Ready to act? Get ACB Breakout Arrows Indicator Now

Breakout Retest Indicator MT4/MT5 for Smarter Trade Entries

In trading, the breakout gets the headlines, but the retest gets the profits.

Every chart is a battlefield. The breakout candle? It’s just the opening shot.

The real war is fought at the retest, where the market decides whether that breakout was true or a trap. And if you're serious about precision entries, you already know: reaction isn't enough. You need structure, confirmation, and a plan.

A breakout retest indicator quietly observes, tracks the return, and confirms intent.

When everything lines up, it delivers. For the strategic trader, this is your second-chance entry… with first-class risk-to-reward.

Why Retest Entries Cut Through Market Noise

Breakouts are noisy. They attract FOMO entries and stop-run liquidity grabs.

But retests?

Those are clean. Mechanical. Predictable if you know where to look.

When the price breaks the structure, smart money often lets it breathe, then brings it back to the scene. That retest does three things:

- Confirms structure: Former resistance becomes support, or vice versa.

- Cleans the order book: Traps emotional traders, clears cheap liquidity.

- Signals intention: If the level holds enough, momentum takes over, and the rest is history.

This is where institutional algorithms reload not on the breakout, but on the validation. As a trader, your job isn’t to predict the break. Your job is to capitalize on the confirmation at the end of the day.

The markets are not a place to guess and play random games.

How a Breakout Retest Indicator Actually Works

A well-crafted breakout retest indicator goes far beyond just reacting to a breakout candle; it interprets structure, sequence, and timing with precision.

First, it identifies clean range breaks by recognizing when price decisively exits a well-formed structure such as a box range, wedge, or flag.

These breaks signal potential shifts in market control. Once a breakout is detected, the indicator doesn't assume continuation blindly; instead, it intelligently maps the origin of the move to the point where institutional buyers or sellers took control and marks that zone as a key retest level.

From there, the real edge emerges. The indicator patiently tracks whether the price returns to this zone within a valid timeframe. If it does, it looks for price behavior that confirms the level is holding, think of rejection wicks, engulfing candles, or narrow-bodied pauses that signify exhaustion.

To add depth, some advanced indicators integrate volume and momentum filters. By incorporating tools like RSI, Money Flow Index (MFI), or On-Balance Volume (OBV), the indicator verifies whether smart money is reinforcing the retest, adding a layer of behavioral insight that pure price action misses.

And for traders with specific styles, whether scalping short pullbacks or hunting deep swing entries, many retest indicators offer adjustable sensitivity.

This allows you to fine-tune how strict the retest criteria should be, aligning the signal logic with your personal risk appetite and timeframe.

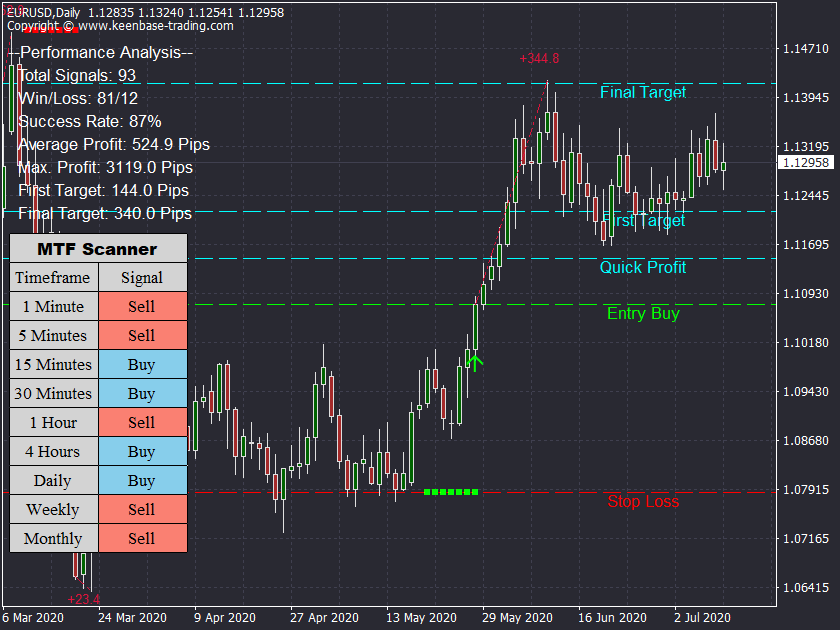

ACB Breakout Arrows: Quietly Built for Retest Traders

You don’t need flashy arrows or repainting indicators. You need precision logic. And that’s where the ACB Breakout Arrows Indicator quietly earns its keep.

It doesn’t explicitly label “retests,” but it won’t fire until all conditions align. That includes:

- The full candle body closes (no wick-fakes).

- Volume-based strength filters.

- Smart SL/TP levels are grounded in structure.

- Optional Quick Profit Line for scalpers.

- Real-time alerts across hundreds of charts, all from one dashboard.

The result? You don’t chase price. You track conviction.

Pro tip: Pair ACB with your own horizontal support/resistance zones. It’s a deadly combination, especially when you let the retest come to you.

Breakout-Retest Entry Framework: Professional Execution Flow

This is how disciplined, risk-adjusted entries are built by funded traders, desk professionals, and technical specialists who don’t flinch at volatility.

Step 1: Confirm the Break and DON’T Chase the First Candle

The first breakout candle isn’t your entry; it’s your signal to start stalking.

Wait for a full-bodied candle close that clearly displaces structure above resistance or below support. Wick breaks, no matter how dramatic, are nothing more than emotional noise and liquidity bait.

Your focus: Clean break. Closed conviction. Not excitement.

Step 2: Let the Market Return, Don’t Jump the Gun

Breakout retests don’t always happen immediately. Give the chart 2–6 candles. Patience here is the trade.

As price retraces, monitor indicators like:

- RSI: Is it cooling but still above 50? That's a healthy pullback.

- MFI: Is money flow neutral or rising on the pullback? That’s accumulation, not exit.

- BB or Keltner Channels: Are they compressing again? A second expansion could follow the retest.

This is your wait-and-track phase, no emotion, just observation.

Step 3: Observe the Retest Zone, Look for Smart Money Footprints

This is the decision zone, where amateurs get trapped and professionals wait for confirmation.

You want:

- Pin Bars: Long-tailed rejection candles showing the price was rejected hard.

- Engulfing Candles: True takeovers by buyers or sellers at the retest level.

- Volume Confirmation: Use OBV or MFI. If price is bouncing and smart money is active, you’re seeing a green-light scenario.

- Hidden Divergences: RSI making higher lows while price retests the same level? That’s a stealth cue.

You’re hunting, not hoping. Keep that in mind.

Step 4: Execute With Precision-Level Risk Control

This is where most traders sabotage good setups.

- Stop-Loss Placement: Use the tail of the rejection candle. Not the zone low, the actual wick that marked the shift.

- ATR(14) Calibration: Don’t just eyeball it. Let ATR determine if the setup suits your account size. High ATR? Smaller lot size. Low ATR? More room to breathe.

- Take Profit Strategy: Go for at least 2–3R, but structure-based. Use swing highs/lows, liquidity pools, or FVGs (Fair Value Gaps), not arbitrary numbers.

Want to scale? Use QPL (Quick Profit Line) for partials and let the rest ride on structure or trailing stop logic.

Tailoring the Retest Strategy to Your Style

Every trader sees the market through a different lens. Your retest system should match your rhythm:

Time Frame | Retest Type | Risk Logic |

|---|---|---|

M1 - M15 | Micro pullback (2–3 bars) | Tight SL + Quick Profit Line (QPL) |

M15 - H1 | Clean pullback into range | ATR SL + 1.8–2.5R Take Profit |

H1 - H4 | Deep retest into zones | Structural SL + Fibonacci Extensions |

100% | 5 Years | 3.8 Years |

For ACB users, dial down the indicator sensitivity if you want to prioritize only the strongest breakouts with clean follow-through. This naturally filters more noise and creates space for retest logic to shine.

The Retest Mindset

Retest traders don’t care about the candle that moves fast; they care about the level that holds strong.

Using a breakout retest indicator isn’t just a technical decision. It’s a psychological shift. You’re no longer trying to win by being early. You’re winning by being precise.

Let others get trapped. Let others chase momentum. You wait. You confirm. You execute.

Because in a game built to punish emotion

Patience becomes a weapon.

Take Your Trading to Next Level

Take Your Trading to Next Level

You Might Also Like: