We hope you enjoy reading this blog post.

Become a Pro Trader by using our fine-tuned Indicators and Expert Advisors.

Best Breakout Indicator for Forex – How to Catch Big Moves in Forex Market

Breakout trading remains one of the most powerful strategies in a trader's arsenal, capable of delivering exceptional profits when executed correctly. However, without the right tools and indicators, even experienced traders can struggle to distinguish between genuine breakouts and costly false signals.

In this guide, we'll explore everything you need to know about breakout trading in the forex market, uncover the most effective indicators for identifying high-probability setups, and reveal why the ACB Breakout Arrows Indicator stands as the ultimate solution for traders seeking consistent breakout success.

What is Breakout Trading?

Breakout trading is a strategy that involves entering positions when a currency pair's price breaks through established support or resistance levels. These breakouts signal either the start of new trends or the continuation of existing market movements.

The fundamental principle is simple and powerful: when price breaks out of a consolidation phase with increased market volatility and trading volume, it typically continues in that direction with substantial momentum.

This creates ideal entry points for traders who can accurately identify these signals before major price movements develop.

Why does breakout trading work so effectively in forex markets? The answer lies in market psychology and sentimentality. When price breaks through significant levels that previously constrained movement, it often triggers a cascade of new orders as traders react to the emerging trend.

This influx of trading activity fuels further price movement in the breakout direction.

Understanding Forex Indicators for Breakout Detection

Forex indicators serve as the analytical foundation for identifying potential breakouts. These mathematical calculations applied to price data help traders recognize patterns and signals that might not be immediately visible on price charts.

For breakout trading specifically, the best forex indicators provide:

- Early detection of potential breakout conditions.

- Confirmation of breakout strength and momentum.

- Filtering mechanisms to eliminate false breakouts.

- Guidance for optimal entry and exit points.

While numerous technical indicators exist, only a select few excel at identifying high-probability breakout opportunities while minimizing exposure to false signals.

Top Forex Indicators for Breakout Trading

Relative Strength Index (RSI)

The Relative Strength Index (RSI) measures the magnitude and speed of recent price changes to evaluate overbought or oversold conditions in the market. For breakout traders, RSI provides valuable confirmation when price breaks through significant levels.

When price breaks through resistance with RSI reading above 50 and rising, it often signals a strong bullish breakout. Conversely, breaks below support with RSI under 50 and falling can confirm bearish breakouts.

This momentum indicator helps filter out potential false breakouts, making it essential for any breakout trading strategy.

Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that reveals changes in the strength, direction, and duration of a trend. For breakout traders, MACD provides crucial confirmation signals:

- MACD crossing above its signal line during a potential bullish breakout adds significant confirmation.

- MACD histogram expanding after a breakout suggests strong momentum in the breakout direction.

- Divergence between MACD and price can warn of weakening momentum and potential failed breakouts.

When combined with price action analysis, MACD creates a powerful system for validating breakout signals and avoiding costly false breakouts. Keenbase Trading offers a specialized KT MTF MACD indicator that displays MACD signals across multiple timeframes.

Average True Range (ATR)

The Average True Range (ATR) measures market volatility, making it an invaluable technical analysis tool for breakout traders. During legitimate breakouts, ATR typically expands, confirming increased market volatility that supports the breakout's momentum.

ATR also helps traders:

- Set appropriate stop-loss levels based on current volatility.

- Determine realistic profit targets for breakout trades.

- Identify low-volatility periods that often precede significant breakouts.

As a volatility indicator, ATR doesn't predict direction but instead reveals the intensity of price movements. It is crucial information for breakout traders managing risk across multiple currency pairs. Keenbase offers a specialized Forex Volatility Indicator to help traders measure market conditions.

Bollinger Bands

Bollinger Bands adapt to market volatility, making them particularly effective for identifying potential breakout conditions. The bands create a dynamic envelope around price, with breakouts beyond these bands often signaling significant movements.

After periods of low volatility (when the bands contract), breakouts tend to be more powerful. A "Bollinger Band squeeze" creates ideal conditions for breakout traders looking for high-probability setups across multiple timeframes.

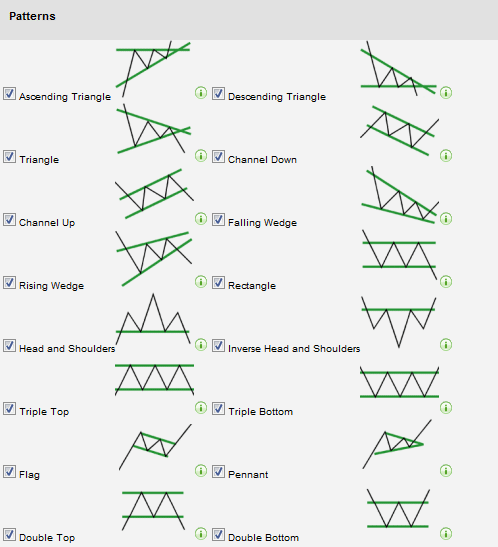

Identifying High-Probability Breakout Patterns

Successful breakout trading requires recognizing specific chart patterns that frequently precede significant price movements:

Rectangle Patterns

Rectangle patterns form when price moves sideways between parallel support and resistance levels, creating a trading range. A breakout above resistance or below support often signals the continuation of the previous trend.

Volume typically confirms these breakouts, with higher trading volume in the breakout direction increasing reliability.

Triangle Patterns

Triangle patterns (symmetrical, ascending, or descending) represent periods of consolidation before significant price movements. As price compresses within the triangle, market volatility decreases, setting the stage for a powerful breakout.

When price breaks through either boundary of the triangle, it frequently moves in that direction with strong momentum.

Keenbase Trading offers specialized tool for pattern recognition, including the KT Pennant Pattern indicator that helps identify these high-probability setups.

False Breakouts: The Greatest Challenge

Not all apparent breakouts lead to sustained price movements. False breakouts occur when price temporarily breaks through support or resistance before reversing direction. These "fakeouts" can trap unwary traders and lead to significant losses.

The challenge of distinguishing between genuine breakouts and false signals represents one of the greatest hurdles that breakout traders face. This is precisely why having a reliable breakout indicator is essential for consistent success.

ACB Breakout Arrows: The Ultimate Breakout Indicator

While traditional indicators provide valuable information, the ACB Breakout Arrows Indicator from Keenbase Trading represents a revolutionary approach to breakout trading.

This powerful indicator has been specifically designed to identify high-probability breakout opportunities while minimizing the risk of false breakouts, saving retail traders from becoming an easy dinner for big whales and market makers.

What Sets ACB Breakout Arrows Apart

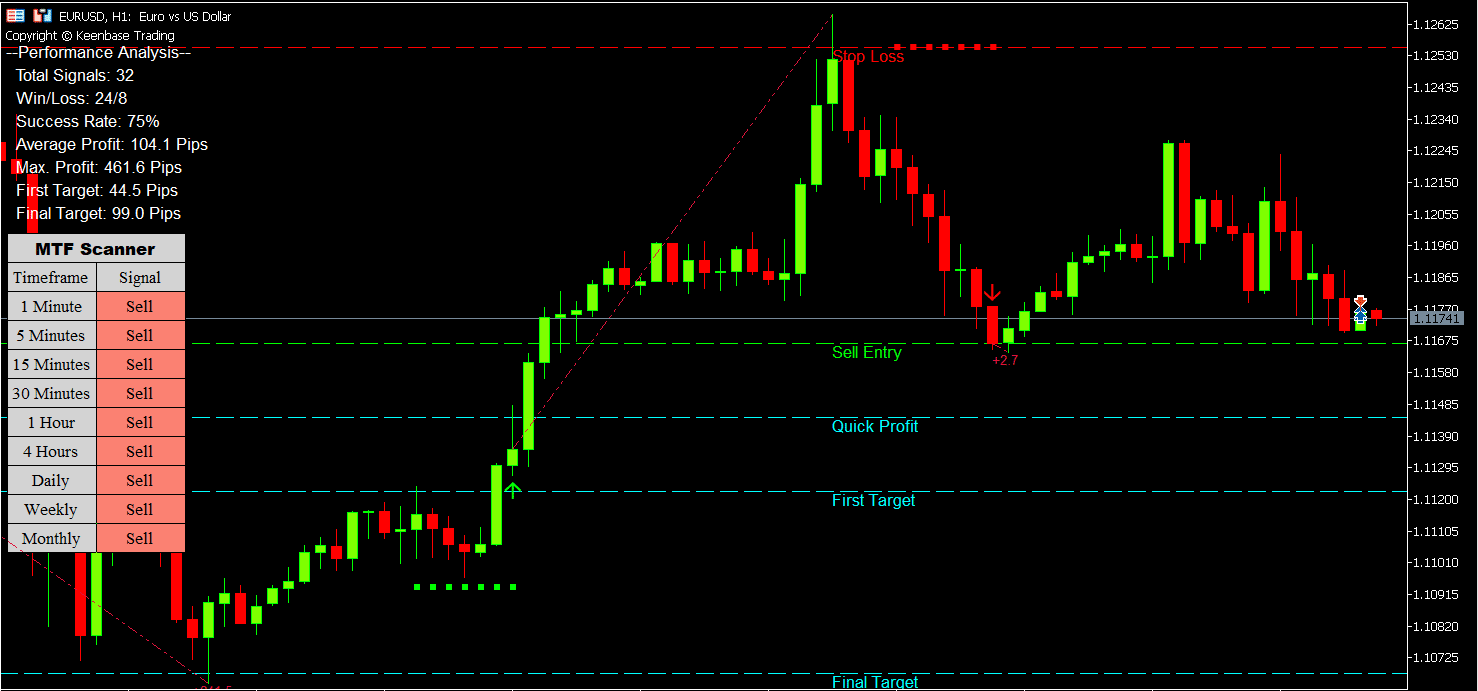

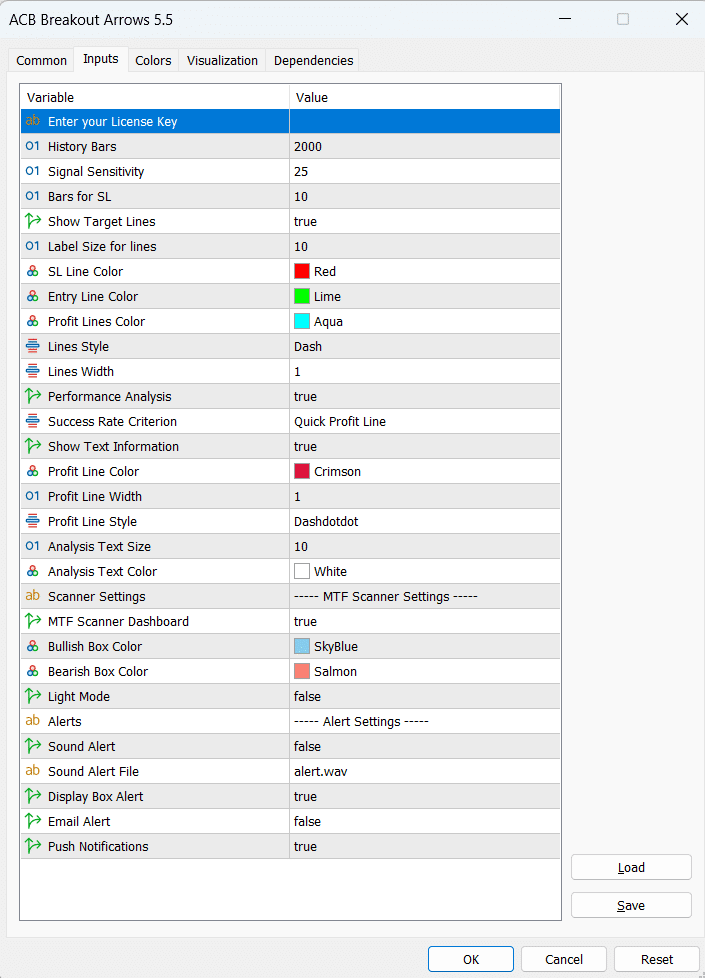

The ACB Breakout Arrows indicator utilizes a sophisticated algorithm to scan price action and detect a special breakout pattern that often precedes major market moves.

Unlike basic indicators that rely on historical data alone, ACB Breakout Arrows employs dynamic analysis to identify settling momentum in one direction, providing traders with accurate entry signals right before significant price movements.

This approach to breakout detection addresses the fundamental challenge that breakout traders face: distinguishing between genuine breakouts and false signals.

By identifying the specific market conditions that precede successful breakouts, the ACB indicator gives traders a significant edge in today's competitive forex market.

Key Advantages of the ACB Breakout Arrows Indicator

- Precise Entry Points: The indicator marks exact entry points with clear arrow signals, eliminating guesswork from your trading decisions.

- Built-in Risk Management: Each signal comes with recommended stop-loss and take-profit levels, ensuring proper risk management in Forex on every trade.

- Versatile Application: Works effectively across multiple timeframes and currency pairs, making it suitable for day traders, swing traders, and scalpers alike.

- Quick Profit Line: Features a special level to facilitate breakeven moves or scalping targets, allowing for flexible trade management.

- Performance Tracking: Includes built-in analytics to track win/loss ratios, success rates, and average profits, helping you refine your trading approach and maximize equity growth.

- Non-Repainting Signals: Unlike many other indicators, ACB Breakout Arrows never repaints, ensuring reliable signals for both backtesting and live trading.

- Support and Resistance Integration: Functions as a breakout box indicator by incorporating support and resistance zones to detect significant breakouts.

Real Trader Success with ACB Breakout Arrows

Traders using the ACB Breakout Arrows indicator consistently report higher win rates and improved trading confidence.

As trader Charles Wanjau notes, "The ACB indicator is confident in giving accurate signals that it has helped me become a more successful trader. I'm making significant steady profits with minimal risks and without being glued to my screen 24/7."

Avoiding False Breakouts: Essential Strategies

Even with the best forex indicator, false breakouts remain a challenge for traders. Here are effective strategies to minimize their impact:

Wait for Confirmation

Rather than entering at the first sign of a breakout, wait for additional confirmation such as increased volume of a successful retest of the broken level. This patience can significantly reduce the number of false breakouts you trade.

Use Multiple Timeframe Analysis

Confirm breakouts across multiple timeframes to increase confidence in your trading decisions. A breakout visible on both hourly and daily charts, for example, has a higher probability of success than one appearing on a single timeframe.

Keenbase Trading offers a Forex Session Indicator to help identify the best trading sessions for different pairs.

Combine Complementary Indicators

The ACB Breakout Arrows Indicator works exceptionally well when combined with other technical indicators for additional confirmation.

This multi-indicator approach creates a more robust trading system. For traders looking to enhance their analysis, Keenbase Trading also offers the ACB Breakout Arrows Scanner that tracks signals across all symbols and timeframes.

Consider Market Conditions

Be aware of important economic releases, market sentiment, and overall trend direction when evaluating potential breakouts. The London Breakout Strategy can be particularly effective when combined with the ACB Breakout Arrows Indicator.

Essential Tips for Breakout Traders

To maximize your success with breakout trading, incorporate these proven practices:

- Practice Patience: Wait for clear breakout signals rather than anticipating breakouts that haven't yet materialized. The best trades often come from waiting for optimal conditions.

- Manage Position Size: Limit risk to a small percentage of your trading capital on each trade, regardless of how confident you feel about a particular breakout setup. Proper position sizing in Forex is essential for long-term success.

- Plan Your Exits: Determine stop-loss and take-profit levels before entering trades, and consider using trailing stops to maximize profits on strong breakouts with extended price movements. Understanding stop out levels is crucial for risk management.

- Keep a Trading Journal: Track your breakout trades, noting successful patterns and market conditions to refine your strategy over time. This analytical approach transforms experience into expertise.

- Use the Right Tools: Take advantage of specialized tools like the ACB Breakout Arrows and the ACB Trade Filter to enhance your trading performance.

Conclusion: Transform Your Breakout Trading

Breakout trading offers exceptional profit potential for forex traders who can accurately identify and capitalize on these powerful market movements. While traditional indicators provide valuable analysis, the ACB Breakout Arrows Indicator represents a significant advancement in breakout detection technology.

By combining the precision of ACB Breakout Arrows with sound trading principles and risk management, you can transform your trading results while reducing screen time and emotional stress.

This strategic advantage is particularly valuable in today's volatile forex market, where capturing significant price movements early can generate substantial profits.

Whether you're a novice trader developing your first breakout trading strategy or an experienced professional enhancing your existing approach, ACB Breakout Arrows provides the edge needed to excel in competitive forex trading.

Ready to elevate your breakout trading? Explore the ACB Breakout Arrows Indicator today and experience the difference that precision entry signals can make in your trading performance.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: