We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

How to use Gann Fan Indicator Like A Professional FX Trader

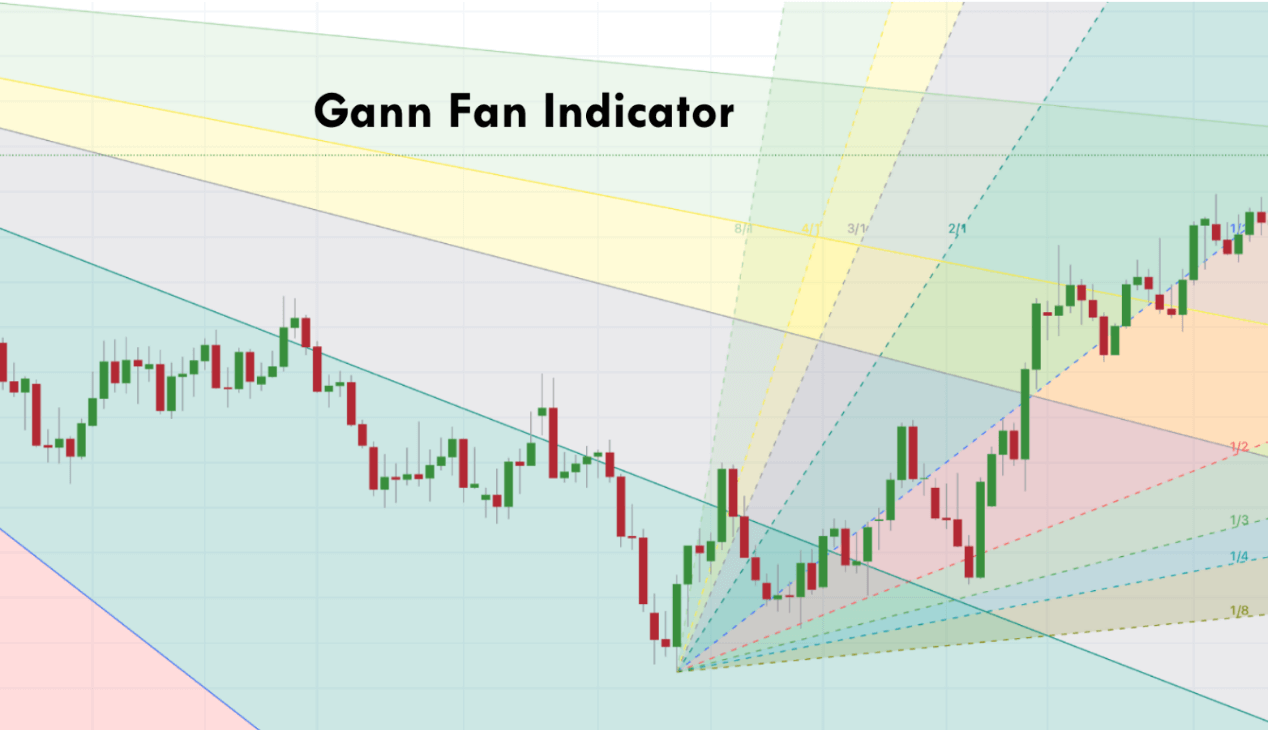

If you're a Forex trader, you probably heard of the Gann Fan indicator. Named after legendary trader WD Gann, the Gann Fan is a popular tool for identifying potential support and resistance levels.

In this blog post, let’s learn how to use Gann Fan indicator like a professional Forex trader. We'll cover everything from the indicator and how it works to how to use it in your trading.

So whether you're new to using this tool or want to brush up on your knowledge, read on!

What is the Gann Fan Indicator

Gann Fan is a technical analysis tool popular among Forex traders for predicting trend reversals.

Developed by WD Gann in the early 20th century, this technical indicator plots diagonal angled lines to help investors detect support and resistance angles from previous price swings based on time and price.

They are created using one or multiple Gann fan angles. These angles range from 8 to 88 degrees and form fan shapes across an asset's price chart.

This makes it easier to gauge past momentum changes and establish potential support and resistance lines.

What makes it worthwhile is its ability to serve as an essential signal towards confirming when an uptrend or downtrend has been broken and allowing traders to identify emerging trends in the markets quickly.

With its straightforward plotting ability and flexibility of use, the Gann Fan remains a time-tested indicator used frequently in modern trading markets to gauge the future price unit of an asset.

How Does Gann Fan Work

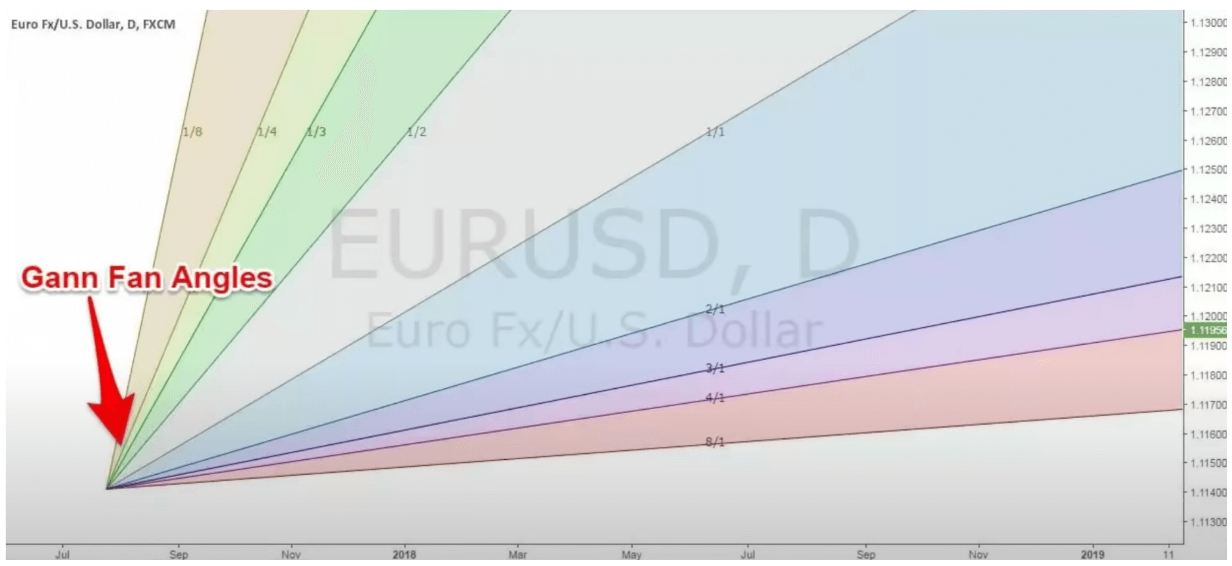

Investors and traders use Gann Fan to identify support, resistance, and trendlines within the Forex markets.

It works by drawing nine diagonal lines related to the specific asset's price on the chart rather than an arbitrary unit of the time period.

The fan lines can be based on time measures or any other key starting point, such as points at which new highs or lows have been reached.

Although Gann Fan Indicator can be used within any timeframe, it works best when using daily, weekly, or monthly candlestick charts.

The unique angles provide more accurate and reliable information about longer-term trends.

Used with caution, this powerful indicator is invaluable for any trader seeking to identify meaningful buy and sell signals within their preferred market!

How to Use Gann Fan Indicator in Your Trading

By analyzing this indicator's plotted-out angles from past highs and lows, you can accurately estimate likely resistance points or favorable entry and exit points.

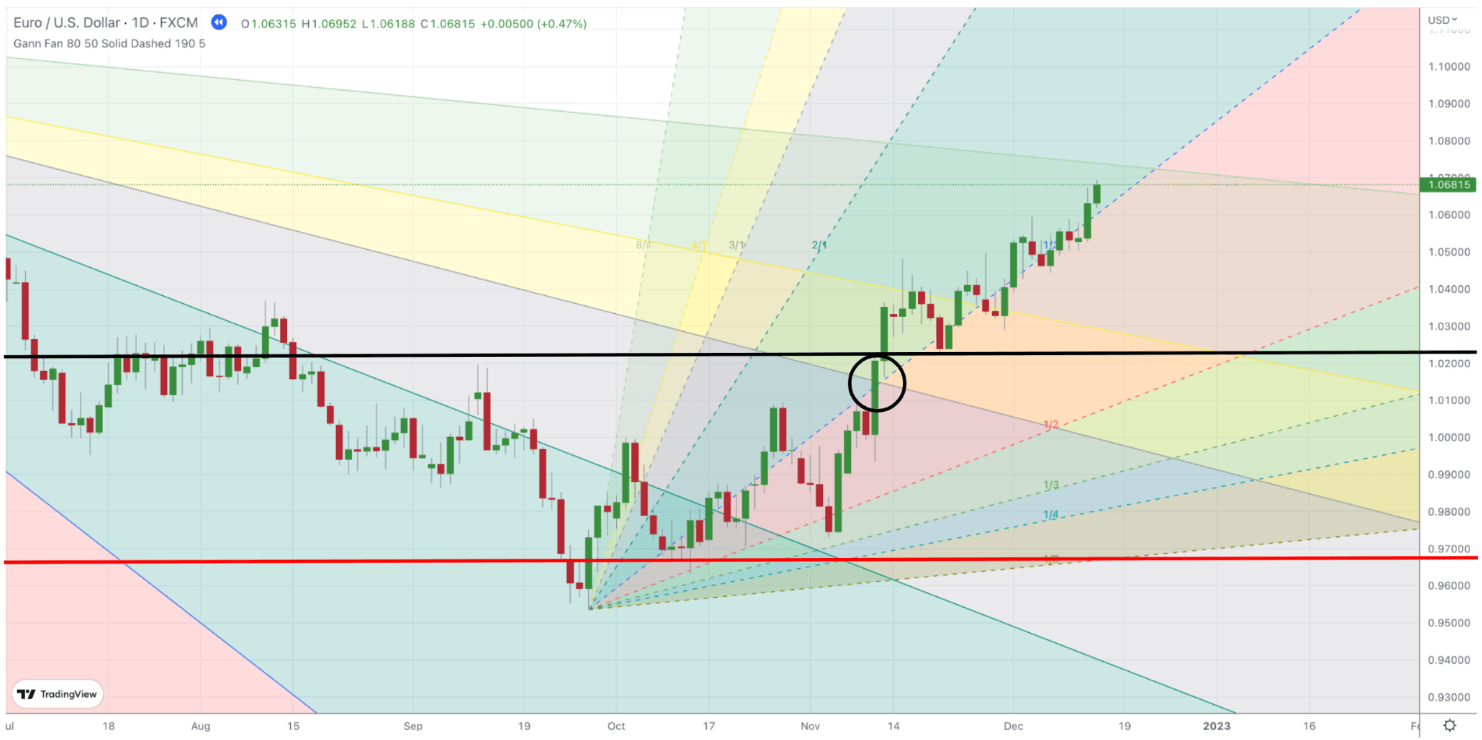

Consider the below example for the Gann Fan trading strategy.

We have applied the Gann Fan Indicator to the EUR/USD daily price chart.

The crux of trading the market using this indicator is to look out for the unit of price to go above the 45-degree Gann angle line - which is the 1/1 line of the Gann Fan Indicator.

In the below chart, the price broke above the 1/1 line (45 degrees line) at the encircled region.

We can also see the solid bullish candle closing above the 45-degree angle line.

We entered the market as soon as the confirmation candle was formed.

Stop loss on this trade is represented by the red line in the above chart. We have placed the SL order just below the structure formation.

You can see how the prices moved to the north right after we entered the market.

It's beneficial for assessing the downside potential of a trend that seems to be running out of steam.

However, it must be used cautiously, as trend lines don't always line up perfectly due to market volatility shifts.

That's why it pays to apply some basic technical analysis principles, such as support and resistance levels, and identify specific patterns when using this indicator.

Pros

- Gann Fan Indicator is made up of simple trendlines and helps determine the potential for a reversal in the trend.

- Fan lines provide reliable indications of when it might be a good idea to buy or sell Forex pairs.

- You can easily find accurate entry and exit points on your trades.

- Gann Fan indicator is also very reliable; while trends can often be hard to predict, this indicator provides accurate predictions based on how it’s configured.

- Enterprising traders everywhere have begun to take advantage of the flexibility and accuracy provided by this tool, helping them stay one step ahead in volatile markets.

Conclusion

The Gann Fan Indicator is an excellent tool for any trader to have in their arsenal. It can be used in any time frame and provide valuable insights into market direction.

While there are some drawbacks to using the Gann Fan Indicator, these can be mitigated with proper understanding and implementation of the indicator.

First, draw a Gann Fan indicator line on demo accounts to master the above-mentioned strategy.

Following the tips in this article will help you get the most out of the Gann Fan Indicator and give you an edge in your trading. All the best!

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: