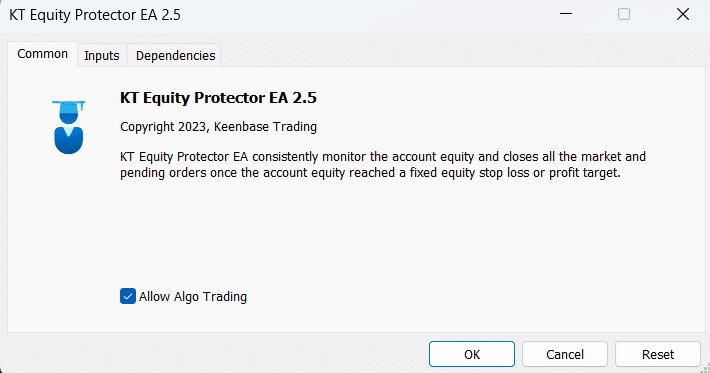

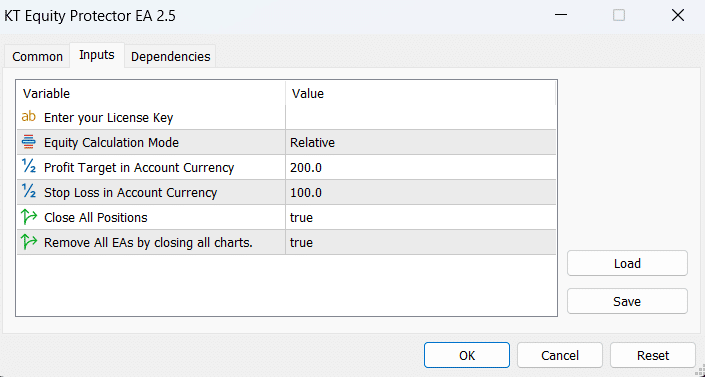

This is where the Equity Stop Loss EA becomes invaluable for funded traders. The EA automatically monitors daily drawdown in real-time, closing all positions when the firm's risk limits are approached or come a bit near, removing the emotional element that destroys most funded accounts and your mental health as well.

Specifically designed for prop firm requirements, it acts as an automated safety net that prevents the costly mistakes that generate revenue for these firms.

With automated protection active and watching you, the ability to trade with confidence, knowing you'll never violate daily drawdown rules increases, allowing you to focus entirely on executing your trading strategy rather than constantly monitoring risk metrics manually.

Your Path to Funded Trading Success

The main differentiator between the 10% who succeed and the 90% who fail isn't trading skill; it's disciplined risk management. As prop firms are promised to benefit from trader mistakes, the KT Equity Protector EA guards you and flips the odds in your favour by automating the risk controls that most traders neglect.

Don't become another statistic. Join the elite 10% of successfully funded traders with proper automated protection.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: